Long positions on EUR/USD:

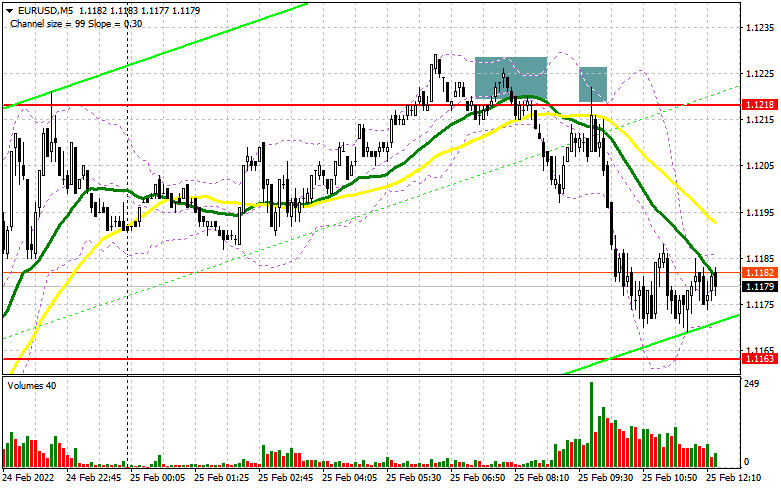

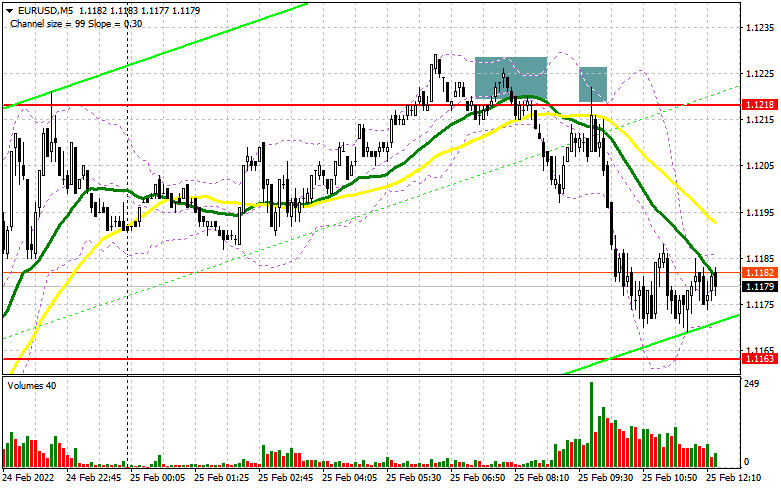

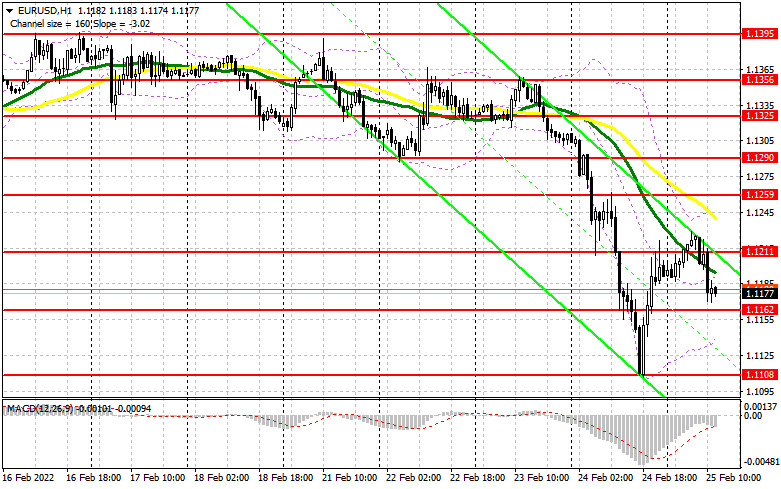

In my forecast this morning, I drew your attention to the level of 1.1218 and recommended entering the market from this level. Let's have a look at the 5-minute chart and analyze what happened. The false breakout at 1.1218 in the morning formed a sell signal for the euro, which created a strong sell-off, and raised the pair by 40 pips. The pair did not reach the target at 1.1163, but there is a high chance of breaking through it. From the technical point of view, in the second half of the day, nothing has changed.

