To open long positions on GBP/USD, you need:

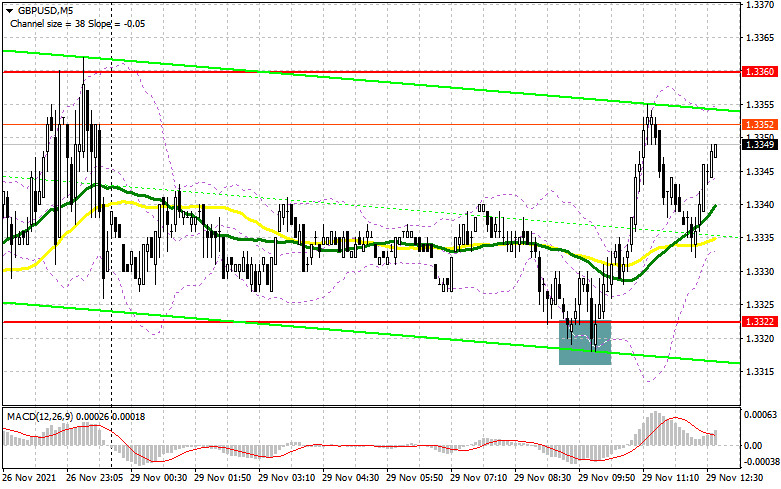

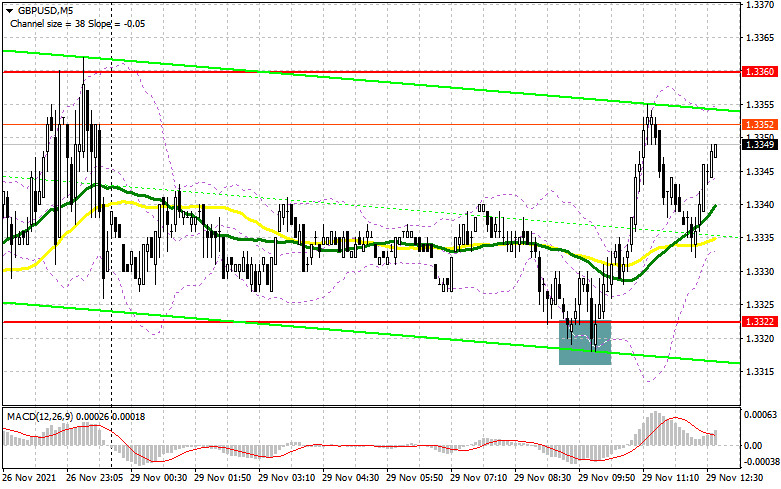

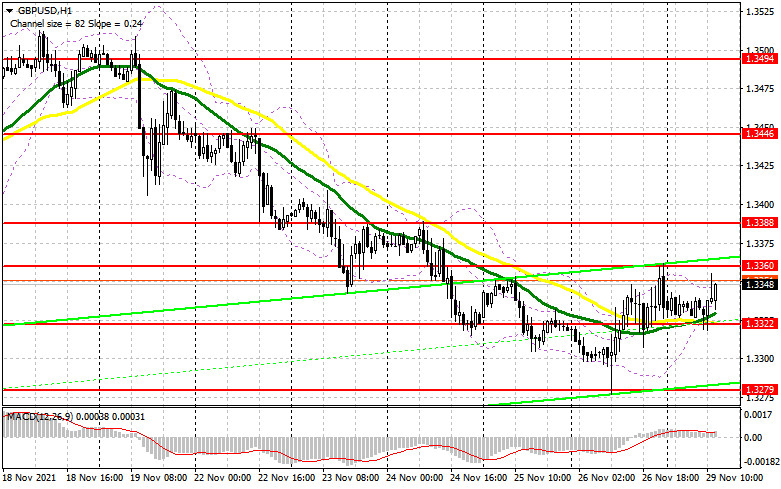

Pound buyers managed to protect support at 1.3322, thus creating a strong buy signal. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.3322 mark and recommended making a decision based on the price reaction to this level. Thus, the price failed to fix below 1.3322 and formed a false breakout. As a result, a strong buy signal was created. At the time of preparing this material, the pair has already advanced by more than 30 pips, approaching the resistance level of 1.3360. From a technical point of view, the situation has barely changed.

