On Monday, the EUR/USD currency pair resumed trading. This is not at all surprising considering that the entire first trading day of the week was devoid of any significant fundamental developments or macroeconomic publications. The odd thing was that, in contrast to last week, when there was simply something to pay attention to, the pair displayed only moderate volatility and no discernible trend movement. Additionally, there is nothing of note this week, so it won't surprise us if the euro/dollar pair moves slowly and completely ineffectively throughout the week.

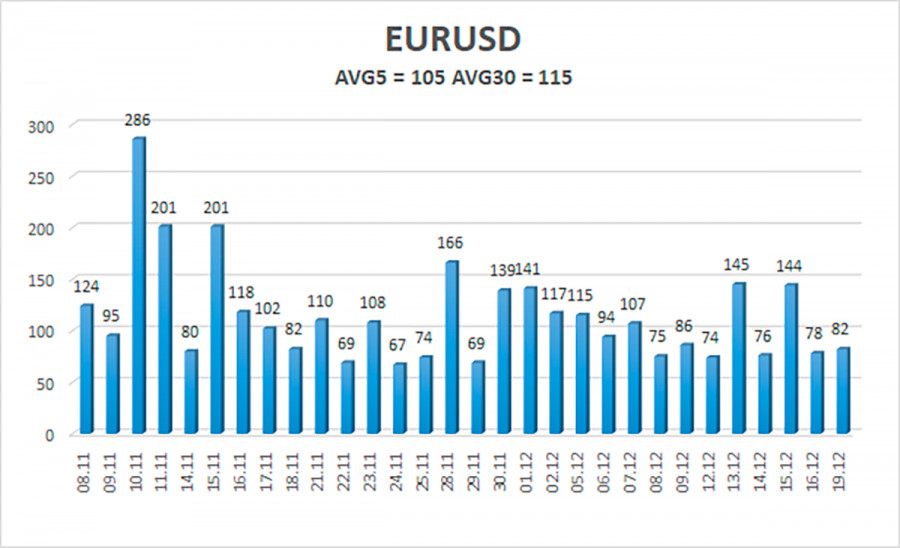

Here, it's important to keep in mind that it's December 20. In other words, the New Year and the entire "set of holidays" are still less than two weeks away. Although the market doesn't always go on vacation two weeks before the New Year's holidays, volatility can significantly drop simply because many traders will leave the market. The graphic below demonstrates how volatility has decreased over the last few weeks. If we ignore the two days last week when the pair gained 145 points, then the pair now gains, on average, 70–80 points per day. And the graph unmistakably demonstrates how volatility is decreasing as the New Year's holiday draws near.

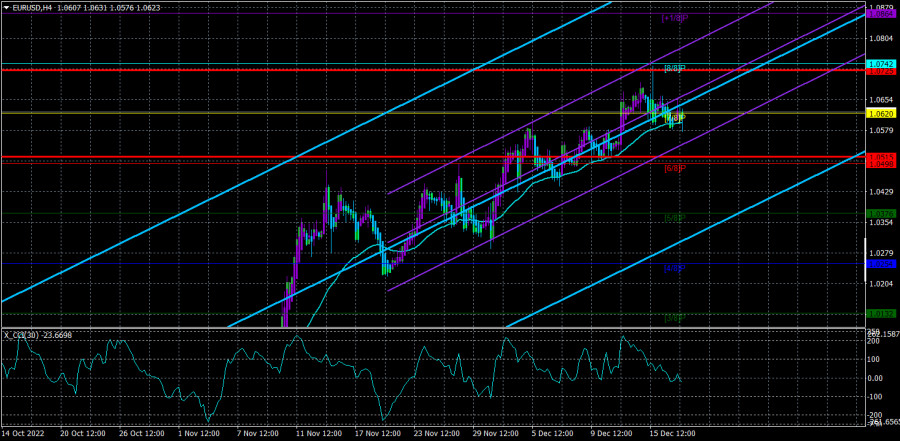

There was no fundamental background going back to Monday. Given that it was delivered a few days after the ECB meeting, we do not consider Luis de Guindos' speech to be significant. Later on, we'll discuss it, but only within the parameters of the form. Technically speaking, the pair is currently close to the moving average. At the very least, this movement must be overcome to determine the start of a potential strong downward correction, which we have been watching for several weeks. But not just any victory, but self-assurance. In theory, the pair had overcome significant challenges in recent weeks, "if only by some kind of." We keep emphasizing that the most recent round of the euro's growth can be deemed 70% unjustified. The price was only able to fluctuate by 100–150 points in the previous month. As a result, the only option is to wait for the correction.

The stakes will go up, says Luis de Guindos.

In theory, the message of the ECB Vice-Chairman's speech is already clear. He only reported "unreal" news to the market. Of course, Christine Lagarde and her "deputy" speak frequently, and their rhetoric is consistent throughout each speech. As a result, we cannot claim that de Guindos' speech was significant or had an impact on the market's mood. Mr. de Guindos added that he was unable to predict how high the ECB rate would ultimately rise. In other words, de Guindos omitted to respond to the current currency's most crucial query.

Let's discuss why this query is the most crucial. Since one decline does not constitute a trend, the ECB started to slow down the pace of monetary policy tightening even though inflation had not yet started to decline. As a result, it has already taken a backward step in the battle against inflation. Everything is fine if we are referring to the fact that the European regulator will simply increase the rate "to the bitter end" at a slower rate. We have bad news for the euro currency if it raises the rate with an eye toward the problematic EU nations. Consequently, if de Guindos had stated the target clearly, it would have been possible to deduce certain information from which to base a trading plan for the upcoming weeks. However, he remained silent, so nobody knows if the rate will increase after one more meeting or after 21. We continue to think that given the current situation, the euro must simply begin adjusting, so we are watching for the moving average line to cross and the euro to decline.

As of December 20, the euro/dollar currency pair's average volatility over the previous five trading days was 105 points, which is considered "high." So, on Tuesday, we anticipate the pair to fluctuate between 1.0515 and 1.0725 levels. A potential continuation of the upward movement will be indicated by an upward turn of the Heiken Ashi indicator.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance levels

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

The EUR/USD pair is continuing its upward trend. With targets of 1.0725 and 1.0742 in the event of a price reversal from the moving average, we are currently thinking about new long positions. No earlier than fixing the price below the moving average line with targets of 1.0515 and 1.0498 will sales become relevant.

Explanations for the illustrations:

Determine the present trend with the aid of linear regression channels. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.