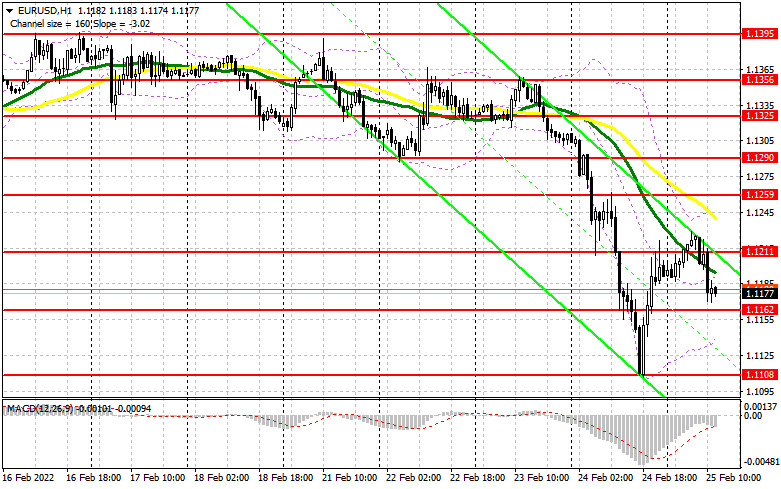

The actions of Russian troops in Ukraine continue to put serious pressure on the euro, which limits the upside potential of risky assets. Many are waiting for further developments after the expiration of the 12-hour ultimatum put forward by Russia on the acceptance of several demands by the Ukrainian authorities. Most likely, official Kyiv will not make concessions, which will lead to another military aggression by the Russian army. This will catalyze building up short positions on the euro. For this reason, I do not recommend rushing to open long positions. In the second half of the day, bulls need to hold the price above support at 1.1162. Only the formation of a false breakdown may form the first entry point to long positions, allowing a slight correction. It is possible to count on a larger recovery of the EUR/USD pair only after easing the military tension and active actions of buyers near new resistance at 1.1211. A breakthrough and a test of that range, when weak US expenditures and earnings data are released, will trigger a buy signal and open the way for recovery to 1.1269, where the moving averages are at the sellers' side. There I recommend locking in profits. However, as I mentioned above, geopolitical tension is likely to affect the euro. With the further aggravation of the Russia-Ukraine conflict, demand for the US dollar may only increase. In case there is no activity at 1.1162, traders will start closing long positions, which will only increase the pressure on the pair. Therefore, it is better to postpone buying the pair until it performs a false breakout near yesterday's low at 1.1108. It is better to open long positions in the euro on the rebound from 1.1070, or even lower near 1.1034 allowing an upward intraday correction of 20-25 pips.

Short positions on EUR/USD:

Bears are completely controlling the market. In addition to the US earnings and spending data, important reports on changes in durable goods orders and the University of Michigan's consumer sentiment index will be released today. As long as the pair is traded below 1.1211, it is likely to continue falling. In the second half of the day, bears need to hold the price below this resistance. The formation of a false breakout at that level, similar to the one that I analyzed above, as well as negative news related to Russia and Ukraine, may form a signal for opening short positions with the target 1.1162 below. A breakthrough of this area and a reverse test bottom/top may signal for the opening of short positions with the prospect of falling to the low of 1.1108 and lower to 1.1070, where traders can generate profit. In the case of strong fundamental statistics in the US, a test of 1.1034 may be expected, with the target of closing at 1.0994. In the case of the euro's growth during the US session and lack of bears activity at 1.1211, it is better to postpone selling the pair. The optimal scenario for opening short positions would be possible if the pair formed a false breakout near 1.1259. Selling euro/dollar immediately on a rebound is possible from 1.1290, or even higher at 1.1325 allowing a downward correction of 15-20 pips.

