The allure of remote work and the ease of global travel have prompted many to consider trading as a profession.

When weighing the pros and cons of trading in the global financial markets, aspiring traders face numerous dilemmas associated with the trade. One common concern is the fear that, as newcomers, they may not have enough money, wit, and intuition to succeed in the market. They worry that they won’t be able to understand complex trading methods.

To gain more insights on what trading methods exist on Forex and what their main principles are, read our article about Trading Methods.

At this point, experienced traders who interact with beginners often reassure them that substantial profits can be made through straightforward and comprehensible tools. These tools do not require exceptional analytical skills, intense intellectual and emotional effort, or years of experience.

Among these straightforward yet effective strategies, professionals frequently mention Victor Sperandeo's method – one of the simplest rules for constructing trend lines.*

Most seasoned traders agree that this trading strategy enables beginners to conduct the most accurate analysis of the currency market using simple logical patterns, without the need for specific knowledge or skills.

Moreover, many veteran traders, having adopted this method early in their careers in the global financial markets, consider Sperandeo's trading approach based on price behavior their primary strategy, often avoiding more complex strategies based on indicators.**

That is why today, we will delve deeper into Sperandeo's method. It is time to explore the features of this trading strategy and learn about all its advantages and disadvantages, as well as the unique opportunities it presents.

*Trend lines are visually represented price changes shown over time. A trend line easily identifies the character of the price change as well as the dynamics and direction of that change.

**Indicators are tools used for analyzing the market and making forecasts about price changes in financial markets. In other words, they are calculations based on the volume of a specific trading instrument and its price.

What is Sperandeo's Method?

The Sperandeo trading strategy, also known as "1-2-3 Reversal," bears the name of its creator, Victor Sperandeo, a legendary trader and financial commentator who has graced the world's financial markets for over 45 years. His approach has stood out among the myriad of strategies discussed on various trading forums, largely thanks to his proven talents and trading successes on global exchanges.

Sperandeo's trading method helped him earn increasingly substantial profits, enabling him to establish his own capital management corporation, Rand Management Corporation.

Now, at the age of 76, Sperandeo focuses on educating new market participants, sharing his secrets through several technical analysis* techniques. On his website, one can find his biography, personal blog, news, and promotions for his books. In one of his books, "Principles of Professional Speculation," Sperandeo explains his simple yet effective method of trend line construction.

The core aim of the Sperandeo method is to precisely determine the end of a trend and the start of a new one immediately after a reversal.* The foundation of this approach is a trend line, which acts as a level of support or resistance,* depending on the prevailing trend, and signals the current direction of the price.

To draw this line, we refer to the classic rules of technical analysis, which state that a trend line should connect two extremum points.* But what if there are numerous highs and lows on timeframes?* Which of them should you choose to build a trend line?

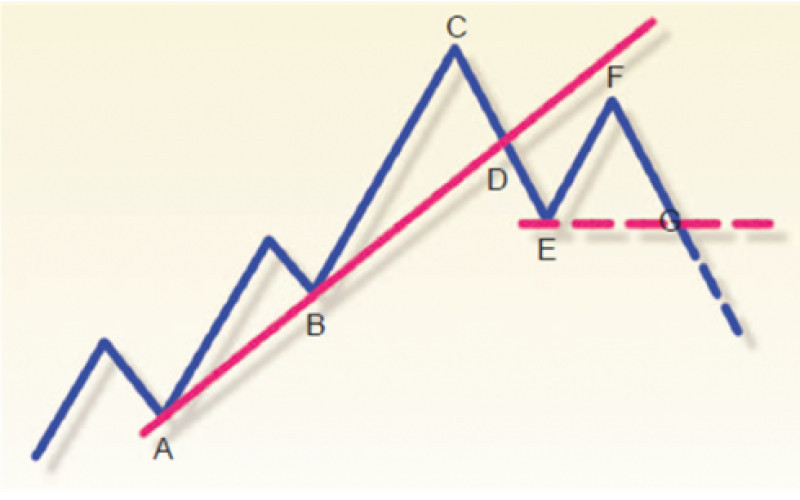

This is where the efficiency and simplicity of Sperandeo's strategy come into action. According to his method, if an ascending trend is present on the chart, the trend line should be drawn through the two extreme lows that occurred before the last high. Conversely, in a descending trend, the line is built through the two extreme highs formed before the last low.

There's another crucial detail to understanding the Sperandeo method that led to its nickname "1-2-3 trend reversal" which implies conditions signaling a trend change.

