To open long positions on GBP/USD, you need:

In my morning forecast, I paid attention to several levels and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. Too low volatility in the first half of the day against the background of the absence of important fundamental statistics for the UK, as well as uncertainty about the future policy of the Federal Reserve System - all this led to the pair remaining in the side channel without updating the nearest support and resistance levels. For this reason, there were no signals to enter the market. The technical picture remained completely unchanged. And what were the entry points for the euro this morning?

The pound was kept from updating the next annual lows today by news about the progress of negotiations between Russia and Ukraine. There is talk that the parties are discussing the option of demilitarization of Ukraine according to the Austrian or Swedish version with the preservation of their army, but without the presence of a foreign military. This option can be considered as a compromise. But most likely in the second half of the day, all attention will be on the results of the Federal Reserve meeting: whether the central bank will adopt a more aggressive policy towards interest rates to protect the country from inflation, or will take a wait-and-see attitude further, acting according to the plan - the further direction of GBP/USD will depend on this. The Fed's plans for now definitely include a March interest rate increase of 0.25 points and no more. But do not rush to sell the pound even in case of unexpected decisions by the Fed. Tomorrow, there will be a meeting of the Bank of England, at which the regulator may also begin to act more aggressively - a bullish signal for the pound in the current conditions.

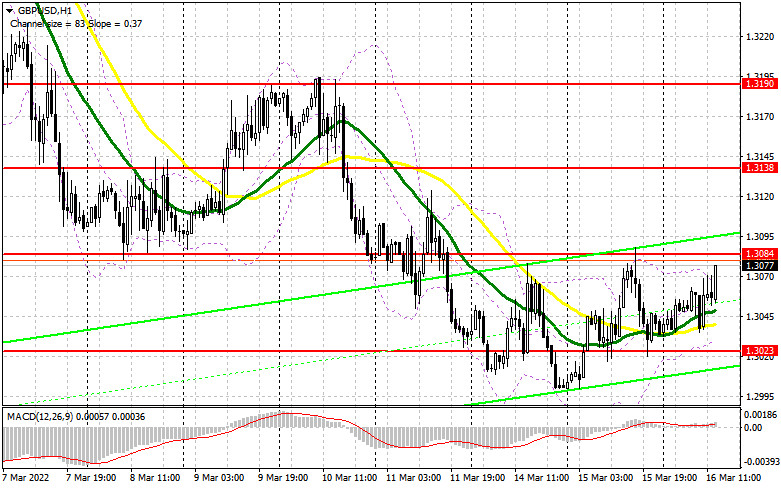

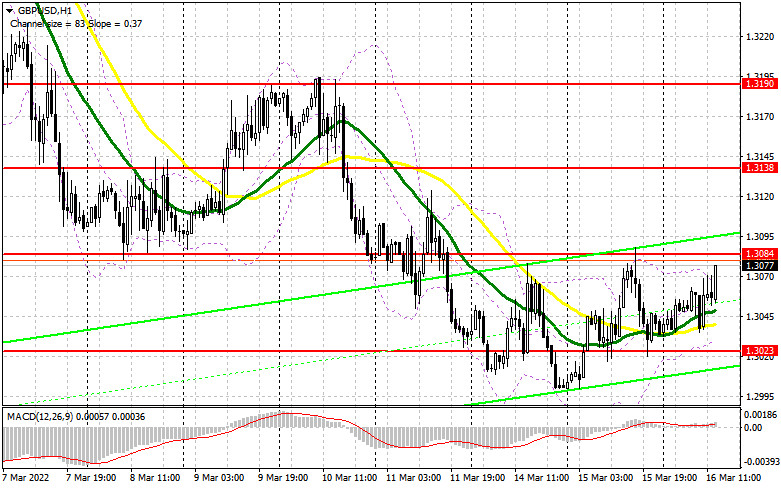

An important task during the American session remains the protection of the 1.3023 support - a new level of support, which, it seems to me, is now of some interest to buyers of the pound. Long positions from this level can be considered only after the formation of a false breakdown. Growth in this scenario will bring the pair back to the resistance of 1.3084. Only a breakthrough and a reverse test of this area from top to bottom of this range, which is not particularly necessary to count on, will lead to the demolition of several sellers' stop orders, allowing bulls to more actively increase long positions. The target, in this case, will be the 1.3138 area. A more difficult task will be to reach the resistance of 1.3190 - this will deal a strong blow to the bearish trend observed in the second half of last week. This will happen in the case of the dovish rhetoric of Federal Reserve Chairman Jerome Powell. I recommend fixing profits there. In the scenario of a decline in GBP/USD during the US session and the absence of bulls at 1.3023, and just above this level there are moving averages playing on the side of the bulls, it is best to postpone purchases against the trend until the next support of 1.2966 - this is a more reliable level. But I also advise you to open long positions there only when forming a false breakdown. You can buy GBP/USD immediately for a rebound from 1.2911, or even lower - from a minimum of 1.2856, counting on a correction of 30-35 points within a day.

