Nowadays, with so many unpredictable events happening in the world, it is nice to know how to earn money from home.

Can FX trading become a full-time job? Is it possible to yield a stable profit by trading on Forex? How much can you earn?

Find answers to these and other questions in this article.

If you want to learn more about trading strategies, read Forex Strategies for Beginners .

Ways of earning on Forex

At first glance, making money on Forex looks quite simple: buy cheap and sell high. In practice, however, it turns out to be a more complicated process.

Success on Forex depends on many factors.

An inexperienced trader can make a number of successful trades relying on intuition. Still, most trades will be unprofitable.

In order to trade successfully and efficiently, you must understand what the market is and how it works. All you need is to undergo training and constantly improve your trading skills.

Nowadays, plenty of training materials, including articles, lectures, webinars, and so on, are in the public domain. In fact, you can get such information completely free of charge.

Professional traders can earn money not only by trading but also by providing their training courses for beginners.

In addition, if you want to succeed, you need to master market analysis, which is also part of the learning process. After all, a successful trader knows how to receive and interpret signals made by the market.

Above all else, you need to take into account a fairly large number of factors, as well as be able to foresee how they can affect the price of an asset.

You can’t just start trading on Forex if you are an ordinary person, and not a large institutional investor.

In order to trade, you need an intermediary – a brokerage company. Choosing a reliable broker is of utmost importance because its reputation and smooth operation are the keys to your success.

A trusted broker is one with a license and well-earned reputation, offering an extensive set of trading instruments, a choice of accounts, and so on.

By the way, big brokers also provide training for their clients, so make sure you do not miss this opportunity.

When choosing a broker, it is worth paying attention to the size of commissions for withdrawals/deposits as well as conducting transactions because the size of your profit also depends on this.

What do potential profits on Forex depend on?

Your potential profit largely depends on the deposit amount and the leverage size.

A deposit is the initial amount of money that you are ready to invest in trading. It is important to understand that you can either enlarge your deposit or lose it partially or entirely.

The deposit is based on your financial capabilities and willingness to lose this amount in case of failure.

Experienced traders say you should not bet your entire deposit on a single trade. This amount should be wisely divided into several parts so that some money is left in your account.

Speaking of leverage, this is when you need a broker. With the help of a brokerage firm, you can enter the market and trade on a par with major players.

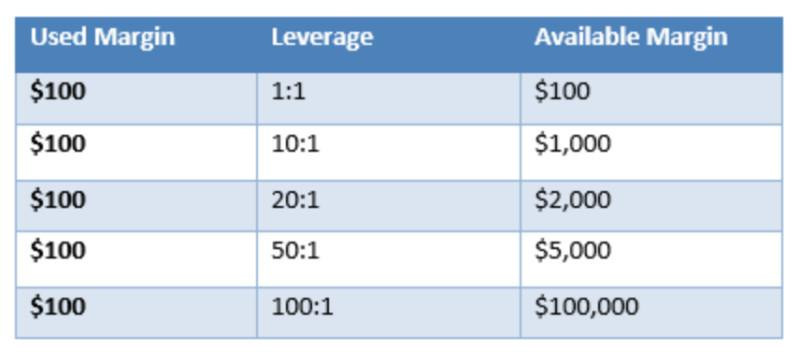

Leverage is like a multiplier for your investment. The size of leverage can vary depending on a broker and asset class.

Thus, when leverage is 1:50, your deposit is increased 50 times. In other words, you have invested $200 but trade as if you have $10,000. Trading can also be with 1:100 leverage or 1:500 leverage.

At the same time, the broker limits potential losses on your trades equally to the amount of your deposit. In the above example, you risk losing all of your $200 if your trade fails.

Meanwhile, the broker risks nothing and will get its money back. So, these are your funds that are always at risk. Still, if you yield a profit you do not have to share it with the broker.

It is also important to understand that the higher the leverage, the larger the profit, but the bigger the loss in case of failure.

How much you can make money Forex

So, how much can you earn daily, monthly, and yearly by constantly trading on Forex?

There is no definite answer to this question because your income is determined by many factors.

Naturally, the bigger the deposit and the bet, the more you can earn or lose.

So, if it is a $10 trade, you could get around $3-5. If you are ready to invest $10,000, your potential income could be $3,000 to $15,000.

