To open long positions on EUR/USD, you need:

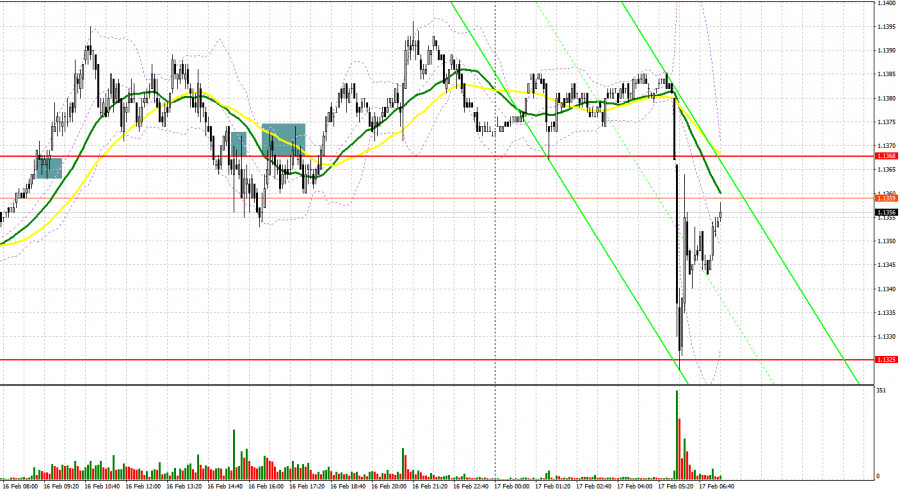

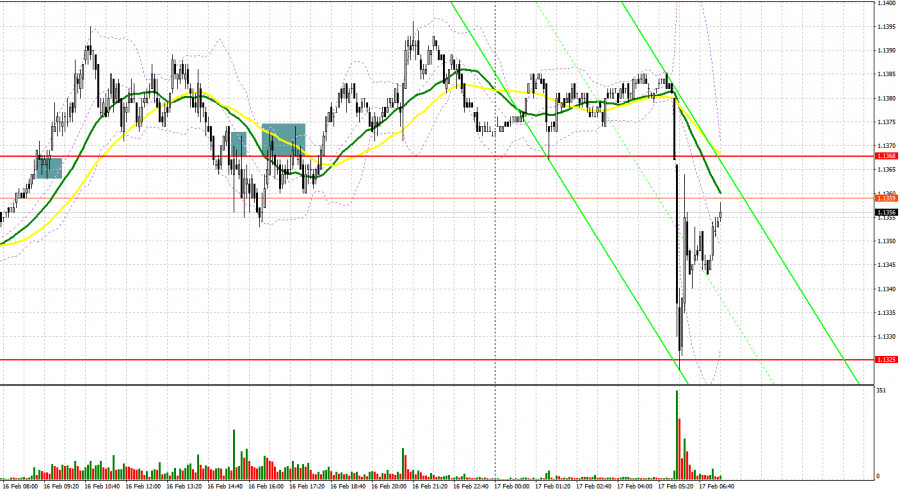

Yesterday, there were several signals formed to enter the market, which made it possible for us to earn. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.1366 level and recommended making decisions on entering the market from it. A breakthrough and consolidation above the resistance of 1.1366 with a reverse test from top to bottom - all this resulted in creating an excellent entry point into long positions, which I mentioned in my morning forecast. Good data on the volume of industrial production in the eurozone only spurred traders to new long positions, which pushed the euro to move up by more than 30 points from the entry point. The technical picture slightly changed in the afternoon. The bulls tried to offer something at the first test of 1.1368, but the data on the US economy was in favor of strengthening the US dollar. A breakthrough and a reverse test from the bottom up of 1.1368 is a signal to sell the euro. However, a sharp decline did not occur. After moving down by 13 points, the bears stopped being active in anticipation of the release of the January minutes of the Federal Reserve meeting.

