Analysis of transactions in the EUR/USD pair

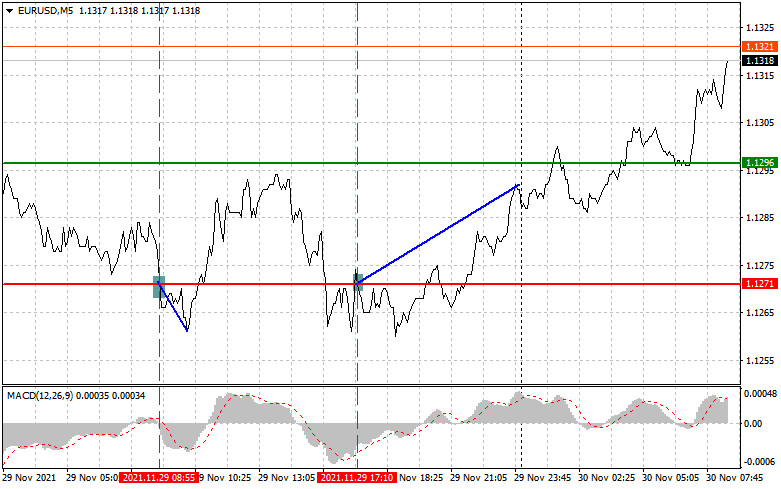

There were some great market entry points on Monday. The first test of the 1.1271 price level occurred at the beginning of the European session. At the time of updating this level, the MACD indicator was just starting its downward movement from the zero mark, which confirmed a good entry point into the market.

However, a major fall did not take place, and after moving down by 10 pips, the pressure on the euro eased. Later, after retesting the 1.1271 price level, a signal to buy was generated. When this level was updated, the MACD indicator had been in the oversold zone for quite a long time, which made it possible to rise by about 20 pips.

Monday's figures on the eurozone consumer confidence indicator coincided with economists' forecasts, which did not affect the European currency in any way. But the data on the German consumer price index supported the euro, as the reduction in inflationary pressure turned out to be less large than experts expected.

Today, we are waiting for a huge number of statistics: watch out for the reports on changes in the volume of consumer spending and GDP in Italy, as well as the GDP of France and the consumer price index. Only very serious positive changes in these reports will be able to push the euro up.

What's more interesting is the report on the German unemployment rate, as well as data on the eurozone consumer price index. The increase in inflation in the eurozone will lead to some revision of its position on stimulus measures by the European Central Bank – a bullish signal for the European currency.

Meanwhile, the US consumer confidence indicator is expected to decrease. If the data disappoint traders, the pressure on the US dollar will get stronger. It will also be interesting to hear what Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen have to say. The Fed is expected to resort to tightening policy and begin to more aggressively curtail the bond purchase program – a bullish signal for the US dollar.

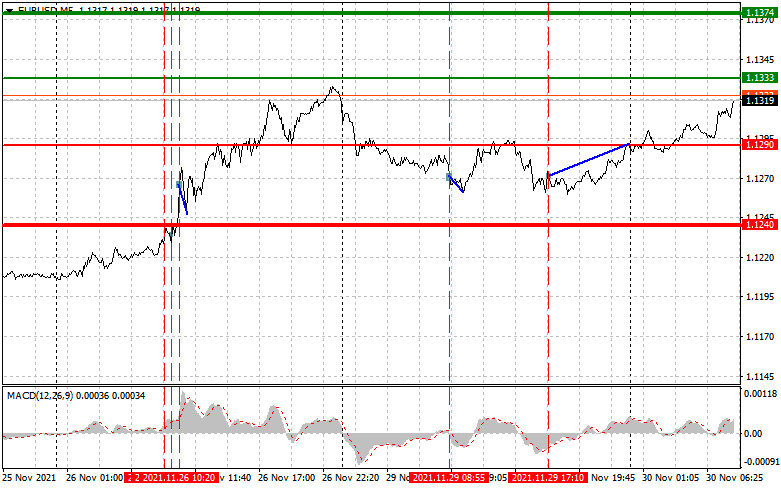

For long positions:

Buy euro when the price reaches 1.1333 (green line on the chart) with the target of rising to the level of 1.1374. I recommend exiting the market at 1.1374 with a profit and selling the euro immediately in the opposite direction (expecting a movement of 10-15 pips in the opposite direction from the level). You can count on the growth after strong statistics on Germany, France, and Italy, as well as the eurozone, where inflation may turn out to be higher than the forecasts.

Before buying, make sure that the MACD indicator is above zero and just starting to rise from it.

It is also possible to buy if the price reaches 1.1290, but at that moment the MACD indicator should be in the oversold area, as only by that will the market reverse to 1.1333 and 1.1374.

For short positions:

Sell euro after reaching the level of 1.1290 (red line on the chart). The target will be the level of 1.1240, where I recommend leaving the market and buying the euro immediately in the opposite direction (expecting a movement of 10-15 pips in the opposite direction from the level). Pressure on the euro will return in case of weak economic performance in the euro area, as well as in the case of lower annual inflationary pressures.

Before selling, make sure that the MACD indicator is below zero and just starting to decline from it.

It is also possible to sell the euro if the price reaches 1.1333, but at that moment the MACD indicator should be in the overbought area, as only by that will the market reverse to 1.1290 and 1.1240.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.