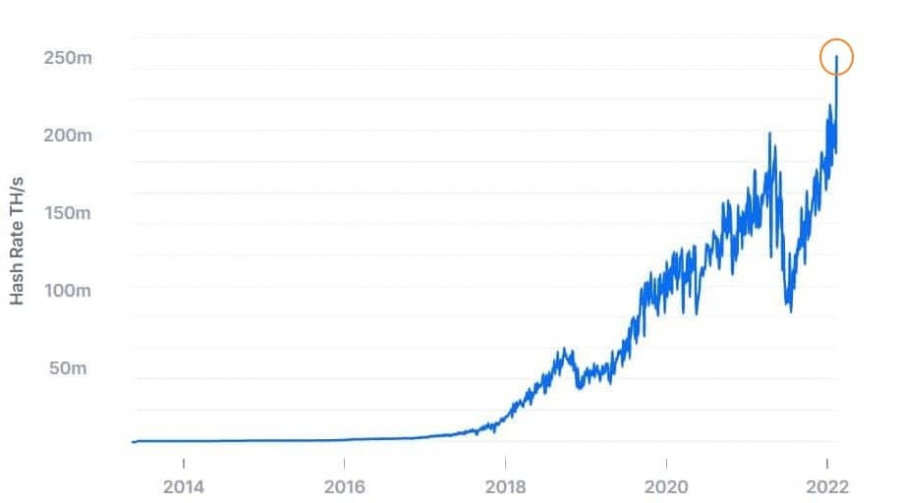

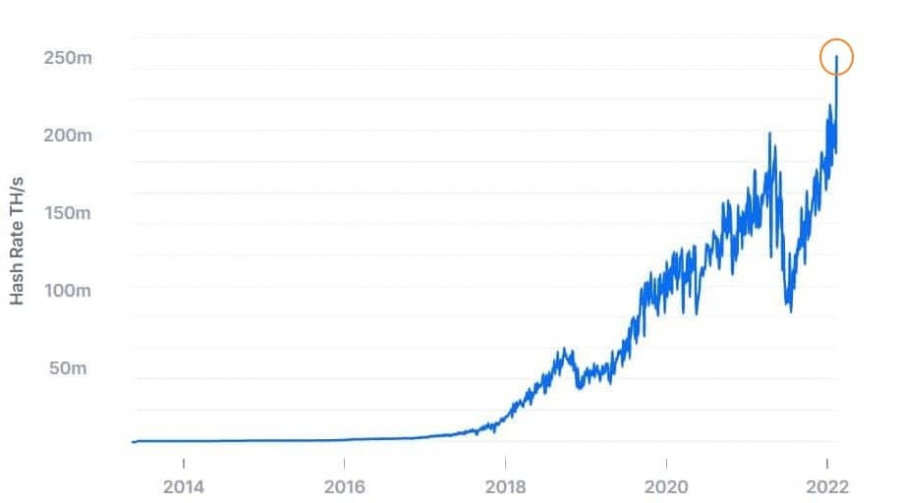

Traders are in no hurry to buy bitcoin, especially in the face of the events that await us today. First of all, we are talking about an extraordinary meeting of the Federal Reserve System, but more on that below. An interesting point is a sharp jump in the hashrate of the Bitcoin network to new historical highs, which, surprisingly, had little effect on the course.

Hashrate is a measure of the processing power required to mine blocks on the bitcoin network, and higher speeds make it much more difficult for individual entities to attempt to control the network in a so-called "51%" attack. At the moment, the hashrate reached 248.11 million TH/s, up from 180 million TH/s last week. Data shows it is currently hovering at 209.63M TH/s, down 15.51% in the last 24 hours. Over the past year, the Bitcoin hashrate has increased by more than 50%.

But while it is getting harder and harder to get Bitcoin, the Federal Reserve System may surprise today on the scheduled special meeting of the Committee for tonight. The fact that all procedures for the emergency meeting were fully followed indicates the importance of the meeting. It is planned to consider the issue of changing monetary policy in the direction of its tightening. In other words, interest rates will most likely be raised, and given that the meeting is special, at least rates will be raised by 0.5%. If this happens, a sharp drop in U.S. stock indices is not ruled out, which will pull the crypto market down with it.

India and 1% tax

Before that, I would like to say a few words about how representatives of the Indian cryptocurrency industry met with senior politicians in the Ministry of Finance to force them to reconsider some aspects of the new cryptocurrency taxation policy. According to experts, at such a level, the meeting was the first interaction between the crypto industry and politicians.

Note that more recently, India's Finance Minister Nirmala Sitharaman, announced a new cryptocurrency taxation policy. According to CoinDesk, representatives of at least one major exchange held informal consultations with a senior official of the Ministry of Finance.

According to rumors, the top management of cryptocurrency exchanges has asked for a revision of the 1% tax levied on all cryptocurrency transactions, stating that it is impossible and difficult to do. The argument was that such measures could scare off small traders and potentially push them to informal P2P trading and to use decentralized exchanges (DEX). Recently, DEX has been gaining momentum very much and volumes there are growing exponentially.

ISA Israel is looking for blockchain developers

As it became known, the Israel Securities Authority (ISA) is making big plans to regulate the country's fintech space. As a first step, it is expected to host its first fintech hackathon next month. With the help of the hackathon, ISA aims to attract new blockchain developers who can improve the infrastructure that supports the securities and government debt market in Israel, experts say.

The department also noted that the hackathon will serve as a catalyst for effective and high-quality cooperation between various participants in the Israeli financial system. The hackathon will be a meeting place for ISA and developers, technology firms and academics scientists. Combining these specialists into teams will create an opportunity for regulators and other stakeholders to gain in-depth technical knowledge about global developments in the field of financial technologies.

As for the technical picture of Bitcoin

Trading is already underway below the support of $42,695, and this is very bad, as gradually the pressure on bitcoin will only increase. If the bulls manage to get higher today after the decision of the Fed and stay at this level - a new wave of demand for the world's first cryptocurrency is not ruled out, which could lead to a price of $45,580 per bitcoin - the third test of the level could become victorious. Only going beyond this range will open a direct road to the highs: $48,554 and $51,810. If the pressure on the trading instrument only increases in the near future, a breakdown of $40,899 will lead to a larger sell-off already in the area of the lows: $38,750 and $36,090. There we will see new activity of large players counting on strong growth this year.

Some experts believe that $33,000 was the bottom of bitcoin and now there is much more asymmetry in favor of growth than in the direction of decline. There are other encouraging signs as well. The coin has exited the downward trend observed since last fall. A return above its 50-day moving average for the first time in 81 days is a very bullish signal.

As for the technical picture of the Ether

The bulls missed out on $3,000 and so far no one is going to return above this range. Until the moment when trading is carried out above $2,750, there is no need to fear for the fate of the ether. But the first signs are already there. Only a return and consolidation above $3,000 will lead to more active growth towards $3,284 and $3,455. If the pressure continues on ETH, I would very much like to see those willing to buy in the $2,754 region. If they suddenly do not turn out to be there, then a return to this level and another sale for $2,470 is not excluded. A break in this range is a direct path to a minimum of $2,130, where large players will start to act actively again.