To become a successful trader, it is not enough to have good intuition and even extensive knowledge of Forex trading. You can succeed only if you have a coherent trading strategy.

An appropriate strategy does not guarantee that all your trades will be profitable. However, it will contribute to increasing your trading account balance at the end of the day, week, month, year.

We will define a trading strategy, distinguish types of trading strategies and discuss how to choose the best strategy for you.

What are Forex strategies for trading?

A trading strategy includes a specific set of certain trading rules that traders should strictly follow.

A significant advantage of this trading algorithm is that traders are less subject to emotions.

A trading system provides guidance on the right time to open and close a trade. Moreover, decisions are made quickly due to the algorithm.

As a rule, traders make money Forex, develop methods of generating profits. They have been trading on foreign markets for many years.

Therefore, novice traders can use ready-made solutions and conduct profitable trades due to knowledge and experience of advanced traders.

Apart from determining the appropriate moment to open a trade, the strategy includes:

- choice of specific time intervals for trading;

- risk management;

- number of lots for each trade;

- exit point.

A successful trading strategy takes into account all aspects of trading. Therefore, traders should follow its rules in any situation.

A certain algorithm provides the rules indicating how to act in a particular situation.

Experienced traders recommend everyone, beginners in particular, to keep records to track their profitable and unprofitable trades. Then this data can be used to analyze and adapt the current trading strategy.

Another advantage of using the trading system is that it is later possible to automate trading by using trading robots.

The algorithm of a trading advisor includes the rules of your trading system. Only in this case the robot can replace you and trade successfully.

How to implement Forex strategies

It is obvious that even the most effective trading strategy is not suitable for all traders.

Therefore, it is necessary to take some steps to choose the best Forex swing trading strategies:

- First, you have to determine your trading style;

- Then you need to analyze the feedback from real users about a particular method;

- Choose which trading strategy suits you best;

- Then it is necessary to test it on historical data of quotes;

- Later, you need to trade in a demo account for a while using this strategy;

- Therefore, you can apply the trading strategy on your real account only after taking all these steps.

Moreover, it is possible that none of the current trading strategies will be suitable for you. In that case, you will have to develop your own strategy combining several different methods.

This will be the best option as it will be in line with your trading preferences. However, it will be the most energy-consuming option and will take a lot of time.

You have to make a choice: either use existing techniques, or invest time and effort and develop your own strategy.

However, it is not enough to choose a trading strategy. It is extremely significant to adapt its principles and follow them.

Types of trading strategies

There are a lot of trading algorithms. Moreover, they can be classified according to various characteristics.

In this section, we will analyze the most significant classification based on time intervals. According to this criterion, trading strategies are subdivided into:

1. Short-term or intraday trading strategies, trades are opened and closed within one day. To trade successfully, you should closely monitor the price movements. Otherwise, you can miss the moment when the price changes dramatically.

- This trading strategy also includes scalping, i.e. a lot of trades are opened during very short intervals of time. The profit on each trade is small. However, traders hope to finally generate considerable profits due to a great number of trades. It is considered the most risky strategy.

2. Medium-term or position trading means opening of trades for a period of several days to several weeks. It is the most stable trading strategy. It is suitable for many traders as they do not have to closely monitor the price changes during the same day.

3. Swing trading is a strategy based on market correction. When the market trend has just emerged, it shows considerable variability. This aspect is used by traders. The trade is opened while the market trend changes.

4. Long-term trading strategy is similar to investment and is quite rarely used on Forex. Positions are opened for a long term, i.e. from several months to several years. Moreover, it is rather difficult to predict what changes the market will undergo during this time. Therefore, this trading strategy is more suitable for major players.

Pros and cons of different strategy types

Each type of trading algorithm listed in the previous section has its advantages and disadvantages. Let’s discuss them according to the above mentioned strategies.

Scalping means conducting a large number of short-term trades. This trading strategy has the following advantages:

- it is easy to gain trading experience;

- it is possible to study basic aspects of market operation;

- it does not require large initial capital;

- it uses a simple trading scheme;

- trades are not carried forward the next day or later periods.

The strategy includes the following major disadvantages:

- it requires a lot of time and effort and exhausts traders considerably;

- high commissions due to large number of trades;

- trading equipment and Internet speed play a key role.

The next type of trading strategy is intraday trading. According to it, trades are opened and closed during a trading day. This strategy has the following advantages:

- All trades are closed together in one day. At night traders can rest and not express concern over their money;

- тTraders conduct less trades than using scalping (up to 10 per day). However, it helps to gain experience;

- It is possible to learn this type of strategy using free educational articles and videos.

