EUR/USD analysis and trading tips

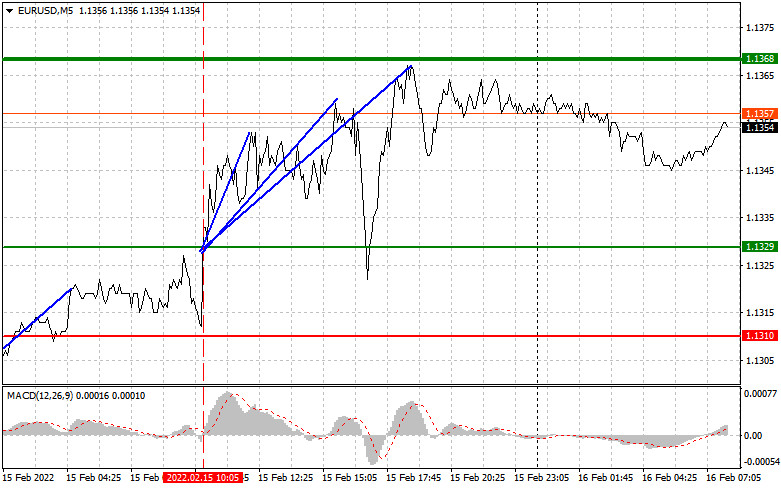

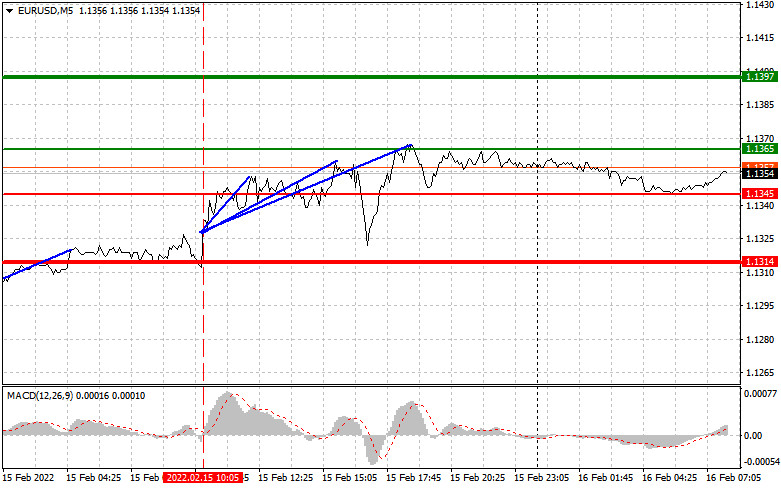

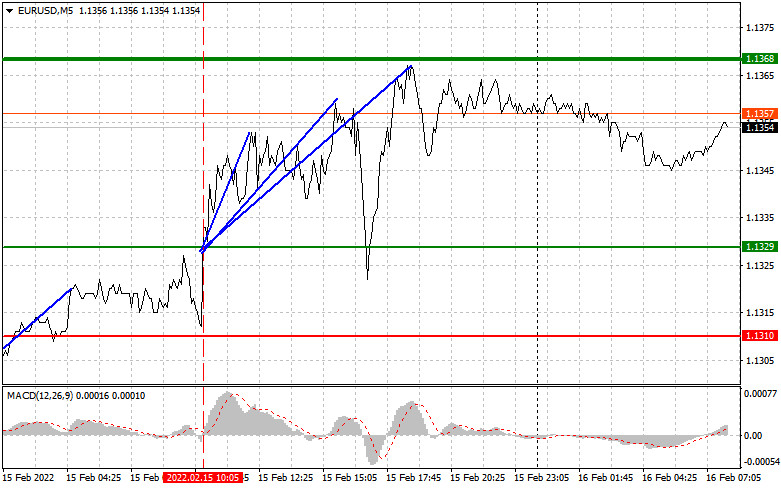

At the start of the European session, the pair touched the level of 1.1329. As the price was testing this line, the MACD started to rise from the zero level, thus generating a buy signal. As a result, the quote advanced by 35 pips, having missed just a few pips to reach the target of 1.1368. For this reason, the pair failed to form a sell signal from the level of 1.1368 right after a rebound. No other entry points were formed during the day.

The upbeat data on the ZEW indicator of economic sentiment for Germany and the eurozone supported the euro in the first half of the day. However, the pair could not extend its bullish move as the report on Q4 GDP in the eurozone did not surprise the market. In the course of the North American session, the euro came under pressure once again amid a drastic change in the US producer price index. The index turned out to be higher than expected, which facilitated the dollar's growth. There are plenty of macroeconomic reports due to be published on Wednesday. In the first half of the day, markets will focus on industrial production in the eurozone. The report will show changes for December. Yet, a slowdown in industrial output may shortly limit the upward potential of the EUR/USD pair. Later in the day, more important reports are coming. For instance, the US will release the data on retail sales and industrial production. A sharp increase in retail sales will indicate the ongoing inflationary pressures in the country which suggests that the Fed may resort to more aggressive policy tightening. The minutes from the January Fed meeting will be published by the end of the New York session. This may cause a possible strengthening of the US dollar and, consequently, a decline in the EUR/USD pair.

Buy signal

Scenario No. 1: you can buy the euro when the price reaches the level of 1.1365 (the green line on the chart) with an upward target at 1.1397. It is recommended to take profit at 1.1397 and immediately open short positions on the euro in the opposite direction, keeping in mind a possible movement of 10-15 pips from the given level. The euro may appreciate in case the eurozone industrial data is strong and demand for risk assets increases. Note! Before buying the pair, make sure that the MACD indicator is holding above the zero level and is just starting to rise from there.

Scenario No. 2: you can also buy the euro when the price touches 1.1345. However, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair and may lead to an upside reversal. In this case, the price may move in the opposite direction towards 1.1365 and 1.1397.

Sell signal

Scenario No. 1: you can sell the euro as soon as the price reaches the level of 1.1345 (the red line on the chart). I recommend exiting the market at the target level of 1.1314 and buying the euro in the opposite direction, keeping in mind a possible movement of 10-15 pips from the given level. Downbeat macroeconomic data in the eurozone may limit the bullish trend, while strong data from the US will put pressure on the pair. Note! Before selling the pair, make sure that the MACD indicator is holding below the zero level and is just starting to decline from there.

Scenario No. 2: you can also sell the euro when the price reaches 1.1365. However, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair and may lead to a downside reversal. In this case, the price may move in the opposite direction towards 1.1345 and 1.1314.

On the chart:

The thin green line indicates the price to enter the market and buy the trading instrument.

The thick green line indicates the estimated level for setting a Take Profit or taking profit manually. The price is unlikely to move above this level.

The thin red indicates the price to enter the market and sell the trading instrument.

The thick red line indicates the estimated level for setting a Take Profit or taking profit manually. The price is unlikely to move below this level.

The MACD indicator: when entering the market, it is important to consider its overbought or oversold status.

Important: Novice traders should be very careful when making decisions about entering the market. It is advisable to stay out of the market ahead of important macroeconomic publications in order to avoid sharp price fluctuations. If you decide to trade during the news release, always place stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

Please remember that in order to be successful, you need a well-developed trading plan like the one I prepared above. Spontaneous decision-making based on the current market situation is a losing strategy for an intraday trader.