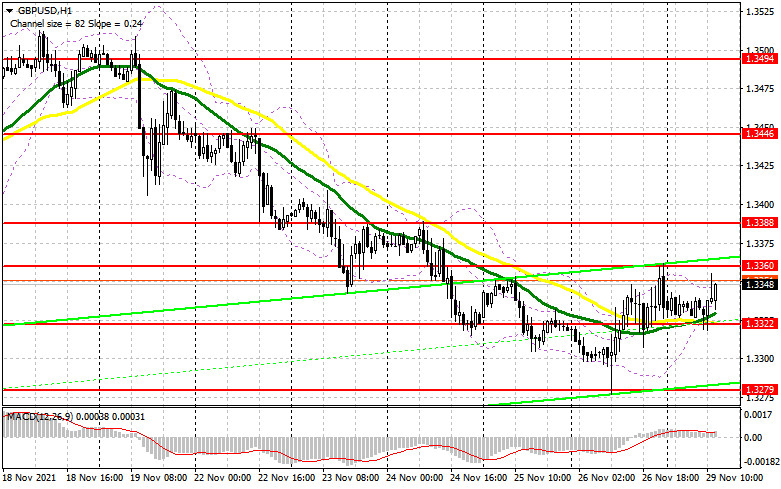

To continue its upward correction, the pair needs to break through 1.3360 and test it from the top down. In this case, the volume of long positions will increase, and the GBP/USD pair will recover to the 1.3388 area. If bulls are able to overcome this level, their next target will be the high of 1.3446, where I recommend locking in profits. However, this scenario is likely only in case of the dovish rhetoric of Federal Reserve Chairman Jerome Powell. If the British pound extends losses during the American session, I recommend opening new long positions only after bulls manage to protect 1.3322, the middle line of the sideways channel. There are moving averages passing at this level. Therefore, its false breakout will provide buyers with additional support and create a new entry point to the market. If buyers' activity is subdued, long positions on a rebound can be considered only from last week's low of 1.3279, with a view to catching an intraday correction of 20-25 pips.

To open short positions on GBP/USD, you need:

Despite an unsuccessful attempt to break through the support level of 1.3322 in the early session, bears should not panic. All they need is to protect the resistance level of 1.3360. A false breakout at this level, to which buyers are currently trying to return the pound sterling, will create a new sell signal. In this case, the quotes will decline to 1.3322, the middle line of the sideways channel, again. GBP/USD will gain stronger downside momentum today only if the price breaks through and fixes below this area and Federal Reserve Chairman Jerome Powell gives hawkish comments. A reverse test of 1.3322 from the bottom up will create a good entry point, and the pair will dive to last week's low of 1.3279, where I recommend locking in profits. If GBP/USD gains in value during the American session and sellers' trading activity is thin at 1.3360, it would be a wise decision to refrain from short positions until the price reaches the stronger resistance level of 1.3388. Short positions at this level can be considered only in case of a false breakout. Going short on a rebound is possible only from the resistance level of 1.3446 or even higher - from a new high in the 1.3494 area, counting on the pair's intraday downward correction of 20-25 pips.

Traders are recommended to read the following articles:

Forex Analysis & Reviews: GBP/USD: trading plan for European session on November 29. Commitments of Traders. GBP rebounds from weekly low. Target at 1.3360

Forex Analysis & Reviews: EUR/USD: plan for the European session on November 29. COT reports. Euro sharply up, but pressure could return quickly