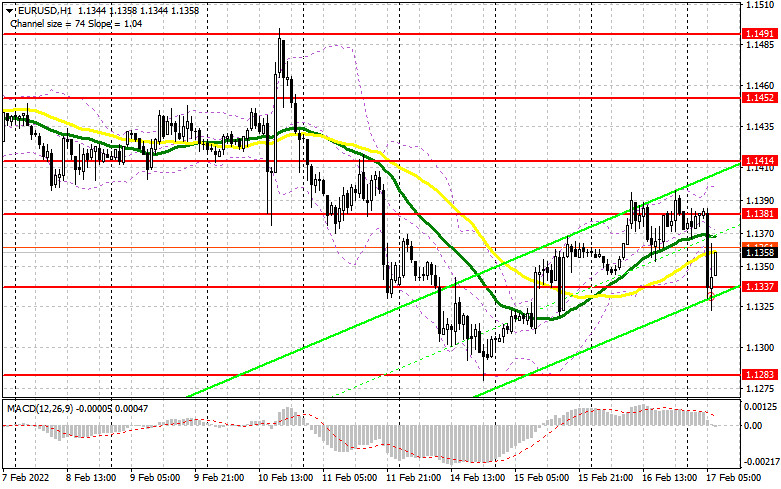

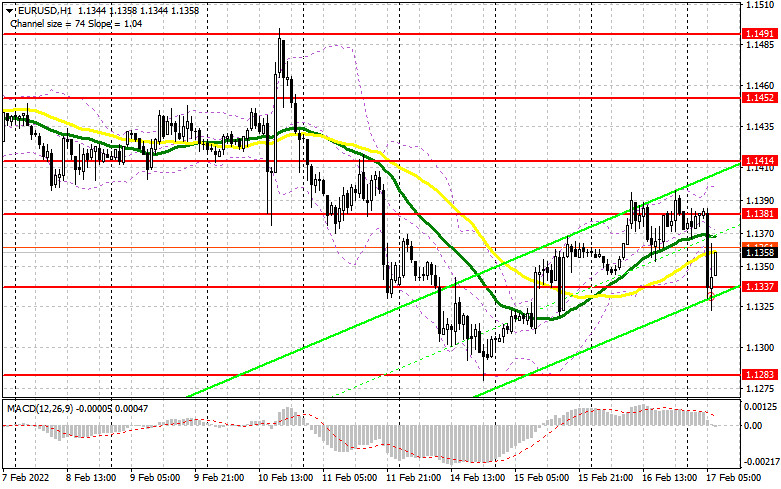

Quite a few representatives of both the European Central Bank and the Fed are speaking today. Today's fundamental data on the eurozone is unlikely to have any serious impact on the direction of the EUR/USD pair, so euro bulls will have nothing to rely on after the morning sale. It is important to protect the intermediate support of 1.1337, formed after the euro's fall during the Asian session. The problem is that trading is already below the moving averages that limit the upward potential. Forming a false breakout at 1.1337 and strong data on Italy's foreign trade balance, together with a positive economic bulletin from the ECB, all form the first entry point into long positions in continuation of the upward correction, which is now under great threat. Protecting this range will also preserve the lower boundary of the new ascending channel. In order to count on the continuation of the EUR/USD recovery, it is necessary for bulls to be more active and for them to cross the resistance of 1.1381, as they could not push the pair to settle above yesterday's results. A breakthrough of this range and a top-down test will lead to another buy signal and open up the possibility of recovery to the 1.1414 area, near which it will become a little easier for euro bulls to "breathe", since a breakthrough of this range will resume the bullish trend and open a direct road to the highs: 1.1452 and 1.1491, where I recommend taking profits. However, it is not yet clear for what reason such a large growth can occur. It is possible that a positive result on the US-Russia-Ukraine geopolitical conflict will return the demand for risky assets. Everything can end very badly if the pair declines during the European session and traders are not active at 1.1337. Therefore, it is best not to rush with long positions. The optimal scenario would be a false breakout at 1.1283, but you can buy the euro immediately for a rebound from the 1.1235 level, or even lower - around 1.1200, counting on an upward correction of 20-25 points within the day.

To open short positions on EUR/USD, you need:

Bears proved themselves in today's Asian session and got a real opportunity to put an end to all of the bulls' efforts observed this week. Still, expectations of a more aggressive policy of the Fed in the spring of this year allow the US dollar to feel more confident. In order to maintain control over the market, bears need to try very hard to protect the resistance of 1.1381, which is now the focus of euro bulls. A little lower are the moving averages, which are already playing on the bears' side. Forming a false breakout at this level will be a signal to open short positions in order to pull EUR/USD to the area of 1.1337 - an intermediate support that can become a springboard for better short positions on the euro. A breakthrough of this area and a reverse test from the bottom up will provide an additional signal to open short positions with the prospect of falling to large lows: 1.1283 and 1.1235. A more distant target will be the 1.1200 area. I recommend taking profits there. However, we can only count on such a large decline if we receive very strong data on the US labor market, or an escalation of the conflict between Russia and Ukraine, which will lead to demand for safe haven assets. In case the euro grows and bears are not active at 1.1381, it is best not to rush with short positions. The optimal scenario will be short positions when forming a false breakout in the area of 1.1414. You can sell EUR/USD immediately for a rebound from 1.1452, or even higher - around 1.1491, counting on a downward correction of 15-20 points.

I recommend for review:

The Commitment of Traders (COT) report for February 8 showed that long positions increased while short ones decreased. This report already takes into account the European Central Bank meeting, at which its president Christine Lagarde made it clear to all market participants that the central bank will act more aggressively if the observed picture with inflation does not change, or changes for the worse. Last week, officials from the ECB took a wait-and-see attitude, and a technical reversal of the bull market led to a decline in the EUR/USD pair. Demand for risky assets has also decreased due to the risk of a military conflict between Russia and Ukraine. However, a more weighty argument for the observed downward movement of the EUR/USD pair is the Federal Reserve's actions in relation to interest rates. An extraordinary meeting was held on Monday, February 14, the results of which were preferred to be hidden from the public – this is even more adding fuel to the fire that is flaring up around high inflationary pressure in the United States. Some economists expect that the central bank may resort to more aggressive actions and raise rates immediately by 0.5% in March this year, rather than by 0.25%, as originally planned. This is a kind of bullish signal for the US dollar. The COT report indicates that long non-commercial positions increased from the level of 213,563 to the level of 218,973, while short non-commercial positions decreased from the level of 183,847 to the level of 180,131. This suggests that traders continue to build up long positions with every good decline in the European currency. At the end of the week, the total non-commercial net position increased slightly and amounted to 38,842 against 29,716. The weekly closing price jumped and amounted to 1.1441 against 1.1229 a week earlier.

Indicator signals:

Trading is conducted below the 30 and 50 day moving averages, which indicates a possible market reversal.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the upper limit of the indicator around 1.1400 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.