To open long positions on GBP/USD, we need the following conditions:

Yesterday, trading unfolded quietly. In the first half of the day, there was no formation of entry points. Volatility in the market is rather low amid the lack of economic reports and ahead of the meeting of the Specialized Committee on the implementation of the Protocol on Northern Ireland. Thus, many traders refrain from opening new positions. In the afternoon, bears tried to push the pair to the level of 1.3460. They lacked only 5 pips to test this level. Therefore, many traders did not enter the market. As a result, the pair got stuck in the sideways channel. Technical indicators also changed their movements. Today is going to be quite an interesting day.

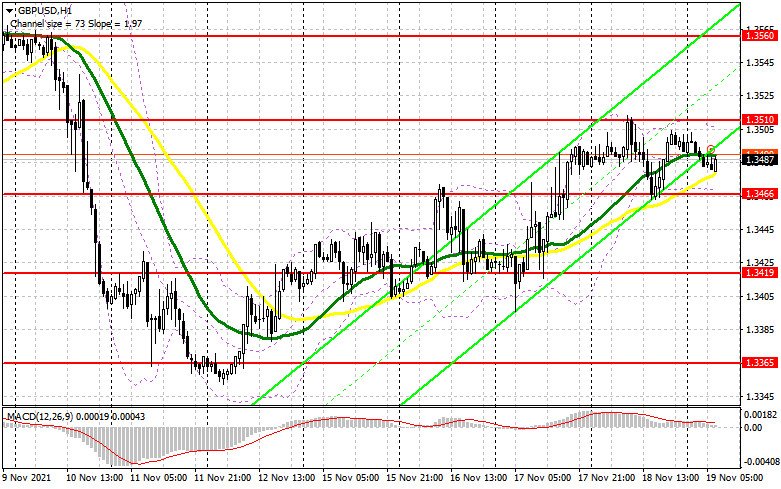

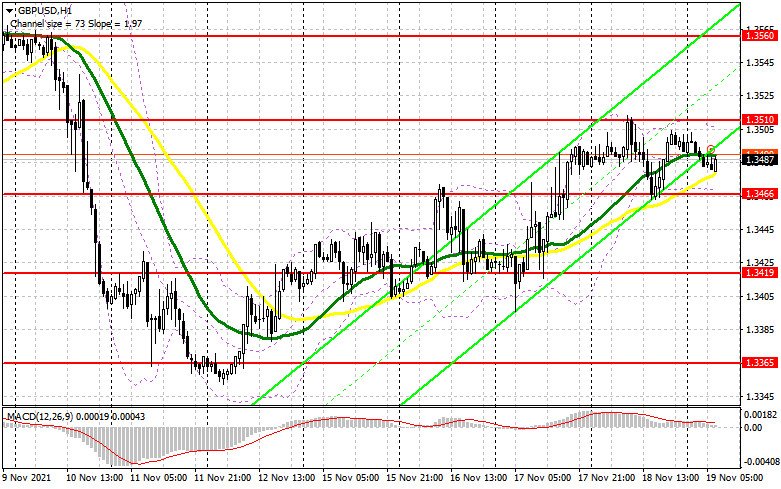

Analysts believe that the pound sterling is likely to be unaffected by the upcoming retail sales report given the fuel costs in the country. Besides, speculators will focus on the results of the meeting of the UK and the EU policymakers on the Northern Ireland Protocol. In the first half of the day, Hugh Pill, a member of the Bank of England, will also give a speech. Yet, his speech is unlikely to influence the GBP/USD pair. Now, it gets stuck in the sideways channel. The best way to buy against the trend is to expect a downward correction to the support level of 1.3466, which was formed yesterday. Only the formation of a false breakout of this level may boost the pound sterling's growth and its return to 1.3510. A breakout and a test of this level will open the way to a high of 1.3560. At this level, it is recommended to close positions. A more distant target level will be 1.3605. Yet, the price may hit this level only if the UK and EU reach an agreement. If the pair dips in the first half of the day failing to rise to 1.3466, bears may increase pressure on the pound sterling. In this case, it is better to open new long positions only after a false breakout of 1.3419. One may consider long positions on GBP/USD, counting on a rebound from the week's low of 1.3365 or from the support level of 1.3308 and an intraday correction of 25-30 pips.

