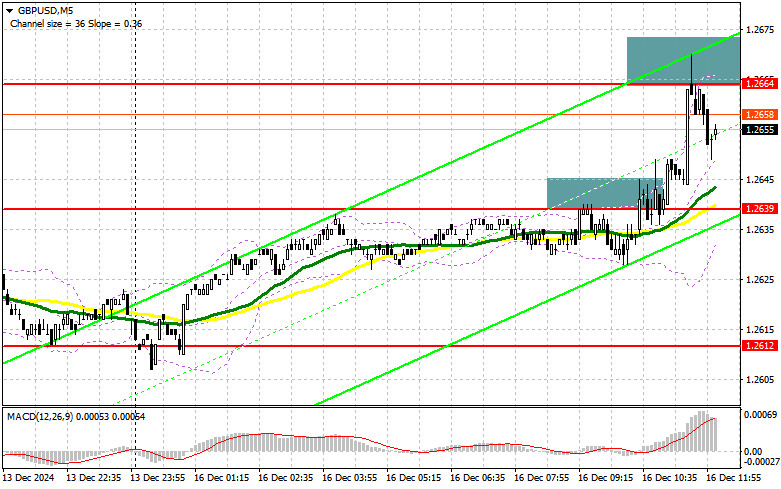

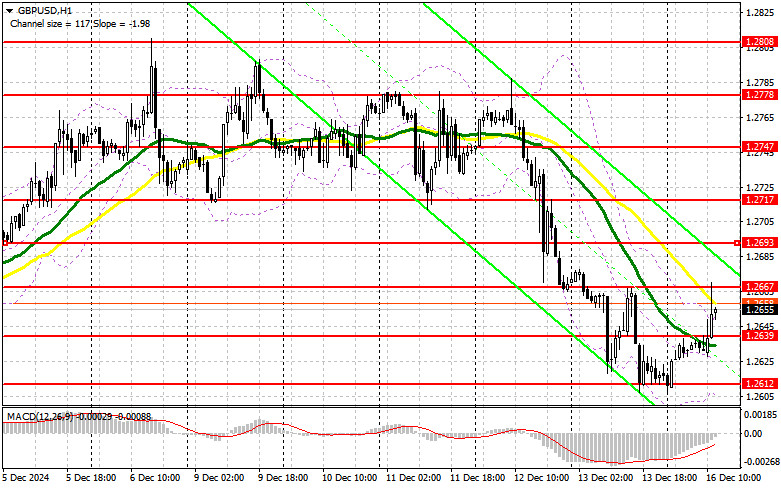

In my morning forecast, I highlighted the 1.2664 level as a key decision point for market entry. Let's review the 5-minute chart to analyze what happened. A rise followed by a false breakout near 1.2664 provided an excellent entry point for selling the pound, resulting in a 20-point drop. The technical picture has been revised for the second half of the day.

For Opening Long Positions on GBP/USD:

News of growth in the UK services sector allowed the pound to recover its positions, though weaker manufacturing data, which fell short of economists' expectations, dampened sentiment. This highlights the UK economy's need for stimulus and lower interest rates.

In the second half of the day, similar PMI data for the manufacturing and services sectors, as well as the composite PMI, will be released for the US. The services sector is expected to continue driving the economy.

In the case of a decline in GBP/USD, only a defense of the new support at 1.2639 will provide an opportunity for further growth. A false breakout at this level will serve as a good entry point for buying, targeting a recovery toward the resistance at 1.2667, established during the first half of the day.

A breakout and retest of this range from above will lead to a new buying opportunity, aiming for 1.2693, where buyers are likely to face challenges. The ultimate target will be 1.2717, where I plan to take profits.

If GBP/USD falls and buyers show no activity around 1.2639, they will lose momentum. In this case, only a false breakout near the next support at 1.2612 will serve as a basis for opening long positions. Alternatively, I plan to buy on a rebound from the 1.2589 low, aiming for an intraday correction of 30–35 points.

For Opening Short Positions on GBP/USD:

If the pound continues its morning upward correction, protecting the nearest resistance at 1.2667 will be the priority for sellers. A false breakout at this level, similar to the morning scenario, will offer a good entry point for selling, targeting support at 1.2639, which acts as an intermediate intraday level.

A breakout and retest of this range from below will trigger stop orders, opening the path toward 1.2612, dealing a significant blow to buyers. The ultimate target will be 1.2589, where I plan to take profits.

If demand for the pound returns in the second half of the day following weak US data and sellers fail to defend 1.2667, buyers will have a chance to drive another wave of growth. In this scenario, bears will retreat to resistance at 1.2693. I will sell there only after a false breakout. If there is no downward movement at this level, I will look for short positions on a rebound from 1.2717, aiming for an intraday correction of 30–35 points.

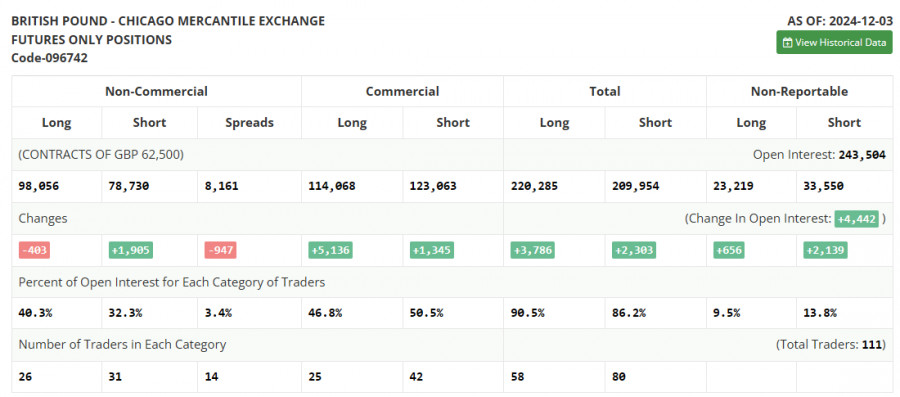

Commitments of Traders (COT) Report:

The COT report from December 3 showed a reduction in long positions and an increase in short positions. How the Bank of England proceeds with interest rates remains uncertain. However, weak GDP data expected in the near future could bring rate cuts back into focus, pressuring the pound against the US dollar. If this scenario does not materialize, buyers may have an opportunity for significant growth in GBP/USD.

The latest COT report indicated that long non-commercial positions decreased by 403 to 98,056, while short non-commercial positions increased by 1,905 to 78,730. As a result, the spread between long and short positions narrowed by 947.

Indicator Signals:

Moving Averages:Trading is taking place near the 30- and 50-day moving averages, indicating market uncertainty.

Bollinger Bands:In the event of a decline, the lower boundary of the indicator near 1.2610 will act as support.

Indicator Descriptions:

- Moving Average (MA): Indicates the current trend by smoothing out price volatility and noise. Period – 50 (yellow line) and 30 (green line).

- MACD: Moving Average Convergence/Divergence. Fast EMA – period 12; Slow EMA – period 26; SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial Traders: Speculators like individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long Non-commercial Positions: Represents the total open long positions held by non-commercial traders.

- Short Non-commercial Positions: Represents the total open short positions held by non-commercial traders.

- Net Non-commercial Position: The difference between long and short positions of non-commercial traders.