These are approximate amounts calculated based on the choice of extremely risky trading strategies and very high leverage. Therefore, they should not be seen as actual earnings.

Besides, the deposit is not everything. A lot depends on your attitude to risk. Some traders dare to risk hoping to hit the jackpot.

There have been cases when traders yielded a profit of as much as $1,000, $10,000, and even 100,000 with a deposit of just $10.

However, these are exceptional cases where a trader earns a fat profit having invested a rather small amount of funds.

Potential profits also depend on the ability to analyze and foresee how certain events, news, and other factors can affect the market.

You can trade efficiently only when you treat trading seriously and know how the market works, how to conduct market analysis, and how to receive signals. Sometimes, however, it is just a matter of chance.

Strategy elements

Having a trading strategy is tremendously important if you want to achieve success in trading. This is a set of rules and not just random trading.

A trading strategy is about time frames, assets, opening and closing levels, trading volumes, and acceptable risks.

Let’s discuss each aspect of a trading algorithm in detail.

The choice of an asset, as well as their number, is a separate case.

Some traders can focus on a single currency pair not to get distracted by numerous quotes.

Meanwhile, others prefer trading several assets at once in order to limit potential losses. Thus, when one asset goes down, the other one can go up.

The choice of a time frame is determined by the time you can spend trading on a daily basis.

Some strategies are designed for trading in lower time frames, such as M5 and M15, and prove to be ineffective for higher time frames.

Likewise, intraday strategies developed for time frames like D1 will be inefficient when trading in lower time frames.

Risk management is also a primary element of any trading strategy. Depending on risk attitude, strategies can be aggressive and conservative.

It is also about the lot size, placement of orders Stop Loss and Take Profit, as well as the number of simultaneously opened trades.

The calculation of entry points is the key element of any trading strategy. This aspect is based on market analysis and trading signals.

Entry points can be determined with the help of technical analysis (based on charts and indicators) and fundamental analysis (based on news and macro data, etc.).

The calculation of exit points is the final aspect of any trading strategy. It is important that the strategy can foresee conditions for exiting.

Traders are sometimes tempted to wait a little longer, hoping for a bigger profit. But as the saying goes, less is more.

If there is a signal to close a trade, do it even if it seems that you can earn more. Otherwise, you risk losing what you have already gained.

Common mistakes of traders

Seeking higher and faster profits, traders sometimes make a lot of mistakes. Here are the most common of them.

The lack of a strategy and intuitive trading are the first and biggest mistakes a trader can make. A trade can be profitable but in the short term only.

It is also about the lack of theoretical knowledge. However, it can be easily rectified as knowledge can be improved. A clear understanding of how the market works is crucial.

Technical and fundamental analysis will help you receive and interpret trading signals.

Trading with large amounts of funds at the very start is the second common mistake. Novice traders should begin trading with no more than $100.

Meanwhile, savvy traders say newcomers should try demo trading first.

A demo account is the best way for beginners to explore trading. It is similar to a live account, except that you trade with virtual money. In other words, you gain valuable experience and risk nothing.

Some brokers offer cent accounts, allowing people to trade smaller lot sizes of up to $1.

Using high leverage at the very beginning is the third common mistake. Remember that the higher the leverage, the bigger the risk of losing funds.

Many trades opened at once are the fourth mistake traders usually make. Indeed, not everyone can monitor the prices of several assets at the same time.

This problem can be partially solved by placing orders Stop Loss and Take Profit. Still, it also requires certain knowledge to set orders right, which brings us to the first common mistake – the lack of knowledge.

Excessive greed and the inability to control emotions is the fifth mistake. Traders should make decisions with cool heads and not be impulsive.

Final thoughts

In this article, we provide answers to the most burning questions of traders. How can you make money Forex? How much can you make? What rules to follow and what mistakes to avoid?

The key factors for making a profit on Forex are your deposit and leverage. However, other aspects, such as training, the choice of a broker, and the efficient trading strategy, should also be taken into account.

In addition, we have outlined the main elements of a trading strategy. They are the choice of a time frame and assets, risk management, and the calculation of opening and closing levels.

Seeking higher and faster profits, traders, especially beginners, oftentimes make mistakes. We have listed them in this article for you to remember and avoid.

Read more

Forex swing trading strategies

Intraday stock trading strategy

Back to articles

Back to articles