This strategy includes the following disadvantages::

- It takes a standard working day. Therefore, it is unlikely to combine it with other work;

- It requires absolute concentration and a lot of effort. It wears traders out just like scalping;

- If traders lack knowledge and experience, they most likely suffer losses instead of generating profits.

The advantages of swing trading are:

- Traders can open trades for a longer period. Therefore, they do not have to sit in front of the computer screen for hours;

-Traders have time for their daily routine and rest, which reduces the level of stress;

- A trade can make more profit if it is closed later, not on the day it is opened.

This trading algorithm has the following disadvantages:

- It can result in more significant losses than intraday trading;

- Traders have little chance to enter the market at the best price due to the fact that they do not monitor it closely;

- It may take several days to await the signal to enter the market.

The medium-term strategy also has its pros and cons. It has the following advantages:

- a wide choice of assets for trading;

- minimal impact of commissions on the final profit;

- a chance to thoroughly analyze events and growth prospects of a particular asset.

The disadvantages of the medium-term strategy are:

- it is necessary to perform fundamental analysis;

- it is necessary to monitor a large number of markets to find the best trading instruments;

- it is not suitable for active traders.

Long-term trading is more commonly referred to as investing. The advantages of this trading strategy are:

- reduced levels of stress;

- a lot of free time;

- a chance for receiving dividends (in case of purchasing company’s shares) apart from rising shares.

The disadvantages of long-term trading include:

- a large volume of free capital is necessary for investing;

- detailed knowledge of the purchased assets and their possible price movements;

- it requires a lot of patience to resist the temptation to sell the assets ahead of time.

Other classifications of Forex strategies

Based on the method of market analysis, strategies are divided into:

- Indicator strategies are based on technical indicators that are shown on trading charts. Indicators give signals in case definite conditions inherent in the algorithm occur. Therefore, these signals are significant for making decisions to open and close trades.

- Non-indicator strategies imply the analysis based on certain patterns which appear on the candlestick chart. These structures indicate either the beginning of a particular trend or its reversal. Depending on the obtained patterns, traders decide to buy or sell the asset.

Based on the type of market analysis, trading strategies are divided into:

- Technical strategies use analysis based on the study of charts and patterns of price movement. Their key principle is that the price of assets should change in the future in the same way as in the past.

- Fundamental strategies analyze economic data, news, large-scale economic and political events. It is necessary to assess how these factors can affect the price movement.

- Combined strategies include elements of both technical and fundamental analysis.

Depending on the moment trades are opened, strategies can be:

- Trend trading strategies imply opening trades in the direction of the asset price movement. Moreover, it is extremely significant to correctly identify this direction.

- Counter-trend strategies take into account the moment of utter shock on the market. Then the price is likely to reverse in the opposite direction. This strategy can yield considerable profits, but is very risky.

- Flat strategies are used at the sideways price movement, i.e. the movement in a certain price range. Such strategies are applied at the moment of price consolidation and are not used when the trend recovers.

Based on the technical component, strategies are divided into:

- Automated trading strategies, i.e. trading is carried out by a specialized computer program without human involvement.

- Manual strategies, i.e. trading is conducted by people, while they can use the signals of trading advisors analyzing the market.

Criteria for choosing trading strategy

While choosing the most appropriate trading system, you need to follow certain rules.

Study all the classifications thoroughly. You should properly understand which algorithms use the parameters suitable for you: trading style, time intervals, trading instruments and others.

Some trading strategies are designed specifically for certain timeframes or specific currency pairs.

Strategies based on technical analysis will not take into account fundamental factors and vice versa. Probably, you need to combine strategies.

Algorithms that use trends to open positions will not be suitable for trades in a flat market.

When you have already determined the above parameters, you need to find detailed information about the chosen trading strategy.

Professional traders often provide training videos, lectures, articles, webinars, and other useful information for beginners on a paid or free basis. Training can also be available on the websites of brokerage companies.

Moreover, it is essential to take into account your temperament. Each personality type behaves differently in trading.

- Choleric people have difficulties with controlling their emotions and being patient. They want to get everything at once. However, they find it challenging to use short-term strategies without having enough experience.

Medium-term trading strategies, mainly hourly and 4H intervals, are extremely suitable for choleric people.

2. Sanguine people are more optimistic, they bravely endure hardships, and focus on maximizing their profits. Short- and medium-term trading strategies are the best for them.

3. Melancholic people trade with caution and are strongly influenced by their emotions. They are sensitive to incurring losses. Therefore, they should place stop loss and take-profit orders.

Long term strategies are most suitable for them.

4. Phlegmatic people are the best personality type for trading. They are calm and balanced and make rational decisions.

Any trading strategy will suit such people.

It is obvious that this division is very conventional. Moreover, people often have features of several personality types. However, one of them is dominating.

Knowledge of their personality types will help traders to realize which strategies may be suitable or undesirable for them.

