Risky assets tumbled yesterday after seeing gains during the European session. The reason was the rapidly growing inflation in the eurozone, which became the main driver of growth in dollar during the US session.

Fed Chairman Jerome Powell said a strong US economy and high inflation could force the central bank to stop buying bonds earlier than planned despite the new omicron coronavirus strain that was discovered and poses a new risk for the future. "I think it is appropriate for us to discuss the prospects for a more active rollback of support measures at the next meeting, which will take place in a couple of weeks," Powell said. "During these two weeks, we will try to get as much useful data as possible to understand how the new strain of coronavirus could affect the economy in the future," he added.

The Fed is currently planning to end its bond purchase program in mid-2022, in line with the plan announced in early November. But at the next meeting on December 14-15, members may decide to speed up the completion of the program. Many traders assume that Powell would do it more smoothly because of inflation and the need to support the economy in the wake of the new coronavirus pandemic.

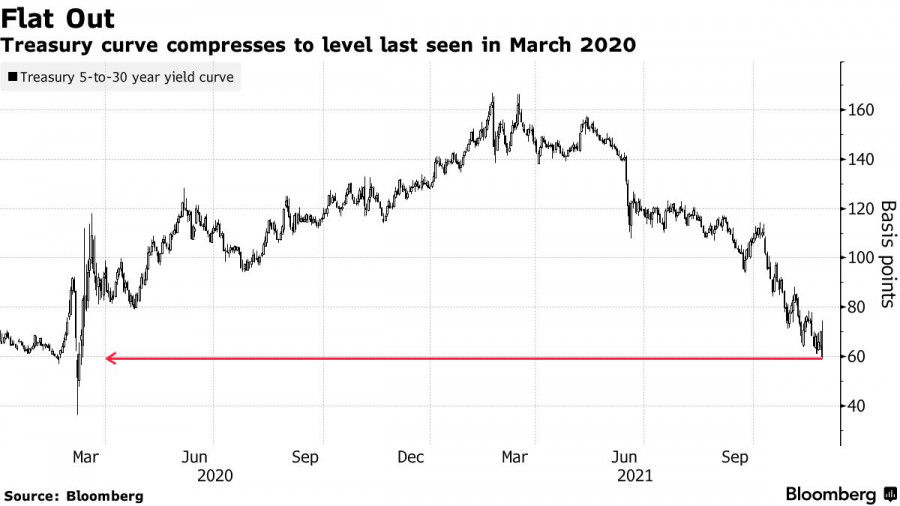

Unsurprisingly, the US stock market also declined, while the yield on US Treasuries flattened. This suggests that investors are increasingly betting on a faster completion of the current bond purchase program and an earlier rate hike, perhaps by 2023. Lately, Fed officials have stated that they want to complete the bond purchase program before raising interest rates.

While on the subject of bonds, it's worth noting that the yield on 30-year bonds fell a whopping 8 basis points to 1.77%, their lowest level since January. This move then drove the five-year treasury yield down more than 11 basis points to 59 basis points.

The yield curve between 2- and 10-year bonds also narrowed by more than 10 basis points. The two-year bond rose 8.5 basis points to 0.57%, which allows the completion of the Fed bond purchase program by the middle of next year. Faster closure opens the door to a potential early interest rate hike.

Shortly before commenting on the more aggressive scrapping of the bond purchase program, Powell said it was time to stop using the word "temporary" to describe inflation. This is a hint of a more hawkish view of the Fed on policy, which will be most likely expanded at the next meeting. "We are no longer inclined to use the term 'temporary', as high inflation begins to transform into baseline inflation - this requires action," Powell said. "I think now is a good time to drop that word and try to explain more clearly what we will do next."

The Fed chief also mentioned the recent rise in Covid-19 cases and the new omicron strain, which poses risks to employment, economic activity and inflation. "Since the last meeting, we have seen increased inflationary pressures, very strong labor market data without any improvement in labor supply and high household spending," he said. "Now we have to look not only at a strong economy, but also at very high inflationary pressures."

