China has released its economic activity indicators for the second quarter and for June, and it turned out to be weaker than expected. China's economic momentum is slowing down, and signs of deflation are becoming more evident.

The economy grew by 0.8% in the second quarter, slower than the 2.2% quarter-on-quarter pace recorded in the first quarter, and the annual GDP growth rate was 6.3%, which is significantly below the expected 7.1%. June's business activity indicators revealed a mixed picture of consumer weakness (sluggish retail sales at 3.1% YoY compared to the expected 3.3% and lower than May's 12.7%) in contrast to stronger-than-expected industrial output (4.4% YoY compared to the forecasted 2.5% and 3.5% in May) and fixed asset investment for the first half of the year rose by 3.8% compared to 4% in May.

Weak data from China fueled concerns about a global recession, and major Asian stock markets were trading in the red, putting pressure on commodity currencies.

The US will release economic reports like retail sales and industrial production in June, which could change the risk balance and cause some noticeable movements in the markets. However, if the data generally aligns with the forecasts, the currency market will continue to trade with low volatility.

NZD/USD

As expected, the Reserve Bank of New Zealand kept its interest rate unchanged at 5.5% last week and confirmed that it would wait for the consequences of previous tightening steps. Inflationary pressures and consumer spending are slowing down in line with the RBNZ's expectations, suggesting that the current position of the RBNZ appears balanced.

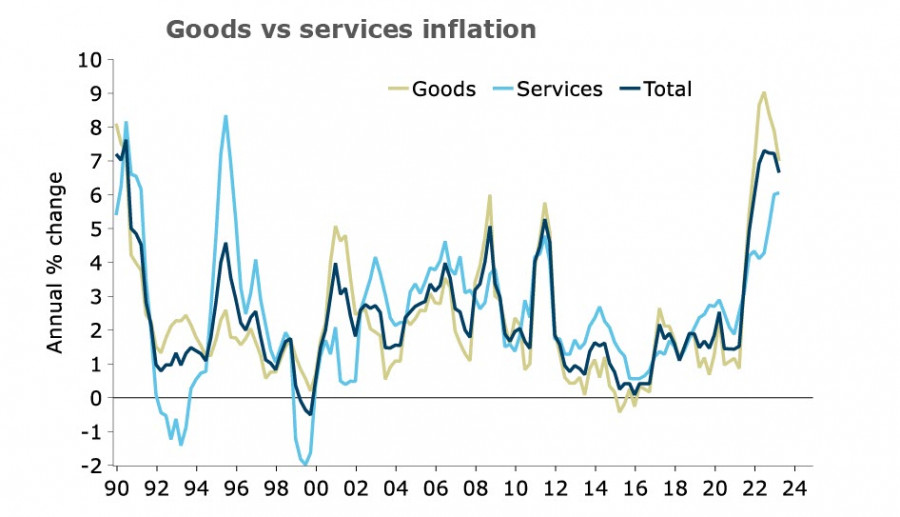

Inflation data for the second quarter was set for release, and is expected to fall to 5.9% YoY, which is below the RBNZ's May forecast of 6.1%. On the surface, it may seem positive, and there may not be a need for further rate hikes. However, a breakdown by components shows that the slowdown in inflation is primarily driven by the goods sector, while there is no observed price decline in the services sector.

The impact of wage growth is primarily felt in the services sector, so from the perspective of future course of actions by the RBNZ, it is important to understand whether growth in this sector has picked up in the second quarter or not. If it doesn't happen, this will increase the chances of an RBNZ rate hike, providing short-term support for the kiwi. However, if it turns out that prices have started to slow down even in the services sector, the NZD/USD will sharply fall.

