The European currency continued to actively lose its positions against the U.S. dollar, and the British pound reached its monthly lows amid expectations that the Federal Reserve will seriously raise the issue of tapering bond purchases next week, as well as make a number of earlier forecasts regarding the timing of interest rate hikes.

Robert Holzmann

The European currency was not helped by an interview with European Central Bank Governing Council member Robert Holzmann, who is very serious about decisions on an earlier increase in interest rates in the eurozone, even despite the continuing emergency bond purchase program. The forecast of the European Central Bank currently states that it will stop buying bonds shortly before it starts raising interest rates. Holzmann, the governor of the Austrian central bank, does not agree with this approach.

"I've always been against linking the bond-purchase program and rate hikes too closely," he said. "Interest rates could be increased while net purchases are still in progress." He also cited Sweden as an example, which took a similar step at the beginning of 2020, and despite this, contrary to economists' fears, capital markets were not affected.

This is not the first hawkish commentary to have been voiced recently by the governors of the European Central Bank. In 10 days, a decisive meeting of the ECB will take place, at which officials plan to determine the volume of future bond purchases. Money markets expect the central bank to raise interest rates by 10 basis points in December 2022. Despite such statements, no one takes them seriously yet, as the President of the European Central Bank Christine Lagarde has made it clear that even after the end of the current pandemic emergency purchase program (PEPP), a decision will most likely be made to extend it in a different form from the one that exists.

Holzmann, who is one of the most belligerent members of the Governing Council, also noted that inflation is unlikely to drop below 2% in 2022, and most likely it will peak at the end of this year. He also expects supply problems to persist and the ECB needs to examine whether it is possible to legally and technically suspend the PEPP without canceling it.

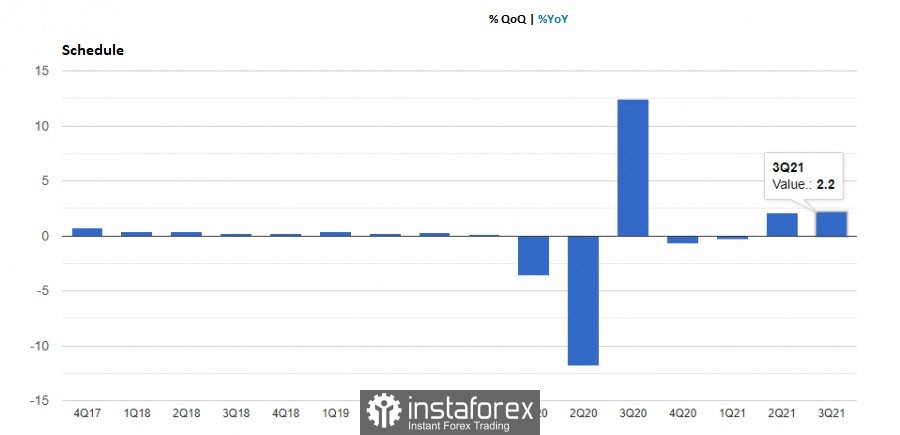

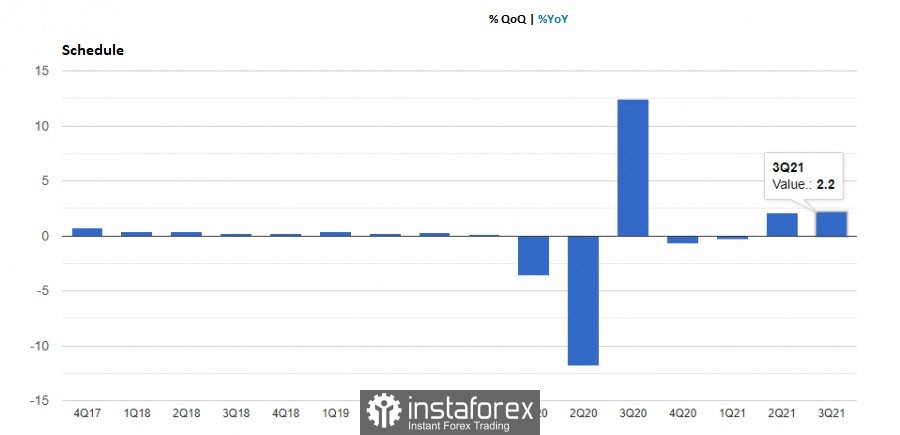

Eurozone GDP

As for Tuesday's fundamental statistics, the eurozone GDP data coincided with economists' forecasts, without providing significant support to the euro. Private consumption contributed the most to the eurozone's economic growth in the third quarter, as the region reopened after isolation imposed due to the coronavirus pandemic. Household spending contributed 2.1 percentage points to gross domestic product growth, while government spending increased it by 0.1 percentage points. Such data was provided by Eurostat on Tuesday. In general, from July to September 2021, GDP grew by 2.2% compared to the previous three months. Production remained 0.3% below end-2019 levels.

