Euro and pound tried to rally on Tuesday, but failed because of strong statistics on the US economy. This better-than-expected data is proof that the Federal Reserve made a correct approach on economic stimulus.

But before discussing that, it is important to note that trouble is brewing inside the US government. Because of stubborn resistance from other cabinet members, it seems that President Joe Biden will fail to deliver one of his key campaign promises - to reverse the 2017 tax cut.

During his campaign, Biden promised to raise taxes for large corporations and reduce the tax burden for ordinary citizens, which received widespread support from citizens. But now he is facing the same political reality that Barack Obama faced: raising taxes and enacting tax reform is an overwhelming task, as some key politicians in Congress are against it.

In Biden's case, the biggest obstacle was Senator Kyrsten Sinema of Arizona. Although she does not publicly voice her views, other Democratic lawmakers say she opposes tax hikes.

Biden has already admitted that he does not have enough votes to allow him to raise the percentage and reverse Trump's corporate tax reform to cut the rate to 21%.

More details are likely to emerge later this week as Democrats plan to release their plan to fund a nearly $ 2 trillion social spending package - which also has some problems.

Talking about the tax changes adopted by Republicans in 2017, the corporate rate fell from 35% to 21%. This lowered the tax rate for the richest Americans to 37%, resulting in a net tax loss of $ 1.5 trillion over ten years. Republicans are confident that in this way they made the country more competitive on the world stage, while Democrats are confident that this did not lead to the promised economic growth and investment, but only significantly helped wealthy Americans and corporations to exacerbate inequality.

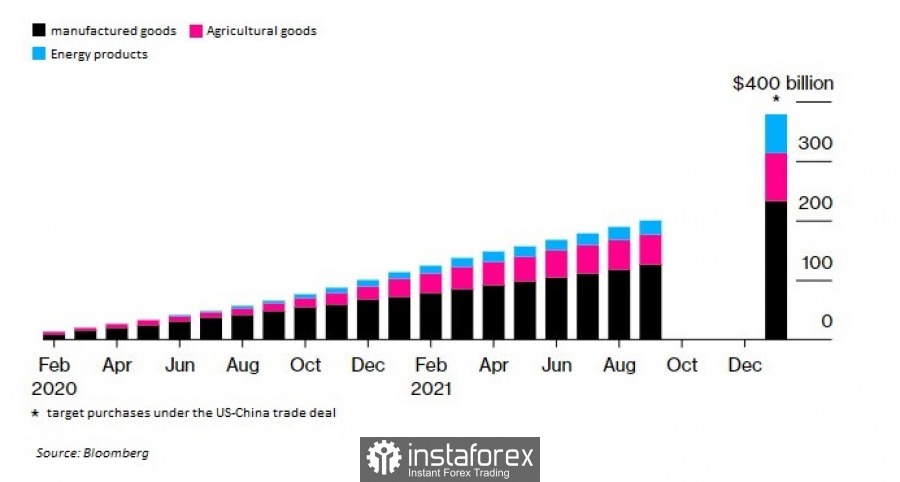

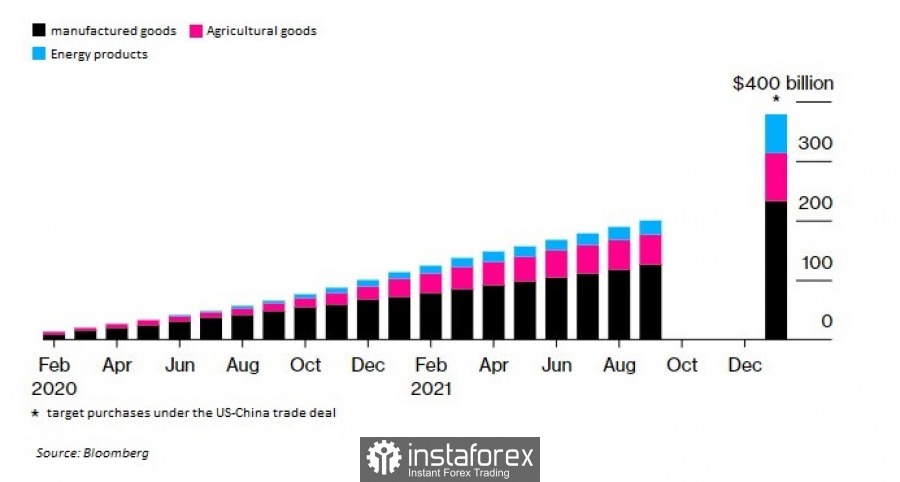

Another hot topic for the United States is trade negotiations with China. According to the latest data, the two governments have made some progress in their economic and trade negotiations after another telephone conversation between Chinese Vice Premier Liu He and US Treasury Secretary Janet Yellen. China described the conversation as "pragmatic, frank and constructive," mentioning that both sides agreed that it is important to strengthen interaction and coordinate macroeconomic policies since the world economy is going through hard times.

