Analysis of EUR/USD and trading tips

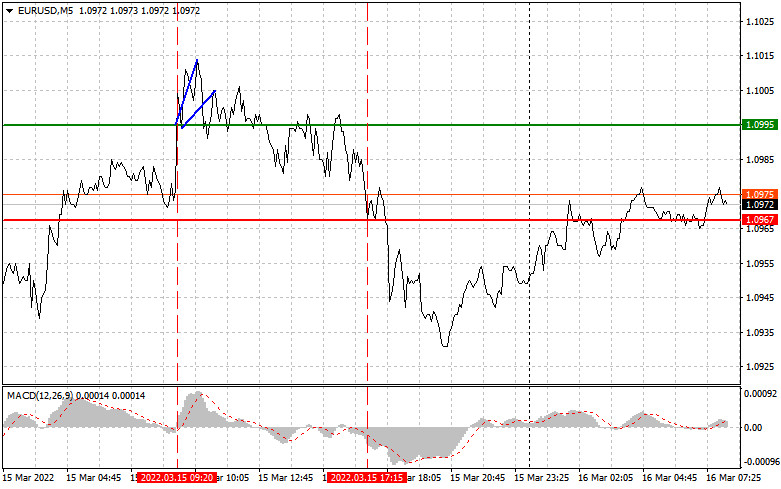

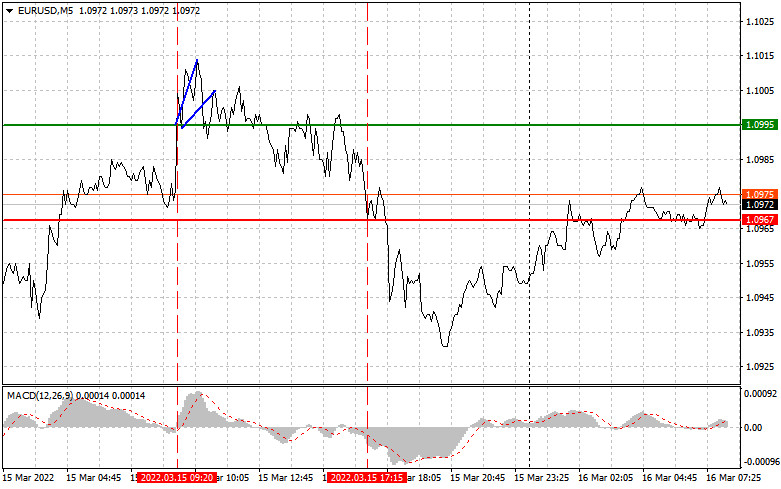

Yesterday, I recommended opening long positions on the euro at 1.0995. The breakout of the 1.0995 level occurred at the time when the MACD had just started to rise from the zero level. It signaled the possibility of an upward reversal. However, after the price approached new highs, demand for the euro declined quickly. After rising by 15 pips, the euro/dollar pair faced bearish pressure again. It was trading around the 1.0995 level. The fall of the euro in the afternoon and the test of 1.0967 occurred at a time when the MACD moved far enough from the zero level. It limited the downward potential of the pair. Although the pair tumbled significantly, I decided not to enter the market

On top of that, the sell-off of the euro was caused by discouraging economic reports from Germany and the eurozone. The ZEW Indicator of Economic Sentiment for Germany and the monthly ZEW Financial Market Survey for the euro area turned out to be extremely negative. Despite the fact that traders braced for downbeat reports, the reports indicated a possible sharp slowdown in the economic growth of the eurozone in the spring of this year. Speculators paid zero attention to the meeting of finance ministers of the euro area countries. The US dollar failed to grow following the release of the US producer price index survey as the figure undershot economists' forecasts. Today, the economic calendar for the EU is empty as traders are anticipating the FOMC meeting in the afternoon. The Fed will finally announce its key rate decision. If the Fed raises the interest rate more than expected, the US dollar will rise significantly against the euro. If the decision is in line with economists' forecasts, market activity will remain almost unchanged.

Buy signal

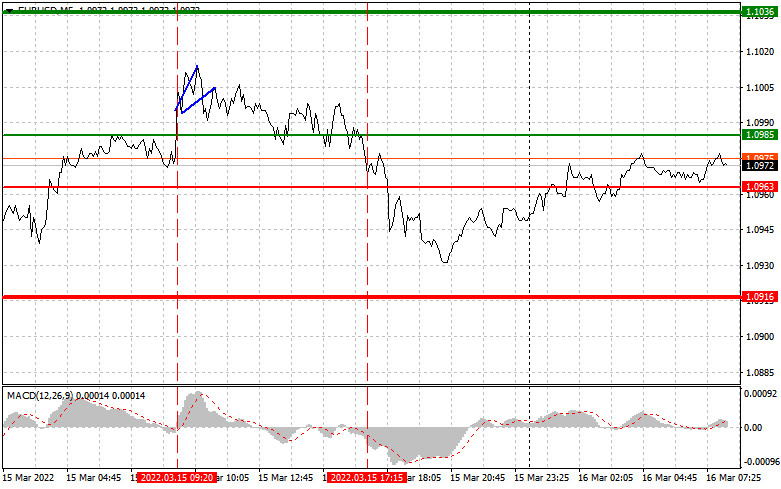

Scenario No.1: it is recommended to buy the euro today if the price reaches 1.0985 (the green line on the chart) with an upside target of 1.1036. I would advise closing long positions at 1.1036 and opening short ones in the opposite direction, keeping in mind a 20-25 pip correction from the given level. The euro is unlikely to advance considerably today due to the FOMC meeting. Important! Before opening long positions, make sure that the MACD indicator is located above the zero mark and it has just started to rise from it.

Scenario No.2: it is also possible to buy the euro today if the price approaches 1.0963. At this moment, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also lead to an upward reversal. The pair is expected to climb to the opposite levels of 1.0985 and 1.1036.

Sell signal

Scenario No.1: you can sell the euro if the price hits 1.0963 (the red line on the chart). The target level will be 1.0916. I recommend closing short positions at this level and opening long ones immediately in the opposite direction, keeping in mind a 20-25 pip correction from the given level. The FOMC meeting is likely to boost the US currency. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price approaches 1.0985. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also lead to a downward reversal. The pair is excepted to slide down to the opposite levels of 1.0963 and 1.0916.

Description of the chart:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Spontaneous making of trading decisions based on the current market situation is initially a losing strategy of an intraday trader.