Besides, while choosing your trading strategy, you should determine how much time you can dedicate to trading, that is the whole day or just a few hours.

Forex strategies for trading

Novice traders want to make money quickly. Therefore, they often start conducting a large number of trades spontaneously.

Only some of these trades can be profitable without extensive knowledge and skills. However, most of them will be unprofitable.

Consequently, traders become disappointed in trading, they write negative comments on forums saying that brokers are scammers trying to sneak their deposits.

However, in most cases the reason for their failures is total ignorance of basic trading rules and lack of a clear trading strategy.

When beginners start trading on Forex, it is rather difficult for them to develop their own strategy.

Therefore, there are algorithms created by experienced traders. It is advisable to study and use them.

Often beginners combine trading on Forex with their full time job. Thus, it is necessary to choose a trading strategy suitable for your daily routine and working time.

Moreover, the trading strategy should be adapted to the particular asset that will be used for trading.

You need to determine which trading style is more suitable for you: conservative or aggressive.

Supporters of a conservative style most often choose trend algorithms. They do not provide substantial income, but also do not carry great risk.

Aggressive trading strategies can generate high income (up to 1000%). However, the risks are also very significant.

Your choice of trading strategy depends on your character, your free time, your attitude towards risk, and your awareness that you can earn substantial profits as well as incur considerable losses.

What algorithms are suitable for novice traders?

Let's discover several trading strategies, which are rather simple and suitable even for beginners.

Major categories of algorithms for beginners:

- Every trader, including beginners, should use support and resistance levels. To determine these levels, it is necessary to wait for a flat market. As a rule, it is advisable to buy at the support level and sell at the resistance level.

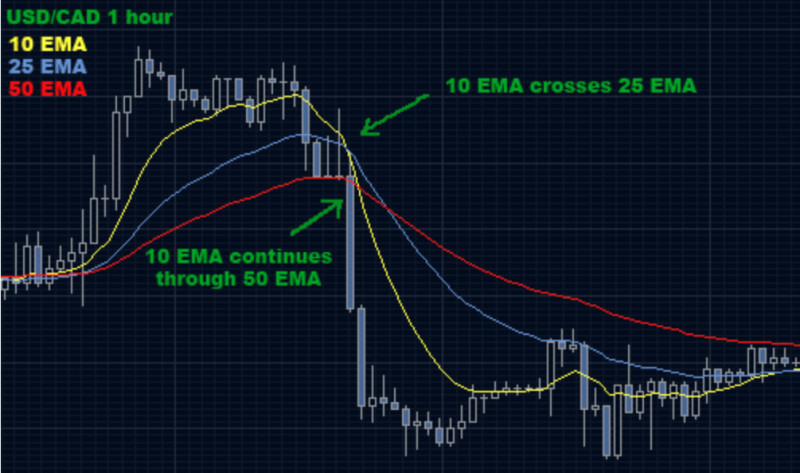

- Moving averages are the most frequently used indicator. It is often used in several variants on one chart. When moving averages intersect, there is an opening point of trade. However, you should remember that they can lag behind the market, then their signals will be false.

- Oscillators allow traders to analyze the current situation on the market. These indicators can determine whether the market is overbought or oversold. Overbought market means that the asset price is too high and traders are not eager to buy. Oversold market means that the price is too low and sellers do not want to sell the asset.

- Breakout trading strategy is a non-indicator algorithm based on support and resistance levels. However, their use is different compared to the first option. The basic principle is that the market reverses when it reaches a support or resistance level.

Let's analyze several examples of existing trading strategies:

- Red Dragon is a trend trading strategy whose operation is based on several indicators: moving averages, Parabolic Sar and Awesome. It is suitable for any currency pairs and timeframes starting from H1.

- RSI-6 is an indicator algorithm using Bollinger Bands and RSI. It is best for M5 and M15 timeframes, and can be used for trading any currency.

- Candlestick reversal is a non-indicator strategy based on candlestick analysis on the chart. It can be used for any timeframe and assets.

- SonicR is a trading strategy based on a single indicator and moving averages. It is used for 15-minute timeframes, extremely suitable for the EUR / USD and AUD/JPY pairs.

- Lark trading strategy is suitable for traders who are most productive in the morning. It is used for the EUR/USD pair on the H1 timeframe. After the market analysis you should place some pending orders and you can get into your daily routine.

- Weekly trend is a strategy which perfectly suits those traders who do not consider trading their major occupation as it is necessary to open only one trade per week. It is a trend trading strategy that is suitable for D1 and H4 timeframes and the GBP/USD pair.

Reliable Forex trading strategies

The research conducted among a large number of successful traders has shown that they prefer different trading strategies.