Currently, another surge of a new strain of coronavirus, named Omicron, again threatens to put downward pressure on economic growth later this year and early next. Much will depend on what restrictive measures the governments of the eurozone member states will resort to. Let me remind you that Austria and Slovakia have already announced the introduction of lockdown and further quarantine measures, which will significantly disrupt supply chains that will prevent Germany, the region's largest economy, as well as other countries from demonstrating growth at the end of the year.

Germany also introduced a number of restrictions last week. Under the new restrictions, only vaccinated or recovered people are allowed to visit restaurants, theaters, and other public places. Officials also backed a plan to make Covid vaccinations mandatory, saying the lower house of parliament will soon vote on the matter.

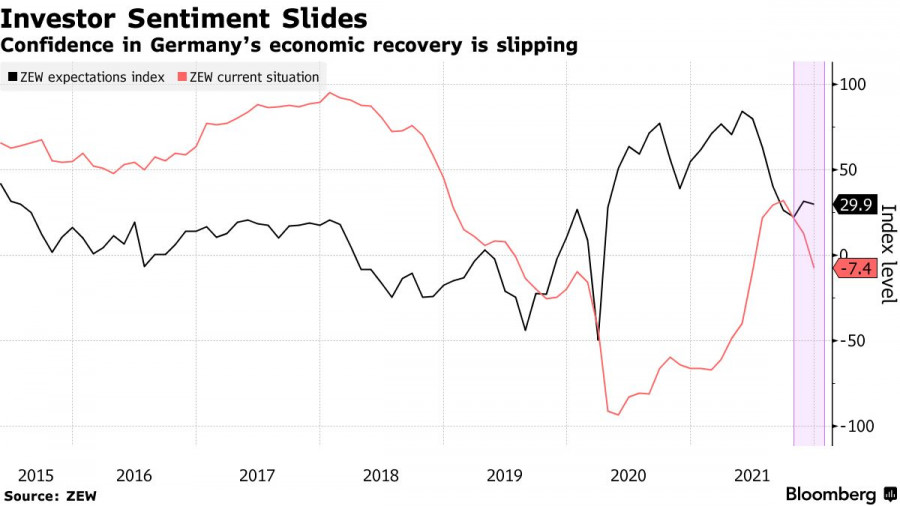

A report was also released Tuesday, in which investor confidence in the German economy deteriorated in December this year. And the main reason is the deterrent measures by the new government, led by Olaf Scholz, to spread the number of Covid-19 infections.

The ZEW economic research institute said its economic sentiment index fell to 29.9 in December from 31.7 in the previous month. The current conditions index fell to a six-month low of -7.4, worse than economists' expectations. Thus, we can say that confidence in the recovery of the German economy is falling. The continuing supply problems are negatively affecting manufacturing and retail. The ZEW also noted that the decline in economic expectations shows that hopes for stronger growth in the next six months are gradually dying. On top of all this, consumers are increasingly complaining about inflation, which is the fastest since the early 1990s.

