To open long positions on EUR/USD you need:

In the first half of the day the European currency continued to grow as expected. However, bulls hit the level of 1.1611 and failed to consolidate there. Let's observe the 5-minute chart and assess the situation. Consequently, a false break was formed, which resulted in formation of a signal to open short positions. However, at the moment of making this forecast, bears demonstrated low activity, therefore the pair's decline within the day is unlikely. The technical picture for the American session has changed significantly, so I advise to pay attention to the new levels and strategy.

In the afternoon we are awaiting the US labor market fundamental data. However, they are not significant due to their weekly period. On the contrary, today's speech by Rafael Bostic, the FOMC member, is of key importance. Hints to more active tapering measures to support the US economy will likely hurt the risky assets, including the European currency. However, judging by the chart, bulls are not going to stop. Their major target will be a break and fixation above the range of 1.1622. The reverse test of this level downward gives a signal to buy the euro, counting on further pair's recovery to the new maximum at 1.1656, where I recommend taking profit. Moreover, the breakdown of this range with a similar test from the top down will form a new powerful bullish impulse, which is able to take the pair to the area of 1.1684 and 1.1713. In case the EUR/USD pair declines in the second half of the day, a large level of 1.1589 will provide support. There are moving averages below. Besides, they will help the euro buyers to cope with the pressure. A false break at this level will form an excellent point to enter long positions, which will maintain the upward trend in the pair. In case bulls demonstrate no activity at this level, I advise not to open long positions until there are new lows around 1.1559 and 1.1537, counting on an upward intraday correction of 15-20 pips.

To open short posiyions on EUR/USD you need:

Bears are demonstrating low activity at the moment. Besides, short pauses around the new resistances only confirm that there are no traders to sell the euro even at current prices. US strong data will exert some pressure on the pair. In the second half of the day bulls will mainly target at supporting the resistance at 1.1622. Only a false break there at this point will put more pressure on the pair, which will probably take it to the major support at 1.1589. This level is highly significant today, therefore bulls will try to protect it by all means. Only a break and a test of this area from the bottom will form a new signal to open short positions, which will force the EUR/USD pair to climb the next support at 1.1559. A more distant target is the low at 1.1537, where I recommend to take profits. With further euro's growth in the second half of the day and the lack of sellers at 1.1622, it is better to postpone selling until the next local highs are near 1.1656. It is possible to open short positions on the rebound, counting on a 15-20 pips downward correction, from the new high at 1.1684.

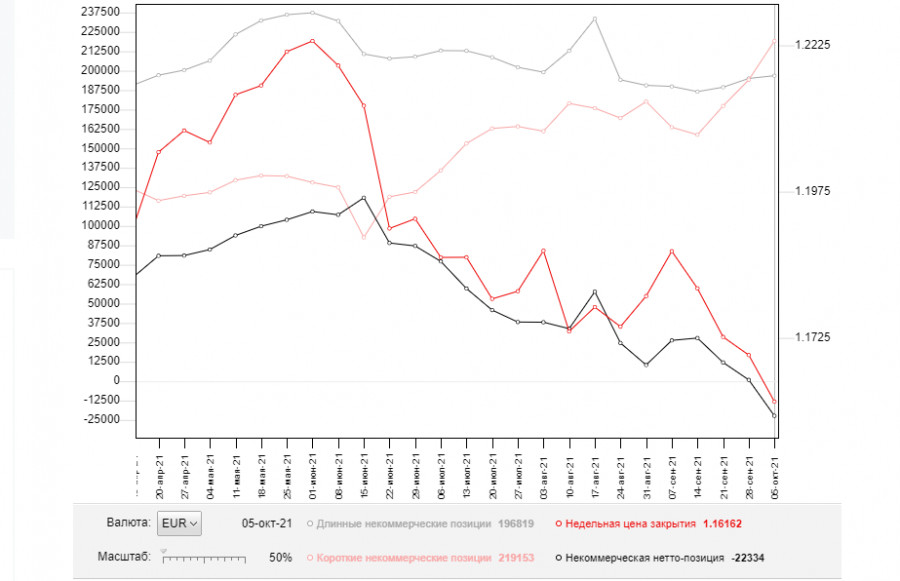

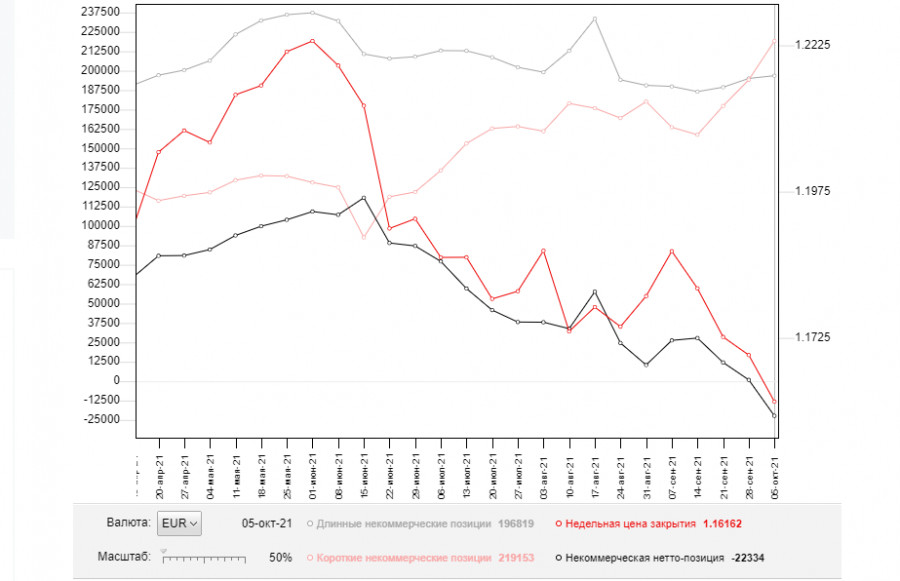

The COT report (Commitment of Traders) for October 5 recorded a sharp increase of short positions and only a slight increase of long positions, which led to a reduction of the net position. The large increase in short positions only confirms the formation of a bear market for the European currency. The political problems in the United States, some of which have been solved by now, also affected the players' current positions in the given COT report. Friday's labor market report from the US Department of Commerce (not included in this COT report) will likely not affect the balance of forces between the buyers and sellers, as the data was quite ambiguous. All these facts confirm the continuation of the bullish trend for the US dollar, which will be observed this week as well. The prospect of changes in the Fed's monetary policy in November this year allows traders to build up long positions on the US dollar without much difficulty, as many investors expect the beginning of the reduction of the bond purchase program by the central bank closer to the end of this year. Demand for risky assets will remain limited due to the European Central Bank's wait-and-see attitude. Last week the ECB president stated that she will continue to monitor the situation and keep stimulative policy at current levels. The COT report indicated that long non-commercial positions rose from 195,043 to 196,819, while short non-commercial positions surged from 194,171 to 219,153. By the end of the week, the total noncommercial net position was negative territory, falling from 872 to -22,334. The weekly closing price also went down to 1.1616 from 1.1695.

Indicator signals:

Moving averages.

Trading is conducted above the 30 and 50 daily moving averages, indicating further euro's rise concerning the trend.

Note: The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

In case the euro declines, the bottom line of the indicator at 1.1570 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. On the chart, it is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. On the chart, it is marked in green.

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.