To open long positions on GBP/USD, you need:

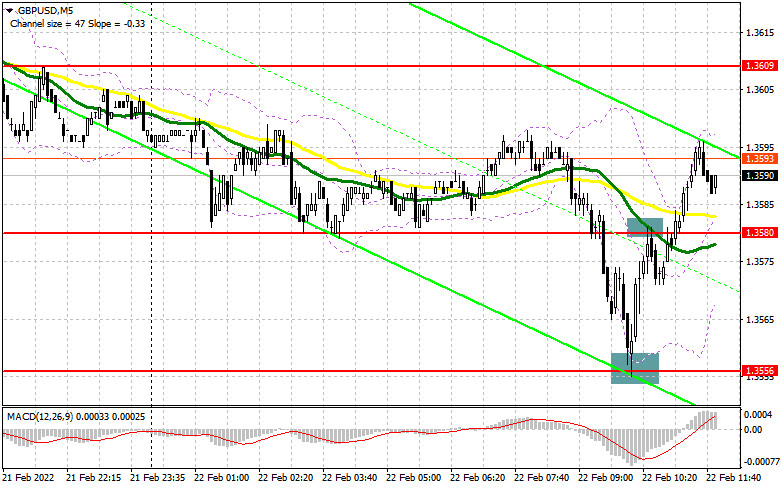

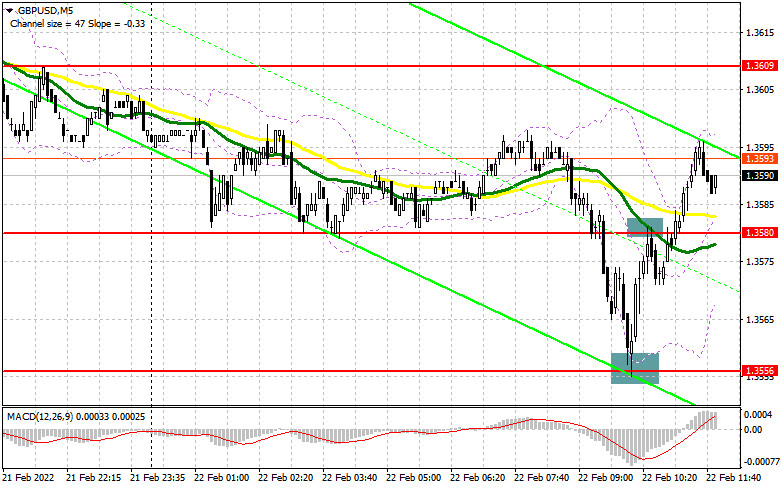

In my morning forecast, I paid attention to the level of 1.3556 and recommended that decisions on entering the market be made from it. Let's look at the 5-minute chart and figure out what happened. A sharp breakout of the 1.3580 support and an instant sell-off of the pound led to a test of a large low of 1.3556, where I advised opening long positions immediately for a rebound. As a result, the pair not only returned to 1.3580 but also at the time of writing reached daily highs in the area of 1.3595. The bears' attempts to defend the 1.3580 level were unsuccessful. In the afternoon, the technical picture has completely changed. And what were the entry points for the euro this morning?

During the American session, we are waiting for a fairly large number of fundamental statistics, but still more attention will be paid to the development of the situation around Russia and Ukraine. Its deterioration may negatively affect the prospects of the British pound. On this occasion, I advise you not to rush purchasing. The key task of the bulls in the second half of the day will be not only to protect the support of 1.3572 - this is necessary to maintain bullish sentiment, but also to break through the new resistance of 1.3603, near which the moving averages are playing on the side of sellers. The best option, of course, will be purchases in case of correction of GBP/USD during the American session and a false breakdown at the level of 1.3572. This may happen based on rather weak data on the consumer confidence indicator in the United States - its sharp decline is predicted against the background of an inflationary jump in the United States at the beginning of this year. The breakout and the 1.3603 test, which buyers are so focused on today, as well as the top-down update of this range form an additional buy signal with further growth of the pair to 1.3637. A more distant target will be the 1.3659 area, where I recommend fixing profits. Under the scenario of a decline in GBP/USD during the American session and the absence of bulls at 1.3572 - the risks of a military conflict between Russia and Ukraine have not been canceled, I advise you to wait for the test of the next major level of 1.3542. Only the formation of a false breakdown there will give an entry point to long positions. You can buy the pound immediately on a rebound from 1.3521, or even lower - from a minimum of 1.3488, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