Victor Sperandeo's method is capable of indicating a precise moment when a trend change might occur in the currency market. To detect this signal, a trader must identify three consecutive conditions that suggest a forthcoming shift in market direction:

- The price breaks through the trend line.

- The price must return to the broken line and test the lowest low in the case of an ascending trend or the highest high in a descending trend.

- The price breaks through the extreme point that was formed after the trend line breakout.

*Technical analysis: This is a set of tools that enables traders to evaluate the current financial market conditions and forecast potential changes by identifying statistical patterns of price movements.

*Trend reversal: This market situation occurs when the general direction of the price movement shifts from downward to upward or vice versa. Reversal points are the horizontal lines that help identify key levels that can trigger a price change.

*Support and resistance levels: These are horizontal lines drawn at the price lows or highs, which can either halt the price movement (support) or push back against an upward movement (resistance).

*Extremum points: These are the highest or lowest points that the asset’s price has reached.

*Timeframe: This is a time interval used to group quotes during the formation of price chart patterns of a traded asset.

Advantages of Sperandeo’s trading method

The Sperandeo method stands out for its ability to minimize subjective bias during technical analysis. By relying on mathematical algorithms to construct trend lines, it sidesteps the emotional and behavioral factors that can influence a trader's decision.

Furthermore, the "1-2-3 Reversal" strategy inherent in this method offers market players considerable flexibility. Traders can draw trend lines using either the shadows or the bodies of candlesticks, with the choice left entirely up to personal preferences and skills.

However, it is important to note that newcomers are generally advised to build trend lines based on the bodies of candlesticks. It simplifies the process of setting stop-loss orders.

If you opt for building trend lines based on candlestick shadows, it can be more difficult for you to set a stop-loss** although it does provide the benefit of highly flexible trend lines and the potential for more elusive price movement signals.

One of the most significant benefits of the Sperandeo method is its proven effectiveness and profitability. Traders worldwide have adopted this strategy both as a standalone trading system and as a supplementary tool. You can hardly find anyone who is not satisfied with the outcomes the strategy provides.

The strategy’s simplicity and convenience are also notable. Even the most inexperienced trader can easily construct a trend line following the "1-2-3 Reversal" rules, not to mention analyze market movements and trend changes based on precise signals from this trend line.

In addition, the high compatibility of the Sperandeo method has won it many fans. It performs splendidly both on its own and in tandem with a vast array of other patterns and elements of technical analysis. Moreover, it is compatible with virtually any trend-based strategy, with the possible exception of scalping techniques.

Finally, the beauty of Victor Sperandeo's approach is that its application is not limited to just currency pairs. Although it operates most effectively with major currency pairs, cross rates** and exotic pairs*** can behave unpredictably with this method.

Nonetheless, numerous traders have successfully extended the "1-2-3 Reversal" strategy beyond the currency market, applying it to stock exchanges, futures, precious metals, and various other markets.

*A stop-loss is a type of trade order where a trader sets a point at which a losing position is automatically closed to prevent further losses.

**Cross rate refers to the exchange rate between two currencies where neither of the currencies is the US dollar.

***Exotic pair consists of one major currency and one from a developing economy, typically characterized by less trading volume and greater unpredictability.

Disadvantages of Sperandeo’s trading method

While the Sperandeo method is indeed a great solution for trading, it is crucial to understand that it is not an infallible tool. Before incorporating this trading approach into your strategies, it is wise to thoroughly study its nuances, potential, and drawbacks.

Perhaps the most significant drawback of this strategy is intrinsically linked to its key advantage: simplicity. Many traders, upon discovering the Sperandeo method, fall into the misconception that they have stumbled upon a simplistic algorithm for easy money-making in the Forex market. The premise seems straightforward: follow a few simple rules and gain profit. However, this is far from reality.

Firstly, before executing any trade, even one that appears simple, it is essential to adhere to the principles of risk management.* This cannot be overstated as a lack of proper risk management can lead to substantial losses.

Furthermore, one must never forget that financial markets are subject to an infinite number of external factors that significantly impact their dynamic. Although the Sperandeo method is based on precise mathematical calculations, they do not guarantee a hundred percent success rate in global financial markets.

To minimize risks and protect themselves against losses, traders should employ fundamental analysis. This type of analysis helps determine what is happening in the market at any given time and allows traders to constantly keep in focus the factors that can influence price movements.

After all, the value of an asset is not an artificially created metric. It represents the real interplay of supply and demand, which, in turn, is heavily influenced by the economic and political sentiments prevailing in the world.

