The bears of the GBP/USD pair tried to overcome the support level of 1.1000, but to no avail: despite the pressure of the US currency, the pound repelled the attack thanks to the "timely" macroeconomic reports.

So, at the start of the European session on Tuesday, data on the growth of the labor market in the UK were published. The report turned out to be surprisingly positive: almost all components came out in the green zone. And although bulls on GBP/USD still could not develop a large-scale corrective growth, they fulfilled the "minimum program": they did not allow a stall in the area of the 9th figure. Looking ahead, it should be noted that the bulls of the pair in the prevailing conditions of a fundamental nature are unlikely to be able to hold the defense for a long time. But the bulls certainly received situational support.

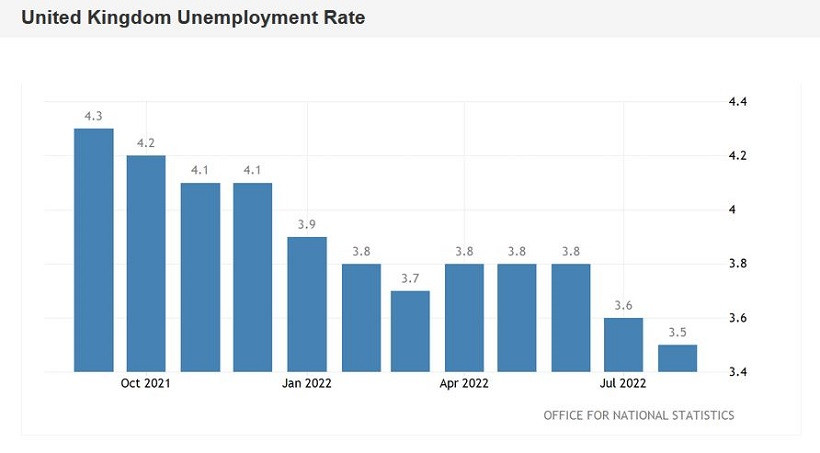

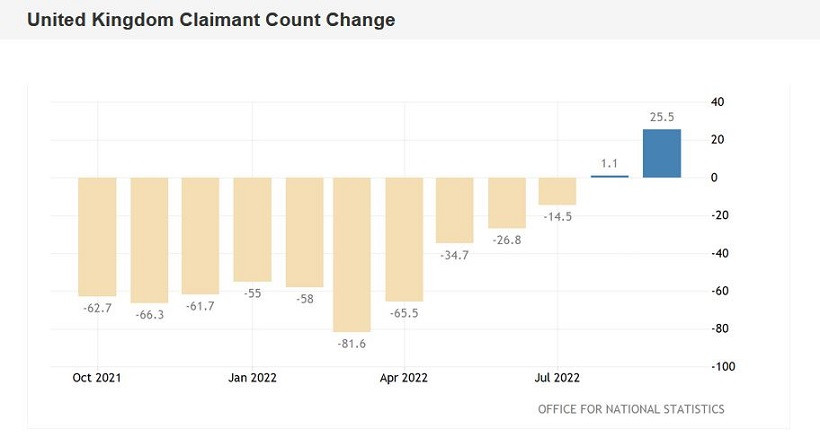

Thus, the unemployment rate fell to 3.5%. This is a long-term record - the best result since 1974. Salaries did not disappoint either. The level of average earnings (excluding bonuses) has been growing for the seventh consecutive month. This component was also in the green zone, reaching 5.4% (the strongest growth rate since September 2021). Taking into account premium payments, this indicator increased to 6.0%. This is also a pretty good result (the highest since June of this year). But the increase in the number of applications for unemployment benefits turned out to be disappointing. This component of the report grew by 25,000 at once, contrary to forecasts of growth by 13,000. This is also a multi-month record, only of a negative nature.

And yet, GBP/USD traders have come to the conclusion that the glass is rather half full than vice versa. Moreover, the figures a priori did not contribute to attack on a rather complex psychologically significant level of 1.1000. Therefore, bears were in a hurry to take profits, and bulls opened, respectively, long positions, taking advantage of the circumstances.

Is it possible to talk about the prospects for the development of the upward trend now? In my opinion, no. At least the pound is unable to turn the situation in its favor on its own. A more or less large-scale correction is possible only if the greenback weakens. Which, in turn, is waiting for inflation releases (especially the consumer price index, which will be published on Thursday). If US inflation surprises market participants with a jumpy growth again, the support level of 1.1000 is likely to fall.

The fact is that the pound is vulnerable. First of all, because of the policy pursued by the government of British Prime Minister Liz Truss, who took up her position in early autumn. Her first steps in the economic sphere caused a real "furor": after the presentation of a plan for large-scale tax cuts, the pound almost equaled the dollar, collapsing to a historic low of 1.0345. A sharp surge in volatility in the markets forced the Bank of England to announce the start of a temporary program to buy government bonds. Truss' anti-crisis plan has been criticized both by many financial institutions (from the IMF to rating agencies) and by most British and European politicians. Truss eventually took a step back, canceling plans to reduce the highest income tax rate. At the same time, she added that this compromise "will allow the government to focus on other parts of the anti-crisis plan."

Such contradictory signals, on the one hand, allowed the GBP/USD bulls to impulsively rise more than a thousand points (to the borders of the 15th figure), but on the other hand, did not allow them to gain a foothold in this price area (the pair dived to the borders of the 10th figure).

Meanwhile, the BoE continues to extinguish fires. The central bank announced that it has expanded its emergency bond purchase program to include inflation-linked government debt securities. There was a discussion among experts in absentia – will the new measures be able to prevent a new collapse of bonds? In particular, analysts at Brown Brothers Harriman are skeptical. In their opinion, the British central bank is trying to eliminate only the symptoms expressed in market instability. But at the same time, the BoE is unable to eliminate the cause. BBH economists are confident that only the British government can reverse the situation if it stops pursuing an "irresponsible" and "adventurous" fiscal policy.

Summarizing what has been said, we can conclude that good data in the UK labor market quite deservedly supported the British currency. But this support is situational, temporary. Therefore, longs for the pair are risky. It is advisable to go into shorts after the bears still overcome the support level of 1.1000 (at this price point, the Tenkan-sen Kijun-sen lines on D1 intersect). It is likely that the downward breakthrough will occur after the release of US inflation reports, if they find themselves in the green zone. The main target of the downward movement is the 1.0900 mark – this is the lower line of the Kumo cloud, coinciding with the lower line of the Bollinger Bands on the four-hour chart.