To open short positions on GBP/USD, you need:

Bears continue to control the market, and the lack of reaction to the good news in the negotiations proves this once again. A surge in volatility is expected only after the decision of the Federal Reserve System and the press conference of Jerome Powell. The fall of GBP/USD may continue at any moment, however, as I noted above, in the case of a tough position of the Federal Reserve System, tomorrow's meeting of the Bank of England may have much more weight for traders in the pound. The bears' priority target for today will be 1.3023 support. A breakout and a reverse test from the bottom up of this range will form an additional sell signal, which will open a direct road to the lows: 1.2966 and 1.2911, where I recommend fixing the profits. A more distant target will be 1.2856, but I would not count on such a drop before tomorrow's meeting of the central bank. In the case of GBP/USD growth in the afternoon, only the formation of a false breakdown at 1.3084 will lead to the first signal to sell the pound with the prospect of a new decline in the pair. With weak sellers' activity at 1.3084, it is best to postpone sales until the next major resistance at 1.3138. I also advise you to open short positions there in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from 1.3190 or even higher - from a maximum of 1.3244, counting on a correction of the pair down by 20-25 points within a day.

In the COT reports (Commitment of Traders) for March 8, a sharp increase in both long and short positions was recorded. Some took advantage of the panic in the market, others had attractive prices. However, there were more of those who increased short positions, which led to an increase in the negative delta. This week, we will have a meeting of the Federal Reserve System and how the American regulator will behave in the conditions of the highest inflation in the last 40 years is a big question. A more active policy on interest rates will increase the demand for the US dollar, which is already trampling the British pound almost every day to the next annual lows. We also remember that although Russia and Ukraine have sat down at the negotiating table, so far these meetings do not give any special results. Against this background, I recommend continuing to buy the dollar, since the bearish trend for the GBP/USD pair has not gone away. The only thing that now saves the pound from a major sell-off is high inflation in the UK, which will force the Bank of England to act more actively as well. The very next day after the Fed meeting, the Bank of England will hold a meeting. This is where a reversal of the pound may occur in the opposite direction, so when selling at the lows of GBP/USD, think about tomorrow. The COT report for March 8 indicated that long non-commercial positions increased from the level of 47,679 to the level of 50,982, while short non-commercial positions increased from the level of 48,016 to the level of 63,508. This led to an increase in the negative value of the non-commercial net position from -337 to -12,526. The weekly closing price dropped to 1.3113 against 1.3422.

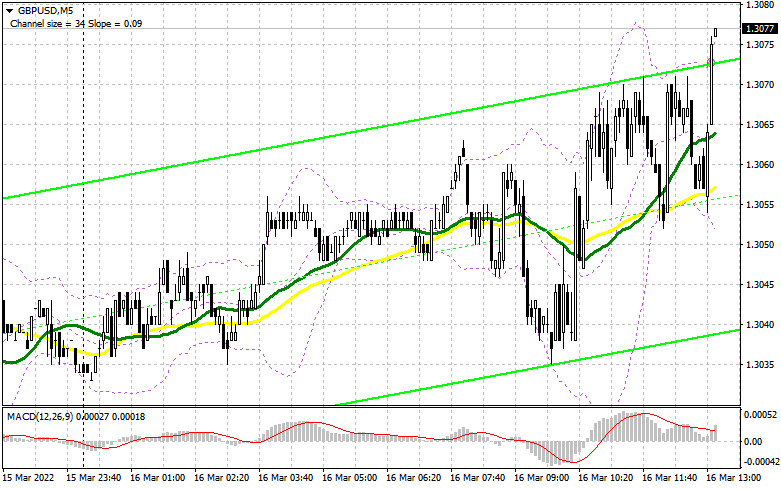

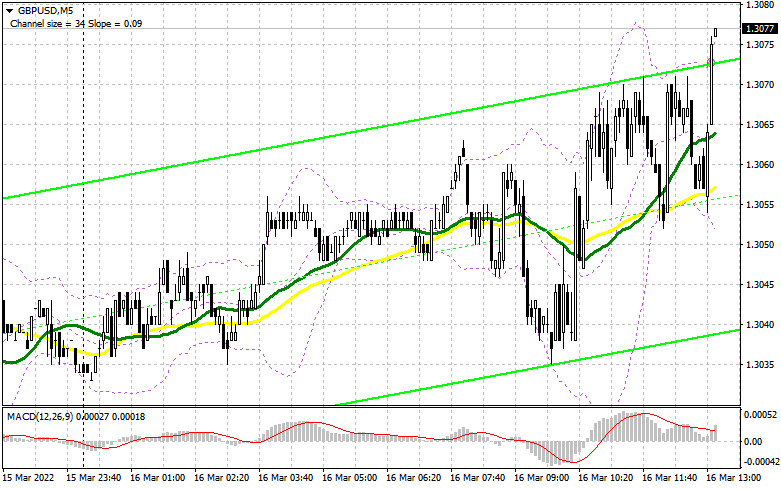

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates an active confrontation between buyers and sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the lower limit of the indicator in the area of 1.3023 will increase the pressure on the pound. A break of the upper limit of the indicator in the area of 1.3080 will lead to the growth of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.