To open short positions on GBP/USD, we need the following conditions:

Bears are also lacking the strength to regain ground. Like bulls, they are awaiting the results of the meeting on the Northern Ireland Protocol. If parties fail to reach an agreement, the pound sterling will extend losses. Importantly, many analysts are sure of such a scenario as the relationship between the UK and the EU has been escalating for some time. Nevertheless, we should not expect a steep drop in the pair as traders have already priced in the possible negative outcome of the meeting. It is recommended to open short positions amid a false breakout of 1.3510. It may lead to the formation of a new entry point into short positions, followed by a decline to 1.3466. This level is quite important for today's trading. The breakout of this range during the speech of BoE policymaker Hugh Pill may give an additional signal to open short positions near the weekly lows of 1.3419 and 1.3365. At these levels, it is better to close positions. If during the European session the pair climbs instead of declining to 1.3510, it is best to postpone sales to a larger resistance level of 1.3560. It is recommended to open short positions, counting on a rebound from 1.3605, or even higher from 1.3649 and an intraday drop by 20-25 pips.

COT report

The COT reports (Commitment of Traders) for November 9 revealed an increase in short positions and a sharp drop in long positions, which led to the formation of a negative delta. The pound sterling lost momentum due to weak UK GDP data for the 3rd quarter, as well as the risk of a slowdown in retail sales in the 4th quarter amid high inflation. The uncertainty over the Northern Ireland Protocol, which the UK authorities plan to suspend in the near future, is also weighing on the pound sterling. The European Union is preparing to introduce retaliatory measures. The US is facing the highest inflation on record. Many analysts expect the Fed to hike the key rate next year. This is bullish for the US dollar. However, it is recommended to stick to the strategy of opening long positions after sharp declines, which may occur because of uncertainty over the BoE's monetary policy. The COT report showed that the number of long non-commercial positions decreased to 54,004 from 57,255, while the number of short non-commercial positions rose to 66,097 from 42,208. The number of the non-commercial net position dropped as well 12,093 against 15,047 a week earlier. The weekly closing price of GBP/USD edged lower to 1.3563 from 1.3654 because of the Bank of England's decision on monetary policy.

Signals of technical indicators

Moving averages

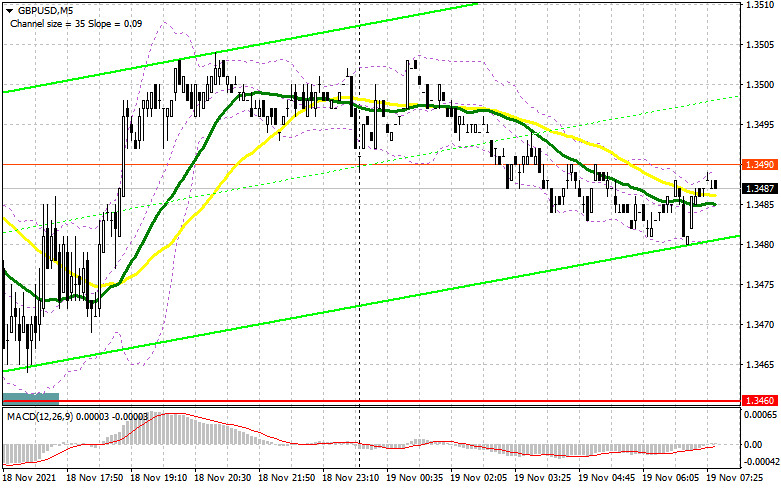

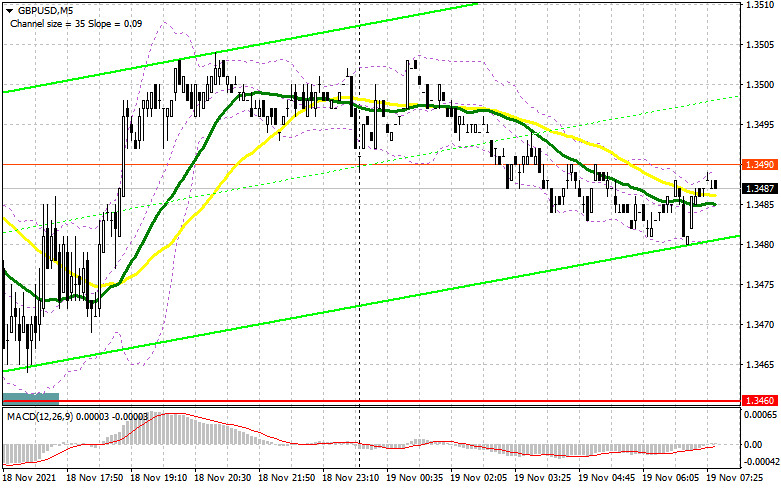

GBP/USD is trading slightly above 30- and 50-period moving averages. It means that the pair is trading without a clear-cut trend.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the upper border of 1.3510 will trigger a new bullish wave of GBP. Alternatively, the breakout of the lower border of 1.3466 will increase escalate pressure on the pound sterling.

Definitions of technical indicators

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.