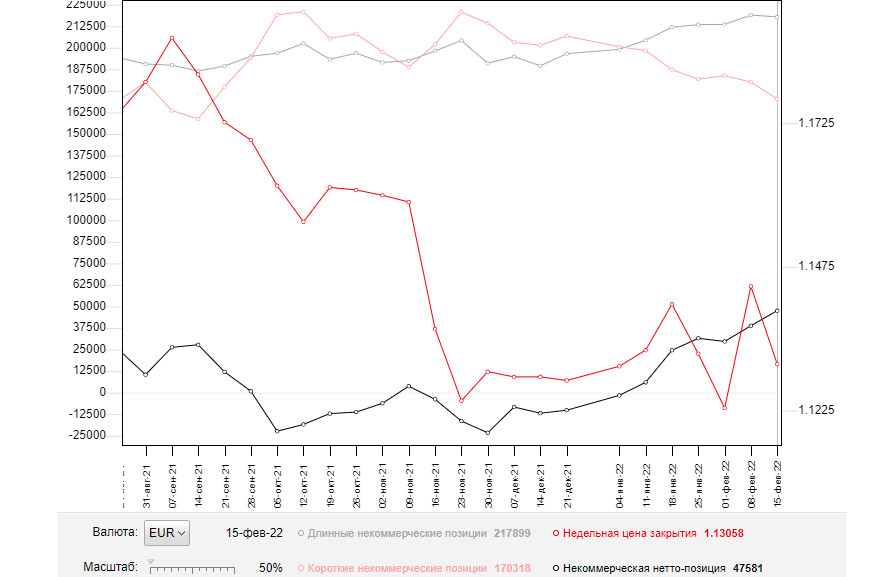

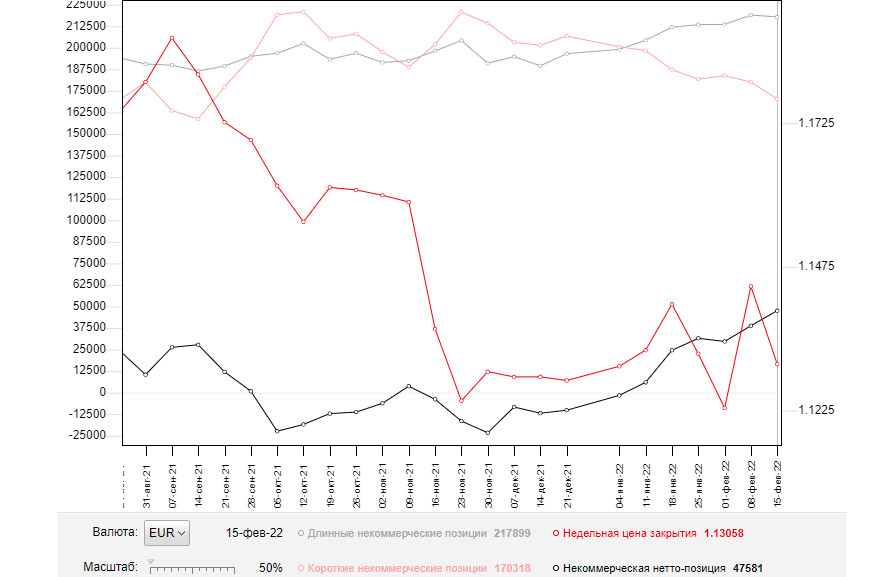

The COT (Commitment of Traders) report for February 15 showed a decrease in both long and short positions, which led to an increase in the positive delta, as there were fewer short positions. The European Central Bank continues to maintain its vague policy. ECB president Christine Lagarde - who just recently said that it was necessary to be more aggressive in case of accelerating inflationary pressures, and last week changed her position completely - leads traders into a deadlock. However, despite the growth of the positive delta, the euro has declined significantly as of the end of the reporting period. This is happening against the risk of a military conflict between Russia and Ukraine. More recently, the Russian authorities have recognized the independence of the LNRD, which only exacerbated the geopolitical tensions around the world. Another strong argument for the observed downward movement of the EUR/USD pair is the actions of the Federal Reserve System about interest rates. According to the minutes of the Fed's February meeting, it is expected that the central bank might stick to more hawkish actions and raise the rates by 0.5% this March, rather than by 0.25% as it was planned. This is a bullish signal for the US dollar. The COT report indicates that long non-commercial positions declined very slightly to 217,899 from 218,973, while short non-commercial positions declined to 170,318 from 180,131. This means that though fewer sellers are willing to sell the euro, the number of buyers is not increasing either. It seems that traders prefer to sit on the fence and wait for the situation to resolve, which is now rapidly gaining momentum. At the end of the week, the total non-commercial net position was up slightly to 47,581 against 38,842. The weekly closing price dropped to 1.1305 against 1.1441 a week earlier.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily moving averages, which indicates a bear market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the level of 1.1245 at the upper boundary of the indicator will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.