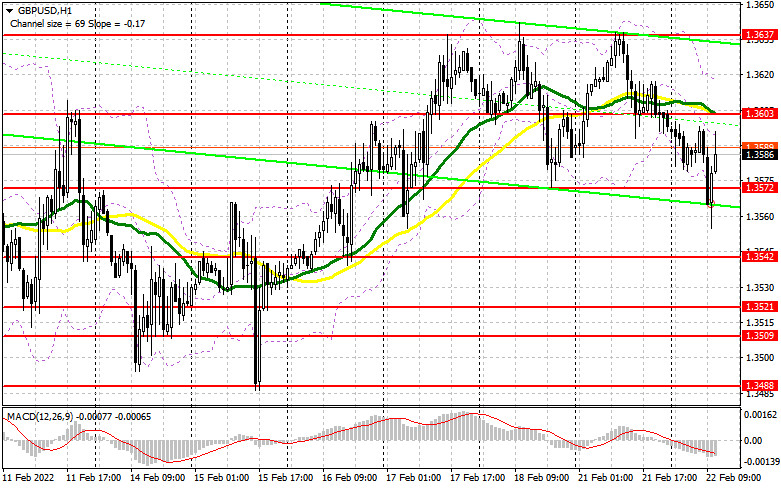

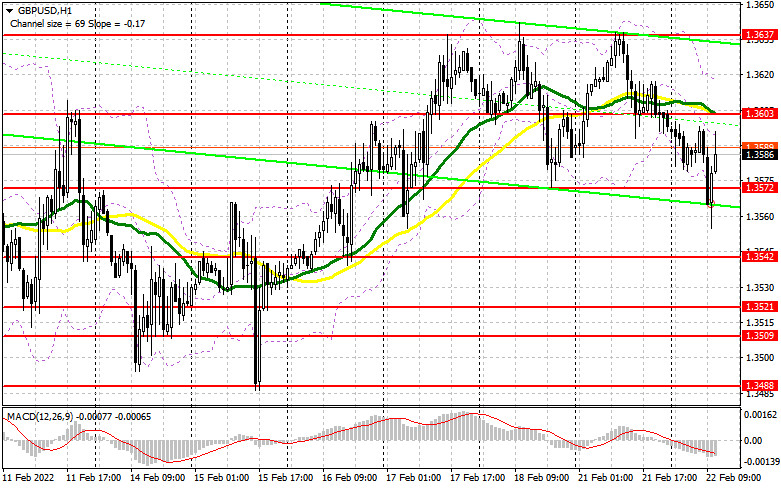

The bears did everything to resume the downtrend, but buyers took advantage of this moment and very quickly bought off another bottom. This indicates bullish expectations or the lack of interest of sellers against the background of geopolitical tensions around Russia and Ukraine. The primary task for today is to protect the new resistance of 1.3603, formed at the end of the first half of the day. By releasing the pound above this range, the bears will completely lose everything they have been fighting for lately. The formation of a false breakout at 1.3603 forms an excellent entry point into short positions. We can also count on the return of the bear market and the pair's decline to the support area of 1.3572 after strong data on activity in the US services sector and manufacturing sector. A breakdown and a test of 1.3572 from the bottom up will give an additional entry point into short positions to fall to 1.3542 and 1.3521. A more distant target will be the 1.3488 area, where I recommend fixing the profits. If the pair grows during the American session, as well as weak sellers' activity at 1.3603, it is best to postpone sales. The demolition of this range will hit sellers' stop orders, which could lead to a sharp rise in the pound. I advise selling GBP/USD immediately for a rebound from 1.3637 and only counting on a correction within the day by 20-25 points.

The COT reports (Commitment of Traders) for February 15 recorded a sharp increase in long positions and a reduction in short ones. This led to the return of the delta of its positive value. Although the results of the Bank of England meeting did not come as a surprise, clear hints from the regulator on a more aggressive tightening of the monetary policy fuels the appetite for risks on the part of major players. If it were not for the ongoing conflict between Russia and Ukraine, which has reached a new level, one could count on a more active recovery of the pound. In the meantime, further demand for risky assets is questionable. Given that the British economy is currently going through not the best of times and at any moment the pace of economic growth may seriously slow down - raising rates may harm the pace of recovery in the near future. However, optimism is inspired by the recent good report on retail sales, which implies strong growth in the indicator. The fact that inflation in January remained at the same levels and practically did not change year-on-year - all this may affect the plans of the Bank of England, which will moderate the pace of policy tightening. Further geopolitical events around Russia and Ukraine, as well as the decisive actions of the Federal Reserve System regarding future interest rates in March of this year - all this will continue to put pressure on buyers of the pound. Some traders expect that the US central bank may resort to more aggressive actions and raise rates by 0.5% at once, rather than by 0.25% - this will become a kind of bullish signal for the US dollar. The COT report for February 15 indicated that long non-commercial positions increased from 44,709 to 50,151, while short non-commercial positions decreased from 53,254 to 47,914. This led to an increase in the non-commercial net position from -8,545 to 2,247. The weekly closing price remained unchanged at 1.3532 versus 1.3537.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates an attempt by the bears to continue the fall of the pound.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.3620 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.