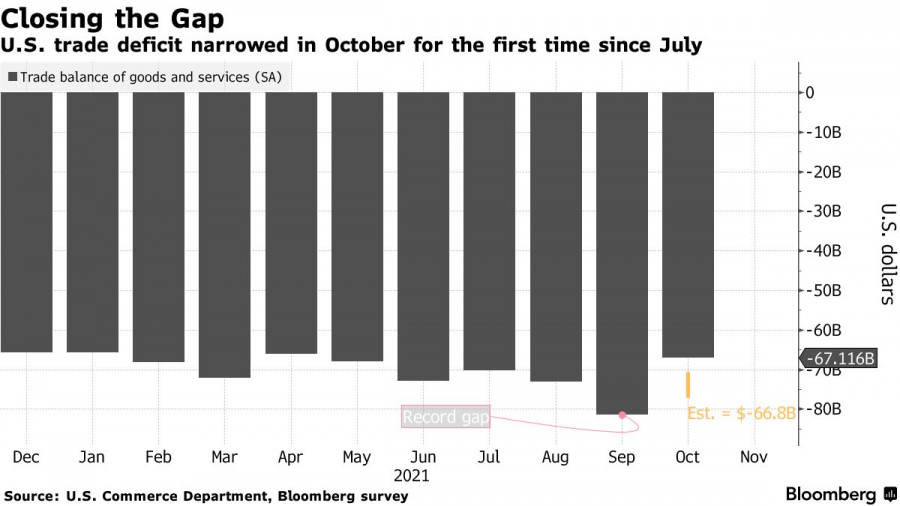

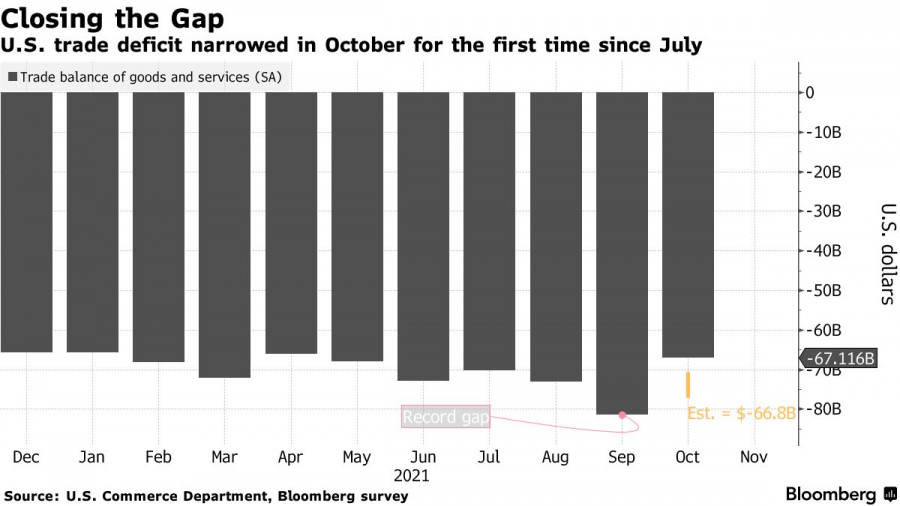

Trade deficit is narrowing

As for the U.S. statistics, the data on the trade deficit were encouraging, which led to some strengthening of the U.S. dollar and instilled confidence in a more favorable end of this year. The U.S. trade deficit narrowed in October this year for the first time since July, reflecting a sharp increase in exports and expectations that external demand for goods will continue to rise. The trade gap in goods and services narrowed 17% to $67.1 billion from a revised $81.4 billion in September, according to Commerce Department data released on Tuesday. Economists had expected the deficit to be $66.8 billion. Exports rose 8.1% to $223.6 billion, the highest on record. The growth was driven by an increase in shipments of manufactured goods, in particular crude oil. Meanwhile, imports rose 0.9% to $290.7 billion, also a record. This happened due to the supply of auto parts and engines.

All this confirms investors' expectations that trade in the coming months will become less of a drag on U.S. economic growth after it took 1.16 percentage points from the US gross domestic product in the 3rd quarter of this year.

As for the technical picture of the EUR/USD pair

The problems of the European currency buyers returned after they failed to deal with the resistance level at the base of the 13th figure on Tuesday. The fact that the market is in a bearish trend is confirmed by the continuous renewal of weekly lows, which continues to be observed after the sharp downward movement of the euro due to statements of Federal Reserve System Chairman Jerome Powell.

The bulls are trying to hold the level of 1.1235, but this will not be so easy. If they miss it during today's trading, the trading instrument will easily return to lows in the near future: 1.1215 and 1.1190 - this will create real preconditions for a decline in the 11th figure area. It will be possible to say that the buyers of risky assets have managed to stop the bear market after the trade moves above the 13th figure. Only in this case will it be possible to talk about an upward correction to the 1.1330 and 1.1360 areas. This scenario will be realized in the event of more hawkish statements by representatives of the European Central Bank on the topic of monetary policy, as well as an improvement in the situation associated with the coronavirus pandemic.