Analysis of trades and trading recommendations

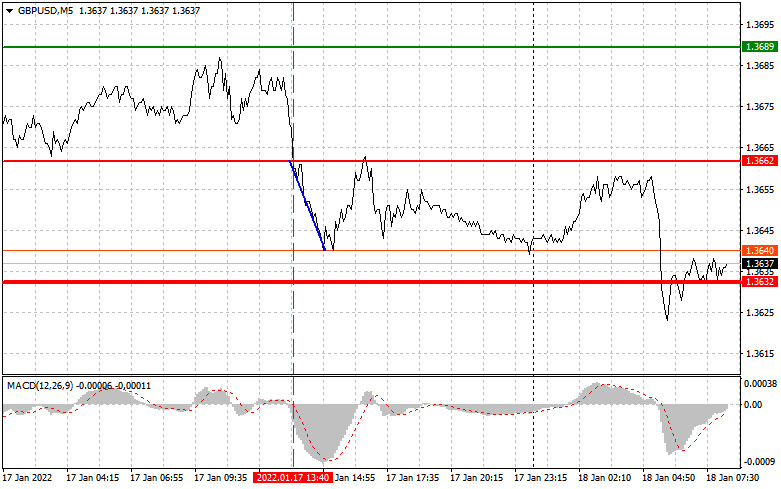

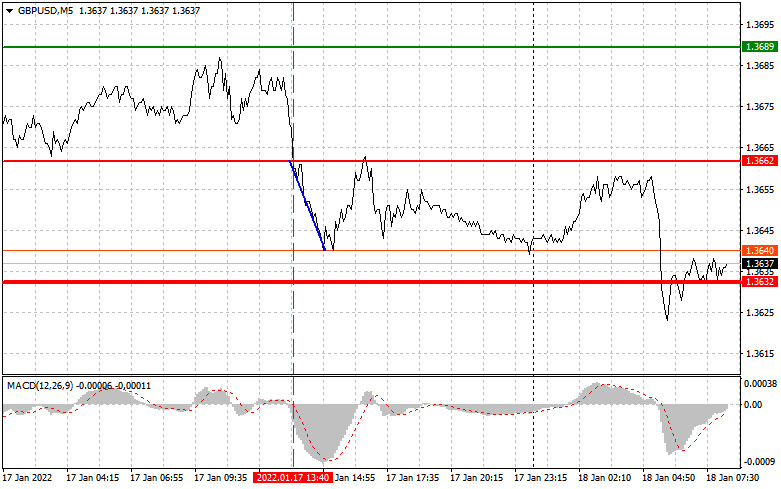

For almost the entire day, the pound/dollar pair has not been able to test the target levels. Only during the US session, it managed to test the 1.3662 level. At the time of testing, the MACD indicator had just started to move down from the zero mark, which was a confirmation of the correct entry point into the short positions. However, trades should factor in a possible decline that started last Friday. As a result, the pair fell by 20 pips, approaching the lows of last Friday. The bearish pressure on the GBP/USD pair subdued. There were no other entry points to the market.

Thanks to the lack of UK economic reports in the first half of the day, bulls managed to maintain control over the market and even build a small upward correction. However, it did not trigger a reversal of Friday's trend. Trading volumes remained low as trading floors in the US were closed on the occasion of Martin Luther King Jr. Day. Therefore, bears continued to exert pressure on risky assets, which facilitated the strengthening of the US currency. It led to a drop in the pound sterling.

Today, investors are anticipating the UK employment report. If the figure exceeds forecasts, bulls are likely to take the upper hand. The UK will unveil its employment report for November as well as initial jobless claims data for December. During the American session, traders will take notice of the Empire State Manufacturing Survey and the NAHB Housing Market Index. However, this macroeconomic data is unlikely to significantly affect the market but it may lead to a small spike in volatility. Today, the pair may finally complete a downward correction. So, be very careful with opening short positions at the lows. It is better to trade according to scenario No. 2.

Entry points to open long positions

Scenario No. 1: you can buy the pound sterling today when it reaches the entry point in the area of 1.3645 (green line on the chart), bearing in mind a possible growth to the level of 1.3685 (thicker green line on the chart). I recommend closing long trades near 1.3685 and opening short trades, factoring in 15-20 pips drop from the level. The pound sterling is likely to climb significantly provided that fresh data turns out to be positive. If so, the pair may resume the bullish momentum. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started rising from it.

Scenario No. 2: it is also possible to buy the pound sterling today if the price approaches 1.3620. At this moment, the MACD indicator should be in the oversold area, which will limit the downward movement of the pair and lead to an upward reversal. The pair is expected to grow to the opposite levels of 1.3645 and 1.3685.

Entry points to open short positions

Scenario No. 1: it is recommended to sell the pound sterling today only after it touches the level of 1.3620 (the red line on the chart). It will lead to a rapid decline of the pair. The key target level of sellers will be 1.3585. I would advise you to close short positions near this level and immediately open long ones in the opposite direction. Bear in mind a possible rise of 15-20 pips. The British currency will face strong bearish pressure if UK employment data is upbeat. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No. 2: it is also possible to sell the pound sterling today if the price approaches 1.3645. At this moment the MACD indicator should be in the overbought area, which will limit the upward movement of the pair and lead to a downward reversal. If so, it is sure to drop to the opposite levels of 1.3620 and 1.3585.

Description of the chart:

The thin green line is the entry point to open long positions on the instrument.

The thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself as the price is unlikely to rise above this level.

The thin red line is the entry point to open short positions on the instrument.

The thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders on Forex need to make very careful decisions when entering the market. Before the release of important fundamental reports, it is best to stay out of the market as it is extremely volatile. If you decide to trade during the news release, then always place stop-loss orders to minimize losses. Without placing stop- loss orders, you risk losing the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions is initially a losing strategy of an intraday trader.