Relations already improved last month after a telephone conversation between Presidents Joe Biden and Xi Jinping. Shortly thereafter, an agreement was reached to release Huawei CFO Meng Wanzhou from extradition proceedings in Canada.

China also said on several occasions that the US should lift export duties imposed during the administration of former President Donald Trump. They also repeatedly denounced US sanctions against companies such as Huawei Technologies. Meanwhile, Treasury Secretary Janet Yellen raised a number of important issues, but details were not disclosed. Both sides agreed to continue negotiations.

In Europe, information has appeared that commercial banks are not going to wait for the European Central Bank to "start moving". They plan to further tighten the terms of home loans in the fourth quarter of this year, and slightly soften criteria for consumer lending.

This is a huge contrast to the situation during the third quarter, when the standards for providing loans to companies were soft, while the conditions for loans were strict. Back then, demand has slightly increased amid improved consumer confidence and lower overall interest rates.

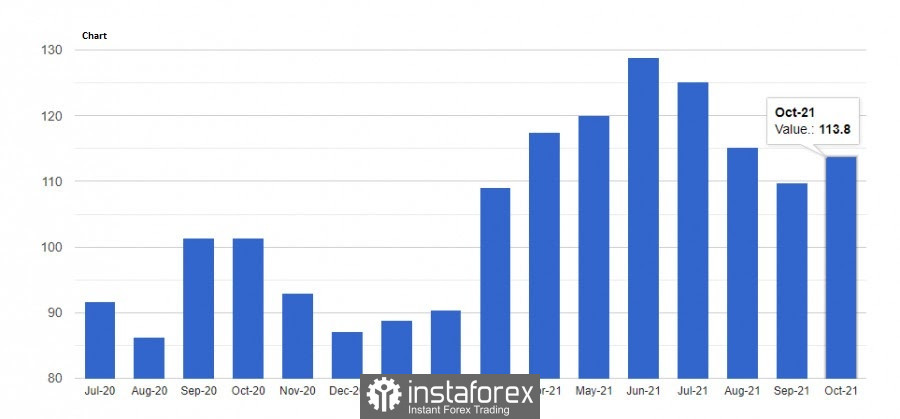

Speaking of consumer confidence, the Conference Board reported yesterday that data for US showed a rise to 113.8 points in October, from 109.8 points in September. Many had expected the index to fall to 108 points.

The main driver of growth was the decline in fears over the coronavirus, while short-term worries about inflation rose to a 13-year high. The report said the proportion of consumers planning to purchase homes, cars and large appliances increased in October - a sign that consumer spending will continue to support economic growth in the final months of 2021. As such, the present situation index rose to 147.4 points, from 144.3 points a month ago.

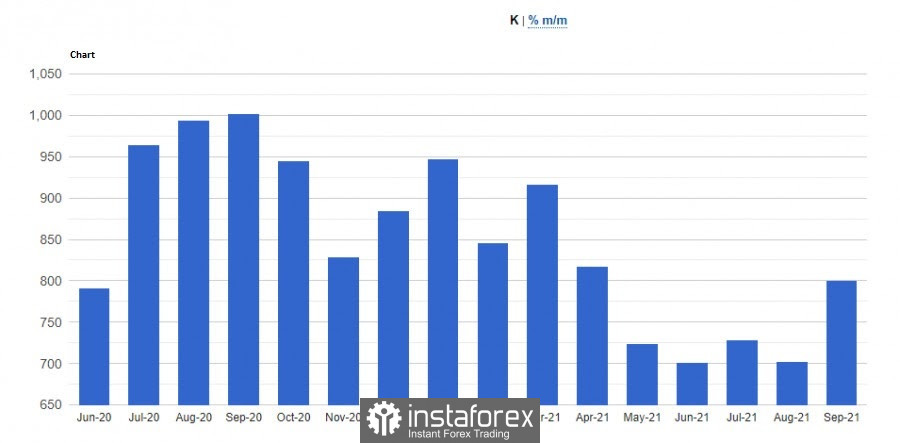

Data on new home sales also increased in September, jumping 14.0% to 800,000. But despite much stronger monthly growth, the figure is still down 17.6% from the same period last year. The Department of Commerce also said the average new home price in September was $ 408,800.

Technical analysis on EUR/USD

Bulls tried to regain control over 1.1625, but failed. As a result, EUR/USD dropped even lower, leading to new weekly lows and a new downward channel. Now, the key level is 1.1590, where a breakdown would lead to a further decrease to 1.1540 and 1.1510. But if the bulls manage to push the quote to 1.1625, the pair will rise to 1.1650 and 1.1670.