Over most of Tuesday's trading session, the EUR/USD pair needed more upward momentum. It is comprehensible, as the pair has been increasing for several weeks, although it does not always do so logically or reasonably. On Monday, the pair increased by 100 points for some reason. We have frequently stated that the growth of the European currency needs to be faster and more reasonable. Simultaneously, this applies to both the short- and long-term. After gaining 1,500 points in the second half of 2022, the pair did not even undergo a significant correction. Thus, our conclusions remain unchanged. We believe the market is completely unfair to the dollar and ignores all aspects it dislikes. Market investors badly want to ignore the reality that the Fed rate is higher than the ECB rate, that the American economy is in significantly better condition than the European economy, and that the ECB rate will not surpass the Fed rate soon. But these are the fundamentals upon which market sentiment should be based. The market now only sees "hawkish" ECB prospects, which might conceivably hike rates more than the Fed in 2023. Based only on this factor, it is still being determined how much farther the euro will grow. Notwithstanding, we do not feel the euro currency merits such a significant strengthening. The euro currency has lost 2,800 points versus the dollar during the past two years, representing a moderate decline. In a few months, it recovered by 1,500 last year. It is still being determined why it is now growing.

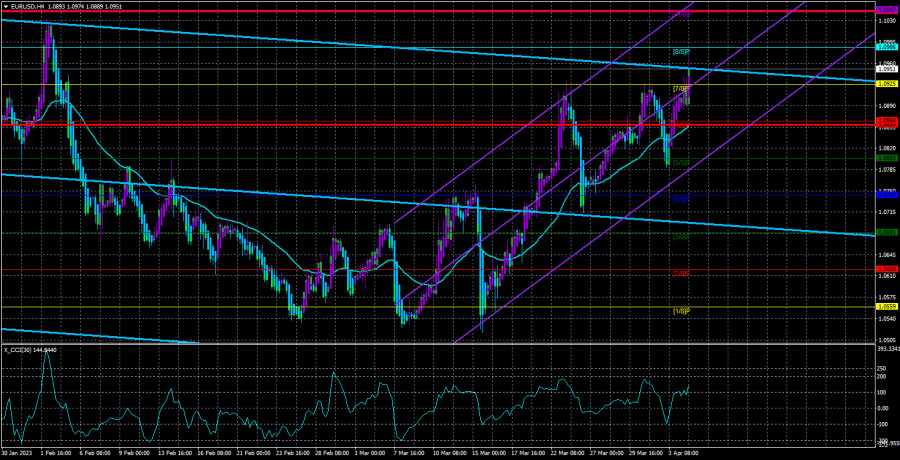

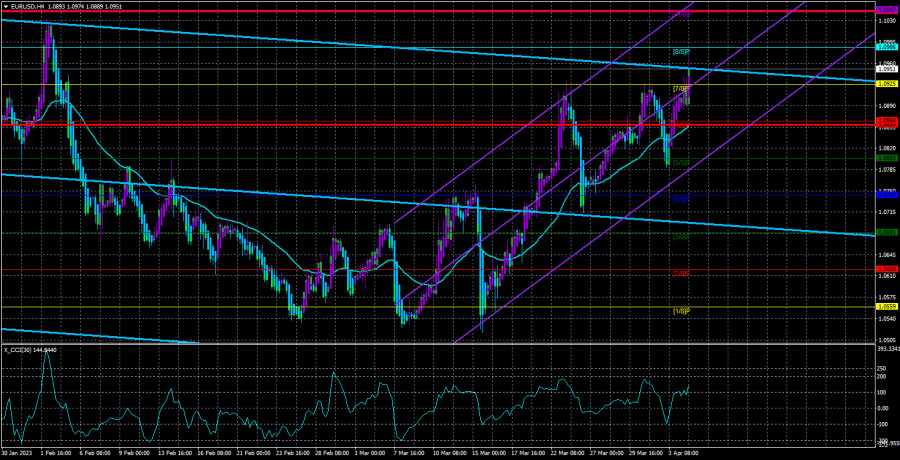

On the 24-hour TF, the technical outlook begins to deteriorate. Sellers are having trouble breaking through the 50.0% Fibonacci level, but this can only continue for a while. There is optimism for a new wave of corrective action, following which the resumption of the upward trend will appear sensible and logical. But if this problem is solved quickly, the euro currency will keep growing. In addition, there are no forthcoming fundamental support factors.

The JOLTs Open Vacancies Report has become an official event.

Officially, there was a reason for the market to drop the US dollar yesterday. A single report worthy of consideration turned out to be rather weak. However, let's examine it in detail. This report details the number of available JOLTs positions. This report is comparable to a report on unemployment benefit applications. Does anyone recall the last time the market responded to statistics on benefit applications? Its weekly values indicate the minimum divergence from expectations. The same may be said for the JOLTs report. This report was as impartial as possible from month to month, but its value was around 0.5 million less than anticipated yesterday. During the time this report was published, the dollar dropped 70 points. It might not seem like a large amount, but a significant output shift occurs when the US dollar loses 50 or 70 points per day.