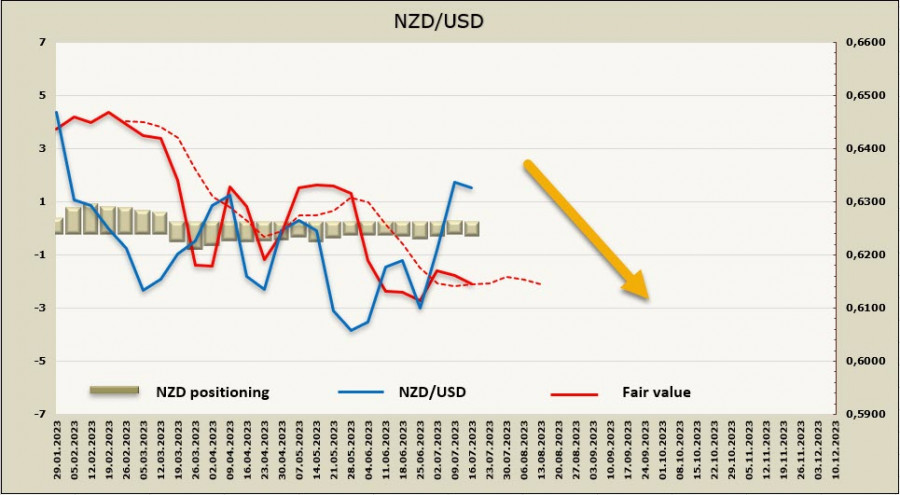

The weekly change in the aggregate speculative position for NZD is -129 million, indicating a neutral positioning. The reference price has no direction, displaying a weak bearish bias.

A week ago, we expected NZD/USD to rise if the RBNZ maintained a hawkish approach to monetary policy. This scenario played out as the kiwi rose above the resistance zone of 0.6270/90 and even formed a new local high. However, this factor has now been exhausted, and it appears that there are few reasons for the pair to rise further. We anticipate that the most likely scenario is consolidation with the upper band of the range at 0.6410 and the lower band at 0.6240/60. A break above the channel provides grounds to consider the possibility of growth towards 0.6535, but in the context of China's weakness, this outcome is only possible if the US dollar weakens across the board.

AUD/USD

The Reserve Bank of Australia released the minutes of its July 4th meeting on Tuesday morning. In justifying its decision to leave the interest rate unchanged, RBA officials noted that economic growth in Australia has significantly slowed, reflecting the impact of higher interest rates and high inflation, with production growth well below the projected pace, and labor productivity barely changing since 2019.

Wages have increased by nearly 11% over the year, but real household incomes have declined by 4% due to inflation, high taxes, and interest rates. Accordingly, consumption growth has been weak, aligning with the RBA's goal of reducing consumer activity as a key factor in managing inflation.

Forecasts for the upcoming meeting in August are contradictory. On Thursday, inflation data for the second quarter will be released, and NAB bank projects inflation to grow by 1.1-1.2%, which would provide more confidence in expecting a decrease in annual inflation. However, it is also expected that in the third quarter, rents, wages, insurance, tariffs, postal services, telecommunications, and energy prices will increase, so there isn't much certainty regarding further inflation reduction.

In general, take note that the AUD exchange rate is currently balanced relative to risks, and there are no solid expectations for significant movements in either direction. Assessments may change after the inflation report is published on Thursday.

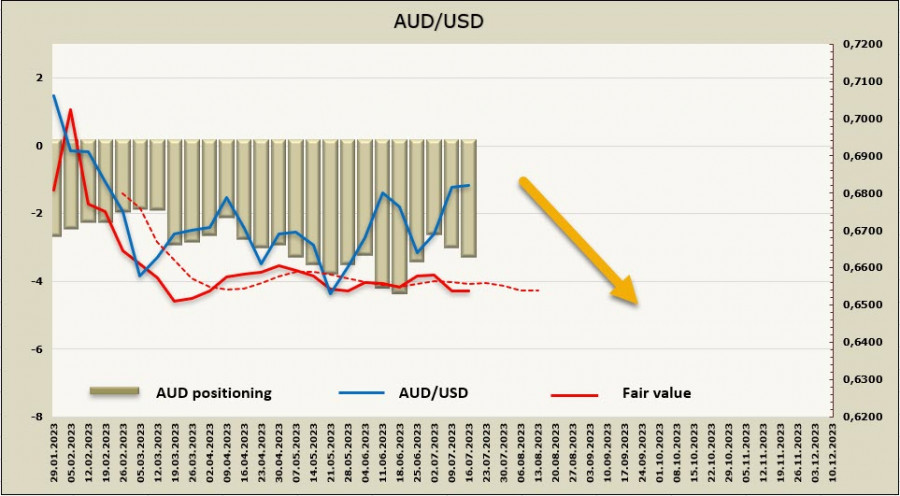

The net short position on AUD has slightly increased to -3.014 billion, indicating stable bearish positioning. The reference price is below the long-term average, but there is no direction.

A week ago, we expected the pair to fall to the support level of 0.6590/6600, but the sharp decline in US inflation and the subsequent massive USD sell-off disrupted all calculations. Nonetheless, the aussie stopped rising below the local high of 0.6900, indicating a weak bullish momentum. We assume that the probability of further growth remains low, and after consolidation, trading will move sideways with a weak downward bias, with the nearest target at 0.6690/6700, followed by 0.6620/30.