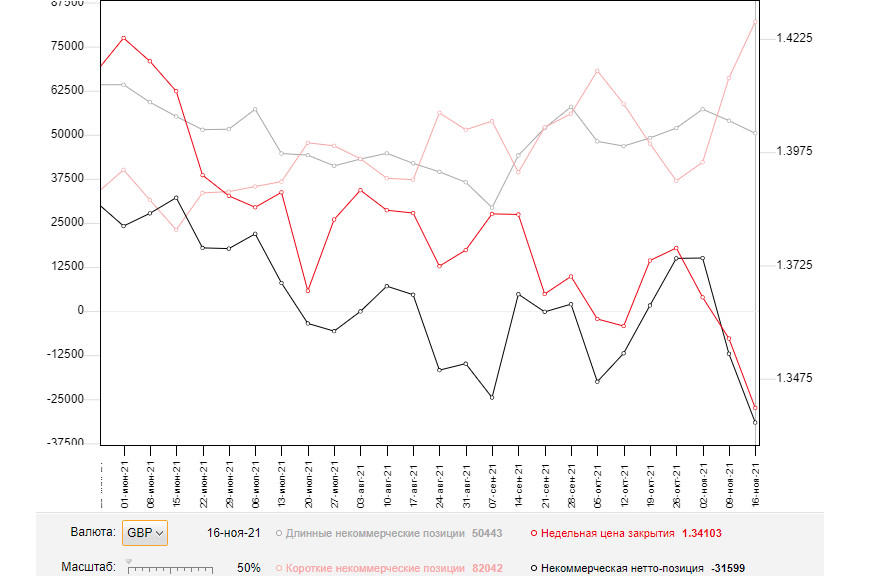

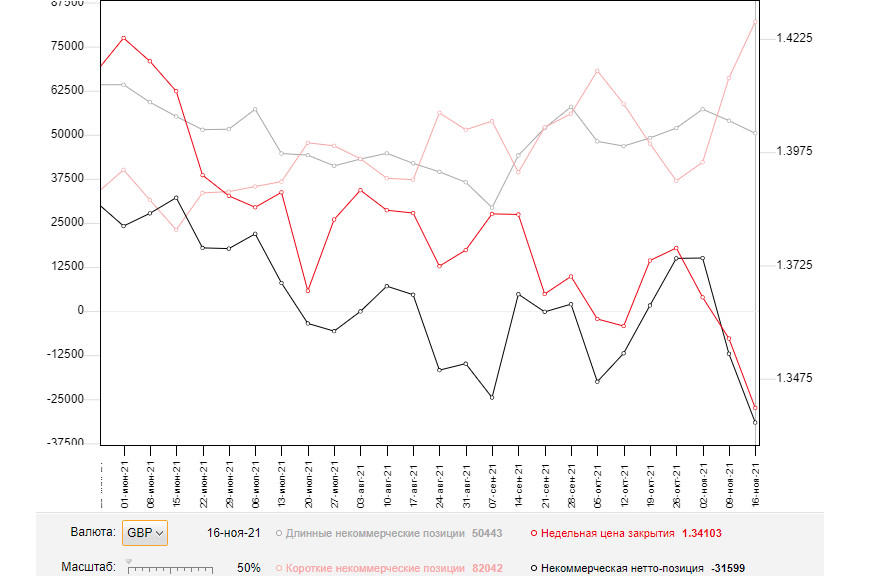

The COT report (Commitment of Traders) for November 16 recorded a spike in short positions and a decrease in long ones, which led to an increase in the negative delta. Upbeat data on the UK labor market, increased inflationary pressures, and higher retail sales - all this supported the British pound last week and gave bulls a chance for the pair's continued growth. However, amid the worsening coronavirus situation in Europe and the statements of representatives of the Bank of England that the regulator was in no hurry to change its monetary policy, the pound/dollar pair came under pressure again at the end of the week. Another important concern remains the unresolved issue around the Northern Ireland protocol, which the UK authorities are planning to suspend in the near future. In this regard, the European Union is preparing to introduce certain countermeasures, which is also weighing on the British pound. At the same time, the United States is suffering from a rise in inflation and there are talks about the need for an earlier interest rate hike next year, which is providing significant support to the US dollar. However, I recommend sticking to the strategy of buying the pair in case of steep falls, for example, amid uncertainty over the central bank's policy. The COT report indicated that the number of non-commercial long positions declined to 50,443 from 54,004, while non-commercial short ones rose to 82,042 from 66,097. This led to an increase in the negative non-commercial net position: delta was -31,599 against -12,093 against a week earlier. Due to the Bank of England's policy, the weekly closing price collapsed to 1.3410 from 1.3563.

Indicator signals:

Moving averages

The GBP/USD pair is trading above 30- and 50-day moving averages, which indicates that bulls are trying to continue driving the price up as part of a correction.

Note: The period and prices of moving averages are considered on the hourly chart and differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the lower boundary at 1.3322 will put additional pressure on the British pound.

Description of indicators

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). The 12- and 26-period EMAs. The 9-period SMA.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, including individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

- Non-commercial long positions refer to the total long open position held by non-commercial traders.

- Non-commercial short positions refer to the total short open position held by non-commercial traders.

- The total non-commercial net position is the difference between short and long positions held by non-commercial traders.