According to IAFT research conducted among 2,400 respondents in 2022, they have chosen the following trading strategies:

- 27% – intraday trading,

- 28% – position trading,

- 31% – swing trading,

- 14% – Forex scalping strategy.

Therefore, almost the equal number of market participants use three main trading strategies: intraday, position and swing trading.

This fact confirms that these strategies are reliable and can lead to generating considerable profits.

As for a point of market entry, 54% of traders stick to trend strategies, 31% of traders use flat strategies and only 15% of traders apply counter-trend algorithms.

To analyze the data in their algorithms, 39% of respondents use technical analysis, 33% of traders use fundamental analysis, and 28% of respondents apply combined analysis.

According to this study, swing trading strategies based on technical analysis are the most profitable.

Scalping and counter-trend strategies are not recommended for novice traders. Traders should have extensive trading experience to use them properly.

Experienced traders also recommend having a rest for one day a week even if trading is your job and steady source of income.

In case you do not rest, you will lose your energy and concentration. Consequently, you will make mistakes. Therefore, your efficiency will decrease in line with your profits.

How to develop your own strategy

You don't have to develop your own trading strategy from scratch. Moreover, it's extremely difficult for beginners.

Therefore, one of stock trading strategies developed by experienced traders can serve as a basis. You need to choose a trading algorithm that suits you best.

Using this algorithm as a base you can build your own trading system which will meet all of your requirements.

You can try out several trading systems to realize which one is more suitable for you. Therefore, most brokers offer novice traders demo accounts.

Before you start developing your own trading algorithm, you need to study the market and focus on movements of certain assets.

It is necessary to find and detect some patterns in asset movements and changes in their prices. These patterns will form the basis of your trading strategy.

Moreover, it is also significant to determine what type of analysis the algorithm will be based on: technical or fundamental. You can also combine these two types.

Next, you should choose the time intervals when you can trade and add this element to your trading system. Intraday trading is more suitable for some traders, others hold their trades for several days or weeks.

You need to determine the levels to set stop loss and take profit orders regardless of your trading style and time intervals.

These orders will help to save money at your deposit and to earn some profits, albeit not record ones, if you incur any losses.

You should also determine the volume of positions, that is whether you plan to conduct big trades.

Most brokers allow traders to open trades starting from 0,1 lot. It is obvious that it is impossible to generate considerable profits with such volume. However, you will not suffer huge losses.

Remember that big bets always pose a great risk. If you're willing to take a risk or confident in your position, you can choose large lot sizes.

Another key principle in a trading algorithm is to determine the moment to close a trade. It is significant to choose the right moment when closing a position will result in record profits.

What other aspects are essential for successful trading

We have thoroughly discussed choosing the right trading strategy and following its rules.

However, it is essential to make a number of key decisions for successful trading, for example choosing a brokerage company to open an account.

When choosing a broker, you should take into account some key points:

- whether the brokerage company has a license and who regulates its activity;

- what spreads and commissions are set for transactions, deposits and withdrawals;

- time of order execution;

- what types of accounts are available and whether it is possible to open a demo account or cent accounts;

- which trading platforms the company uses and whether you can operate these platforms;

- whether the broker offers trading courses for beginners, they include training articles, videos, webinars,etc.

Apart from choosing a reliable broker, you should also learn how to use the trading platform.

Trading platforms may differ from each other and have different interfaces. However, they perform the same functions. Therefore, you need to choose the one that is suitable for you.

Advanced traders recommend everyone, mainly beginners, to keep the so-called trader's diary. Maintain a record of all your trades for a certain period of time (day, week, month).

This will help you analyze your trading strategy and discover any flaws or inaccuracies, which you can later fix.

It is not advisable to establish a goal to generate huge profits at once as it also implies high risks. You are more likely to lose the money you have invested than to yield profits without necessary knowledge and essential trading skills.

Use a chance to practice trading in a demo or cent account. Therefore, you will improve your trading strategy, see how effective it is and feel more confident trading large sums of money.

Conclusion

In this article we discussed what a trading strategy is and why it is essential for every trader. It is proven that it is the key feature of successful trading.

There are various classifications of trading algorithms: based on time intervals of trade, type of analysis, moment of opening of trades, technical component and others.

Each trading algorithm has its own advantages and disadvantages which should be taken into account when choosing one.

Some trading strategies are more suitable for beginners, while other strategies can be used only by experienced traders.

Traders should choose strategies most suitable for them according to their character, personality type, disposable income, and time.

Strategies developed by other traders can be extremely effective and profitable. However, only your own trading algorithm can suit you best.

You do not need to develop a trading strategy from scratch, but use a ready-made strategy as a basis.

However, traders should strictly follow all rules and principles outlined by a strategy as this is the key to success in trading.

Back to articles

Back to articles