Risk appetite declined ahead of a series of central bank meetings scheduled for this week. Some banks are expected to be definitive, and not all will mention specifics. This is because most have different views on how to pursue policies, as some are worried about rising inflation and are ready to impose a decent fight on it. Others, meanwhile, are set to extend stimulus measures to maintain sustainable economic growth rates.

The US Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England, which together are responsible for monetary policy in nearly half of the global economy, will make their final decisions this week. 16 other banks will also hold meetings.

The future of rates were determined already, but uncertainty arose again because of the new coronavirus strain. Omicron's impact on economic growth and inflation will definitely affect the decisions of central banks in the new year. Worryingly, this strain that is more resistant to vaccines has already forced a number of countries to impose new restrictions, so consumers had to stay at home.

That is why changing policies is risky, despite the threat of overheating looming in many countries. Central banks should taper stimulus because of growing inflation, but supply disruptions and new quarantine restrictions make it difficult to do so. The current situation also suggests that recovery will end abruptly, after which there will be a period of stagnation. If inflation still does not hold at 2.0% by that time, central banks will have even more problems.

But Fed Chairman Jerome Powell will most likely insist on a cut in bond purchases this Wednesday, and may even hint that he is ready to raise interest rates earlier than scheduled provided that inflation remains sky-high.

Other central banks such as the European Central Bank and the Bank of England, on the other hand, will carefully determine if the observed surge in inflation is "temporary" or not. The decision will have a huge impact on the eurozone economy.

It should be noted though that maintaining a super-soft policy for too long could allow inflation to spiral out of control, triggering a sharper tightening later on. That will lead to an instant sell-off in peripheral bonds, along with tougher financial conditions that risk harming the economy right now.

Talking about inflation, the ECB made projections last September that it would slow down to 1.5% in 2023. New forecasts until 2024 will be released on Thursday and ECB President Christine Lagarde will rely on them. She is convinced that the observed increase in consumer prices will eventually return to 2%. But Deputy Governor Luis de Guindos recently said he is worried because inflation does not decline as quickly as expected.

Nevertheless, the ECB has reasons to maintain a super-soft policy because changes could lead to economic disruption. Any wrong decision could cause sluggishness in the labor market and relatively low core inflation.

Supply chain disruptions and global shortage of raw materials also persist, although most economists are confident that those problems will gradually go away in 2022. Companies that are facing long lead times are now fewer according to recent polls, and a recent report from the Bank for International Settlements noted that some price trends could reverse when companies stop pursuing more cautious business development strategies.

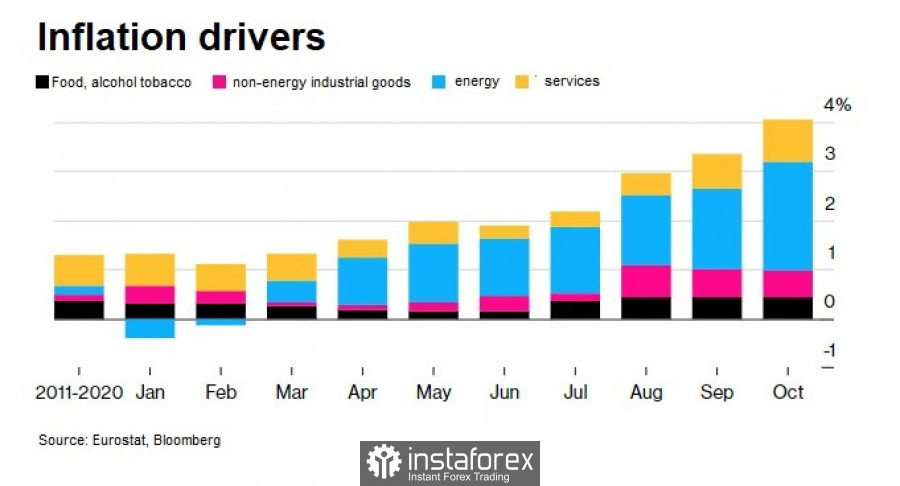

Commodity prices have become a key factor in the growth of inflation, with energy accounting for more than half of the indicator. This year, oil prices in Europe have risen by 48%, and the cost of natural gas has increased five-fold. Economists at Bank of America say prices will be even higher, with the average crude oil price expected to rise to $ 85 a barrel next year.

The policy of the Bank of England also raised more questions as during the last meeting, Governor Andrew Bailey very quickly changed his views from hawkish to dovish, which led to a sharp drop in the British pound. Expectations for early rate hikes also disappeared after Bailey said the economy still needs support. But inflation in the UK is going off the charts, which could seriously undermine the pace of economic growth in the next few years.

This week, if the ECB hints at curtailing support measures, euro will rise in the short term. The same thing will happen in pound if the Bank of England tightens its policy. If not, dollar will remain as the leader at the beginning of next year.

For EUR/USD, a lot will depend on 1.1265 today because a breakdown could lead to a further drop to 1.1230 and 1.1190. Meanwhile, a confident breakout of 1.1380 will provoke a rise to 1.1315 or higher.

In GBP/USD, the key level is 1.3220 as its breakdown could lead to a decline to 1.3185. Meanwhile, a rise above 1.3285 will provoke a jump to 1.3320 and 1.3370.