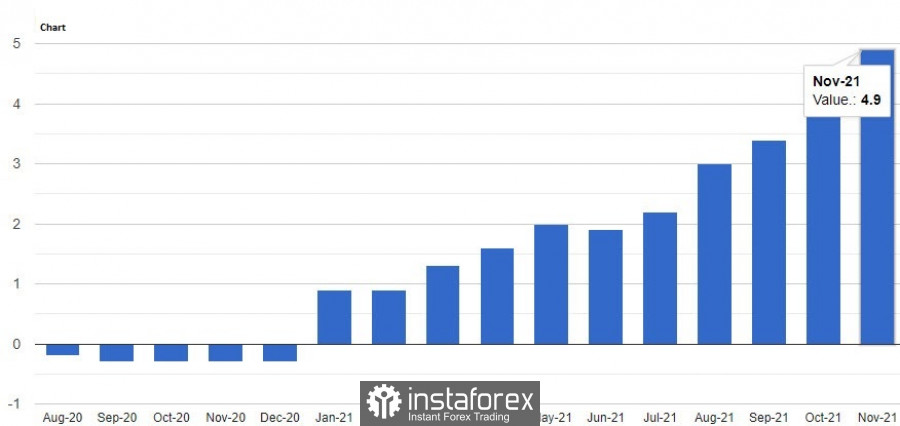

In Europe, inflation also accelerated much more than expected, this time due to the rise in energy prices. It hit 4.9% y/y in November, from 4.1% y/y in October. Likewise, core inflation, which excludes energy, food, alcohol and tobacco, rose to a record 2.6% from 2% in October.

The newly discovered omicron variant has further increased the level of uncertainty, but for now, investors remain calm and expect it to have little impact on inflation going forward. However, it is already clear that headline inflation will remain above the target of the European Central Bank, at least until the end of next year.

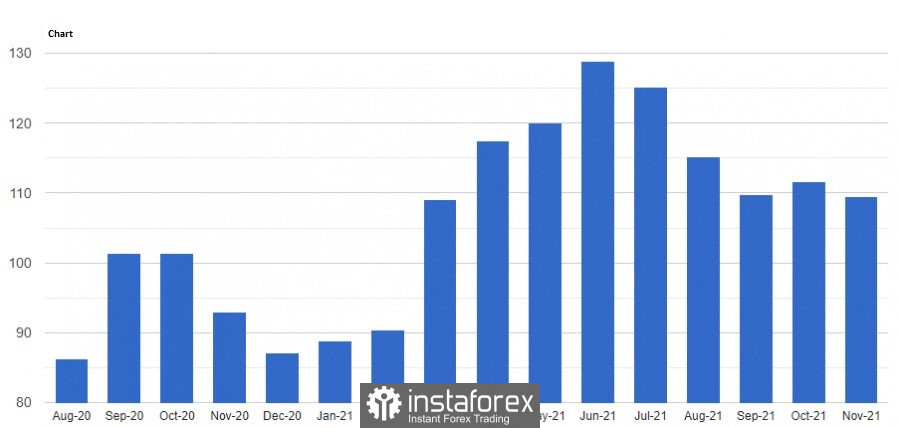

Going back to the US, a number of reports were released showing the state of the economy, which went slightly against the statements made by Powell. Consumer confidence is said to have deteriorated in November, falling to 109.5 points in November. Its figure was 111.6 points last October.

But the main concern for Americans are the ongoing price increases and the persistent coronavirus. Because of those, consumers assessed the current business environment less favorably, bringing down the index to 142.5 points. On the bright side, the assessment of the labor market was moderately favorable, despite the figure decreasing to 87.6 points.

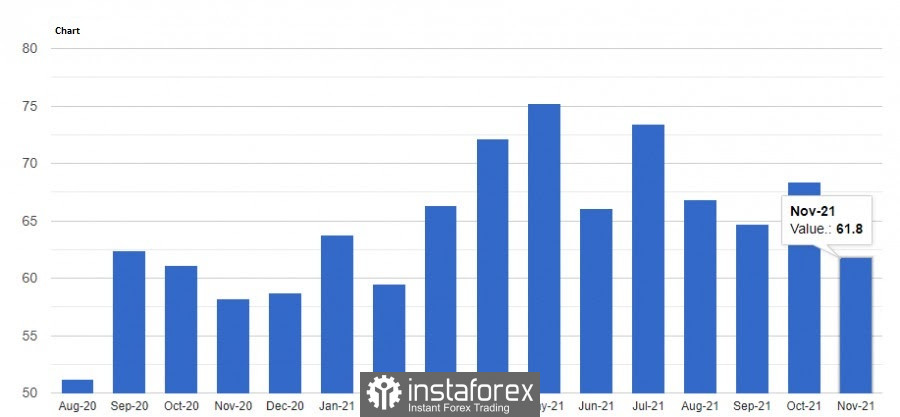

A report was also released yesterday, which said that the Chicago business barometer fell to 61.8 points. The reason was the slowdown in the growth of new orders, which fell back to 58.2 points. The employment index also fell to 51.6 points.

With regards to EUR/USD, although there was a massive drop during Powell's speech, traders recovered quite quickly, closing the day near the opening level. As such, a lot depends on 1.1325 because going above it will provoke another rise to 1.1380 and 1.1420. But if the quote returns and goes below 1.1275, the pair will plunge to 1.1230 and 1.1185.