Significant fluctuations in currency exchange rates can occur at any moment due to changes in countries' monetary policies, investors' reactions to recent economic and geopolitical events, news backgrounds, and fresh macroeconomic statistics, as well as wars, pandemics, and climate catastrophes.

Traders must also be mindful of the so-called force majeure events or black swans** which remind us that the market is always under the influence of factors that do not submit to strict mathematical laws.

This means that correctly drawing a trend line requires more than memorizing the definition of a trend. For example, if you are trading on an intraday chart, it is necessary to check what the daily chart shows before trading begins.

The Sperandeo strategy only works effectively under conditions of high market volatility. In such a scenario, the price of the traded asset approaches its highest peak, tests it, and then reverses.

Moreover, a common issue when employing the "1-2-3 Reversal" technique is traders misplacing the trend line due to incorrect identification of the minimum and maximum points, which serve as the line’s foundation. Although Sperandeo tried to describe the process in great detail, the task of correctly constructing a trend line proves to be too complex for many market participants.

This complexity often arises from traders' emotions and overconfidence. Under the influence of emotional fervor and a firm belief in the method, they mistake their desires for reality, which inevitably leads to significant losses.

It is important to remember that any trading strategy, no matter how simple it may seem, requires the ability to wait and behave rationally. Victor Sperandeo’s method has a clear set of actions for drawing trend lines for a reason. It is imperative to adhere strictly to this algorithm, thoughtfully planning each subsequent step.

Hence, the "1-2-3 Reversal" strategy, like any other tool in technical analysis, requires thorough and attentive elaboration, continuous adjustments, and non-stop filtering.

*Risk management is a set of rules that help traders determine the amount they are ready to invest and the amount of losses they can afford to accept.

**Black swan is a term first used by Nassim Nicholas Taleb in 2007. It refers to unforeseen, inevitable, and rare economic, political, and social disasters that carry distinctive characteristics and bear significant and meaningful consequences for the world.

Final thoughts

Sperandeo's method is often referred to as one of the simplest tools for constructing trend lines. This implies that even a novice trader can make use of it.

To employ the "1-2-3 Reversal" strategy, market players do not need to download additional programs onto their smartphones or PCs, read dozens of thematic books, watch hundreds of video lessons on YouTube, or go through thousands of instructions. This trading tactic requires only precise adherence to a few embedded rules.

Moreover, Sperandeo's technique helps avoid many psychological aspects that market beginners may struggle with. It eliminates the presence of emotions and impulsive urges. At its core are clear and unemotional mathematical calculations that, if followed correctly, prevent the user from any unnecessary emotional gestures and actions.

However, this does not mean that the aforementioned strategy is only suitable for those taking their first steps in the market. The foundation of Sperandeo's method is the determination of the trend, and the ability to accurately identify the trend is a key element for both novices and experienced traders. Without this skill, profitable trading is simply impossible.

By mastering this task, every market player significantly increases their chances of more accurately determining the beginning of a trend, and especially the potential price correction of an asset.

Therefore, the "1-2-3 Reversal" trading method can be named one of the most reliable among the tools of technical analysis. If you spot it on the timeframe, be prepared for a reversal. The chances that the trend will change in the very near future are very high.

In addition, Sperandeo's model is a trading tool that will always be in demand. Despite the fact that the American businessman shared his brilliant trading discovery more than 20 years ago, traders around the world continue to eagerly utilize his invention to this day. This means that the strategy will still be relevant over time.

While the world of trading is constantly changing and becoming more modernized and optimized, Sperandeo's methodology retains its stability and consistency.

It must be emphasized that the "1-2-3 trend reversal" strategy is not a guarantee against financial losses. Despite the numerous advantages of this strategy, it also has its pitfalls, which can sometimes lead to capital losses for traders.

The most significant drawback of the method is the deceptive simplicity when searching for extreme points, which are the basis for drawing the trend line. Market players need to adhere strictly to the algorithm to identify these points correctly, but in the heat of emotion, they sometimes choose to overlook this step.

Moreover, traders often forget that financial markets are anything but static. Loud global events, political upheavals, significant news, and eagerly anticipated macroeconomic reports can instantly impact market volatility and overall conditions.

Many overlook this reality, applying Victor Sperandeo's method to their trading strategy, regardless of the surrounding events.

We hope that today's overview of the "1-2-3 Trend Reversal" trading method will empower you to up your game and thrive even more in the global financial markets.

You may also like:

Back to articles

Back to articles