EUR/USD has reverted to the same trading pattern seen two weeks ago and earlier in the months: sluggish movements, low volatility, and a moderate downward trend. However, if we compare it to the GBP/USD pair, we are honestly pleased with the EUR/USD pair's movement. At least EUR/USD is showing a trend and logical movements. To recap, the latest downward movement started at the beginning of the month after the release of another strong US NonFarm Payrolls report. Before that, the price had gone through a bullish correction for two months. However, the correction did not break the downward trend, which is clearly visible on the 24-hour timeframe, and therefore, it should be the basis for our analysis.

Following the NonFarm report were the European Central Bank and Federal Reserve meetings, where it became clear that the Eurozone has started its monetary policy easing cycle, while the US is not even considering this move. As a result, the market received two more factors to support the bearish bias. Thus, everything is going according to the plan that was outlined at the beginning of the year. We still expect the euro to fall to levels 1.0450, 1.0200, and 1.000. Perhaps the last target is too ambitious, but the price can probably reach the first two.

Everything will now depend on two factors. The first is how frequently the ECB will lower rates. The second is when the Fed will start easing monetary policy. In the case of the ECB, things are relatively clear. Representatives of this central bank have repeatedly stated that the optimal step is "one cut every two meetings." Of course, this may be adjusted if inflation stops decreasing or starts accelerating. However, having a basic plan is already quite beneficial. Therefore, we can expect up to three rate cuts by the end of the year.

ECB policymaker Klaas Knot on Thursday backed market expectations for one or two more interest rate cuts this year. Knot said the "just under three" cuts priced in by financial markets for 2024 were "broadly in line" with the optimal policy path estimated by staff at the ECB. Since the ECB cannot reduce the rate "slightly less than three times" (it must be either two or three), we suggest assuming three cuts. Accordingly, by the end of the year, the ECB rate will be 3.75%.

What about the Fed rate? The most optimistic scenarios suggest the first cut in September, and so the Fed might have time to reduce the rate once more by the end of the year. Therefore, at most, we can expect two Fed rate cuts for 2024. However, take note that this is the most optimistic scenario. For instance, we strongly doubt that the rate will be lowered in September. The current level of inflation does not allow for such expectations. The ECB began easing with inflation at 2.4%. The Bank of England did not start easing even with inflation at 2%. It is unlikely that US inflation will drop to the 2.0-2.4% range by September while it currently stands at 3.3%. Therefore, we believe that a single 0.25% cut is the most logical scenario for the US, instead of the six cuts expected at the beginning of the year. This means that the euro could continue to fall until almost the end of 2024.

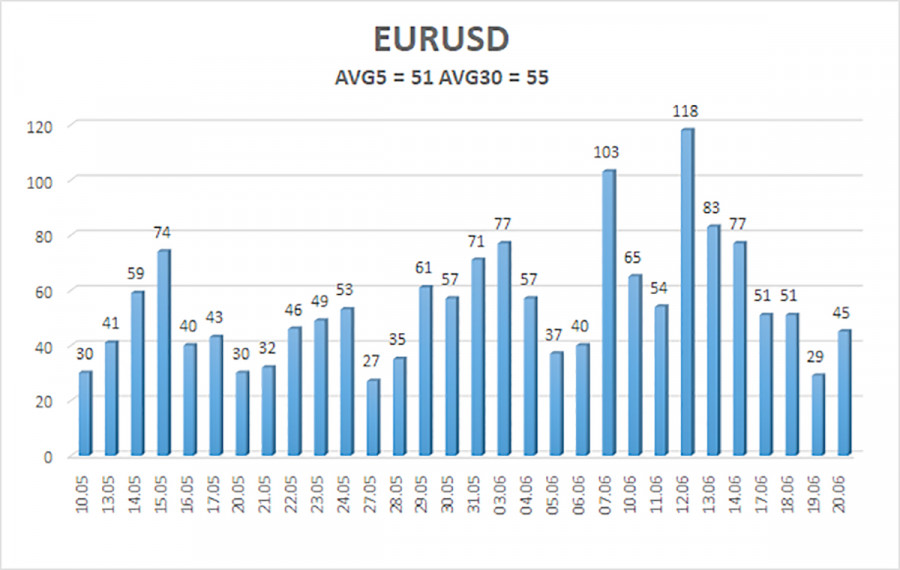

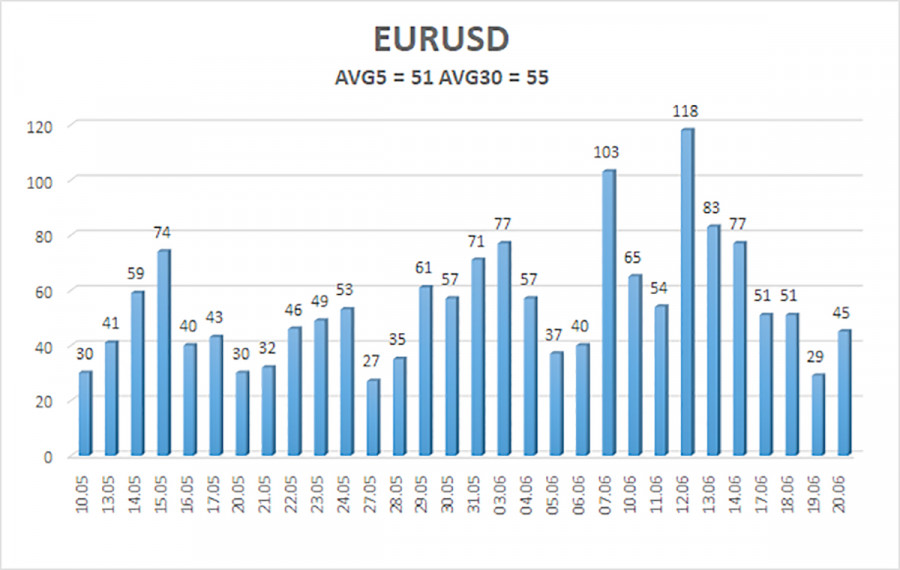

The average volatility of the EUR/USD pair over the last five trading days as of June 21 is 51 pips, which is considered an average value. We expect the pair to move between the levels of 1.0656 and 1.0758 on Friday. The higher linear regression channel has turned upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but at this time we do not expect strong growth.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and continues to stay below the moving average on the 4-hour timeframe. In previous reviews, we said that we don't consider long positions and that we should wait for a continuation of the downtrend. At this time, short positions are still valid. The targets are 1.0620 and 1.0559. A bounce from 1.0681 triggered a bullish correction, but a rebound from the moving average ended it. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.