Analysis of GBP/USD

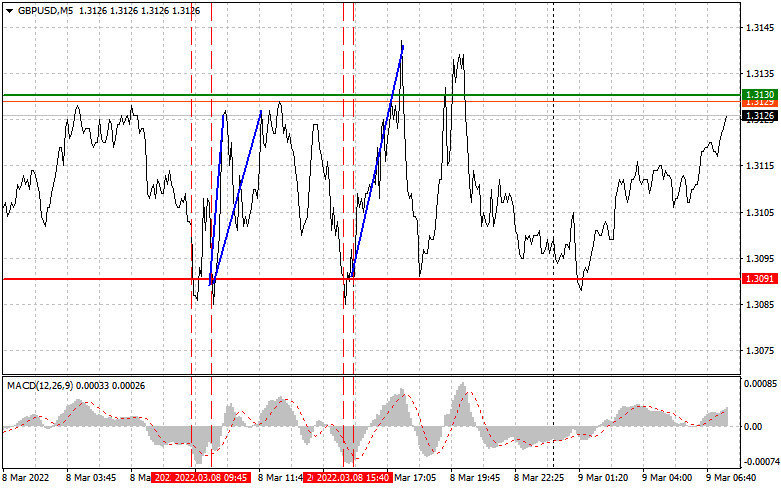

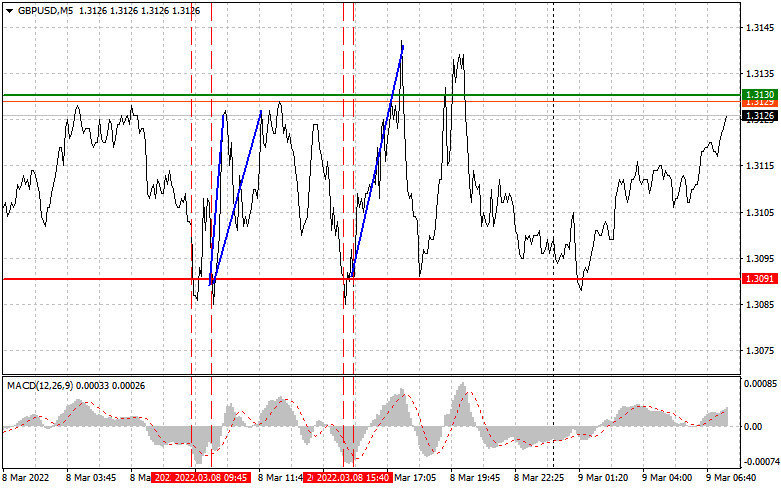

The pound/dollar pair tested 1.3091 when the MACD indicator was far from the zero level, thus capping the downward momentum. It was not a good idea to sell the pound sterling. Some time later, the pair once again tested the mentioned level. At that time, the MACD indicator was in the overbought area and was starting to recover, thus forming a buy signal according to scenario 2. As a result, the pair increased by 35 pips. In the second part of the day, the indicator formed the same signal from 1.3091. The pair climbed by 50 pips.

Positive news on the situation in Ukraine caused a rise in risky assets. In an interview on ABC News, Ukraine President Volodymyr Zelensky said that he was open to compromise on the status of Crimea and the Donbass. He also criticized NATO. "I have cooled down regarding this question a long time ago after we understood that ... NATO is not prepared to accept Ukraine," Zelensky said in the interview. The pound sterling grew amid the announcement. However, a lot depends on the actions of the UK's regulator. The Bank of England is trying to limit the surging inflation that is destroying the UK economy. In fact, the BOE may face even severe problems since energy prices have almost hit their all-time highs. In the first part of the day, the macroeconomic calendar is not rich in events. That is why trades will follow the situation in Ukraine. The second part of the day is also expected to be calm. Data on job openings and US crude oil inventories will hardly support the US dollar or push down the pound sterling. That is why traders will focus only on news from Ukraine and negotiations between the parties.

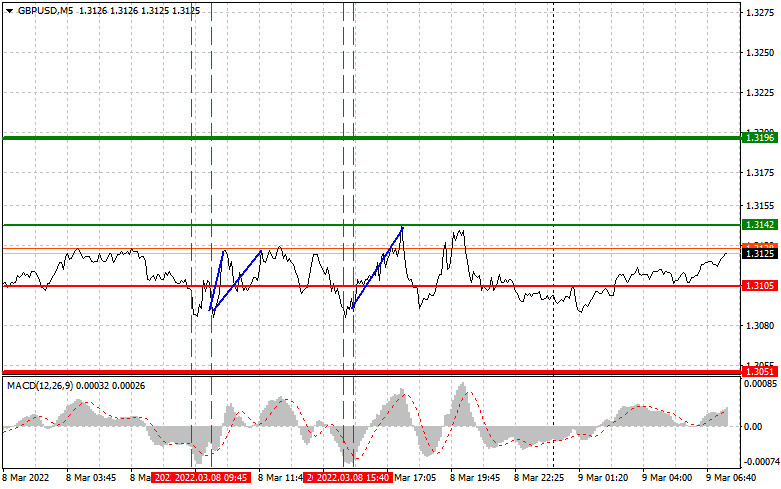

Signals to buy GBP

Scenario 1: today, it is possible to buy the pound sterling at 1.3142 (a green line) with the target of 1.3196 (a thicker green line). At the level of 1.3196, it is possible to open sell orders, expecting a decline of 15-20 pips. The British pound will hardly gain in value in the first part of the day. Only a break of 1.3142 may force speculators to close short positions. Importantly, before opening buy orders, make sure that the MACD indicator is above the zero level and is starting climbing from it.

Scenario 2: it is also possible to buy the pound sterling when the price touches 1.3105. At that moment, the MACD indicator should be in the oversold area that may cap the pair's potential and cause the market reversal. The price may increase to 1.3142 and 1.3196.

Signals to sell GBP

Scenario 1: today, it is possible to sell the pound sterling after the price tests the 1.3105 (a red line), thus causing a decline. The key target is located at 1.3051. There, it is recommended to close sell orders and open buy positions, expecting a rise of 15-20 pips. The pound sterling is likely to remain under pressure since tomorrow the US is going to disclose its inflation report. The data may cause mixed reactions, including a bullish signal for the greenback. It is better to follow scenario 2. Importantly, before selling the currency, make sure that the MACD indicator is below zero and is starting to decline from it.

Scenario 2: today, it is also possible to sell the British pound when the price touches 1.3142. At this moment, the MACD indicator should be in the overbought area, thus limiting the pair's potential and causing the price reversal. The asset may drop to 1.3105 and 1.3051.

What we see on the trading charts:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.

Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation is a losing strategy of an intraday trader.