We have one point: the market is now openly inclined to purchase a pair. For instance, no reports supported the euro currency on Monday, but the pair increased. Hence, even if no JOLTs were reported, the US dollar's value would undoubtedly fall. Perhaps not quite as much. We see an inertial movement when traders buy a currency because it increases. This movement is reminiscent of Bitcoin. A move like this is also impossible to predict because it is based on something other than specific macroeconomic data or major events. All signals for sale must "pass via the cash register." Generally, anchoring below the moving average can be ignored immediately. Hence, when opening any trades, it is important to remember that the current growth is completely irrational but far more likely than a decline.

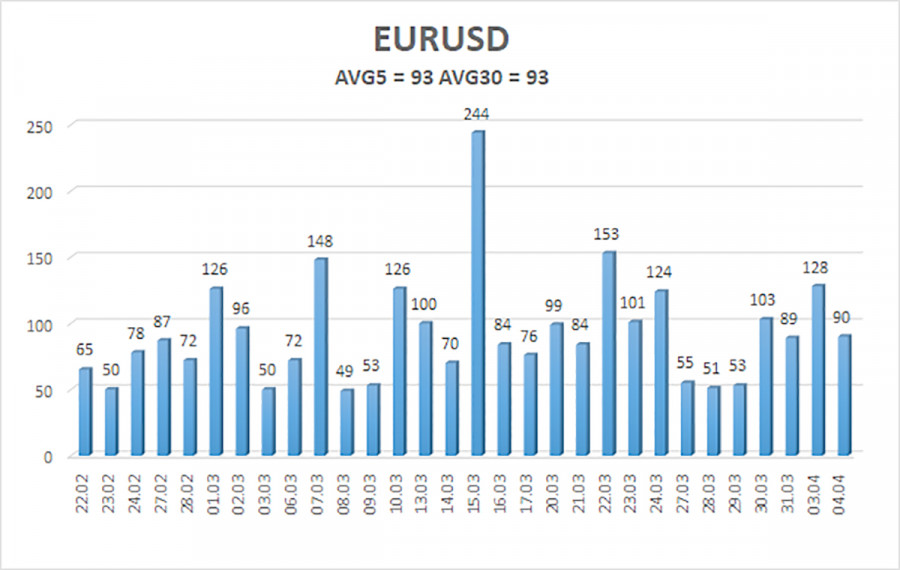

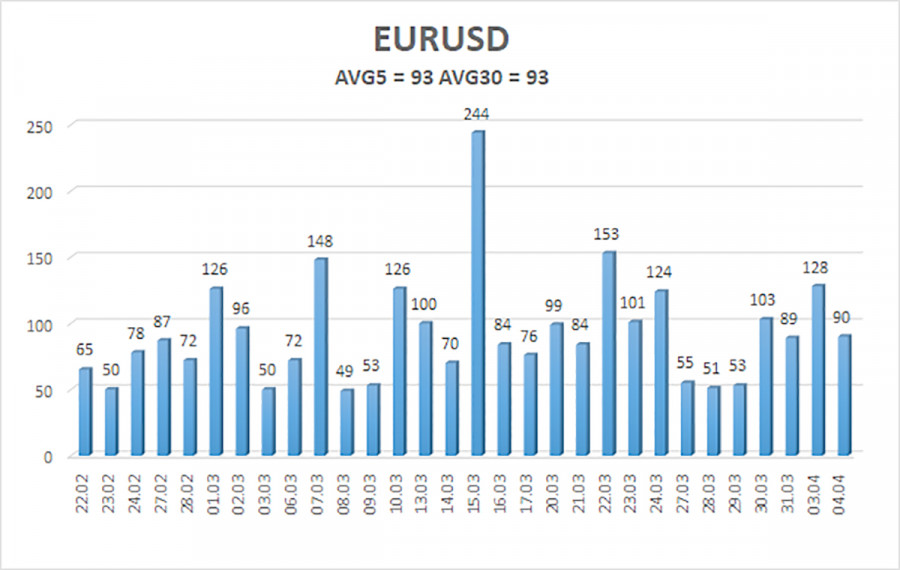

As of April 5, the average volatility of the euro/dollar currency pair for the previous five trading days was 93 points, considered "average." We, therefore, anticipate the pair to trade between 1.0859 and 1.1045 on Wednesday. A new round of bearish movement will start when the Heiken Ashi signal turns down.

Nearest support levels:

S1 – 1.0925

S2 – 1,/0864

S3 – 1.0803

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1047

R3 – 1.1108

Trading Recommendations:

The EUR/USD pair has regained its position above the moving average and continues rising. Until the Heiken Ashi indicator turns down, you should maintain long positions with targets between 1.0986 and 1.1045. Once the price falls below the moving average line, new short options can be opened with targets of 1.0803 and 1.0742.

Explanations for the illustrations:

Channels of linear regression – aid in determining the present trend. If both move in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.