Long positions on EUR/USD:

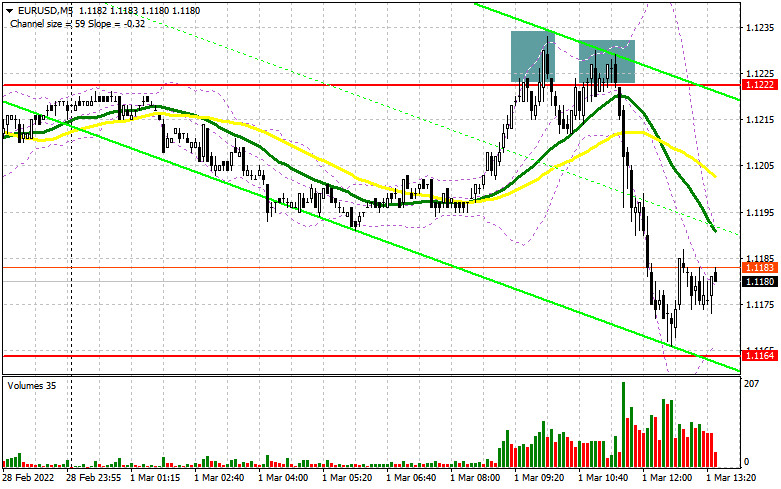

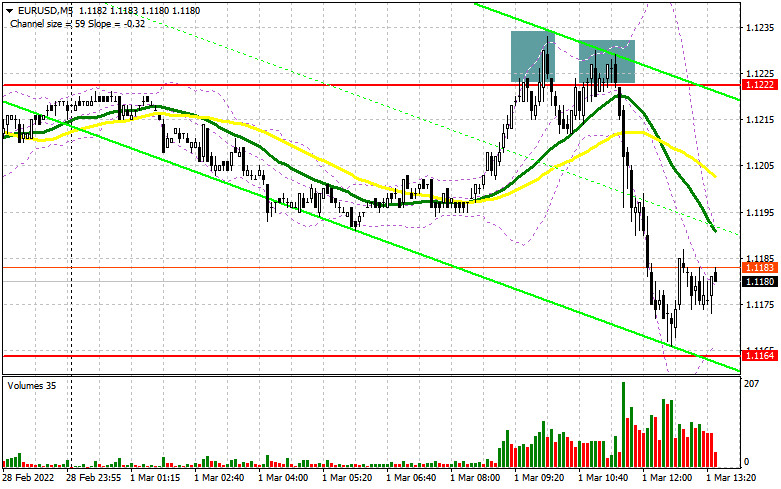

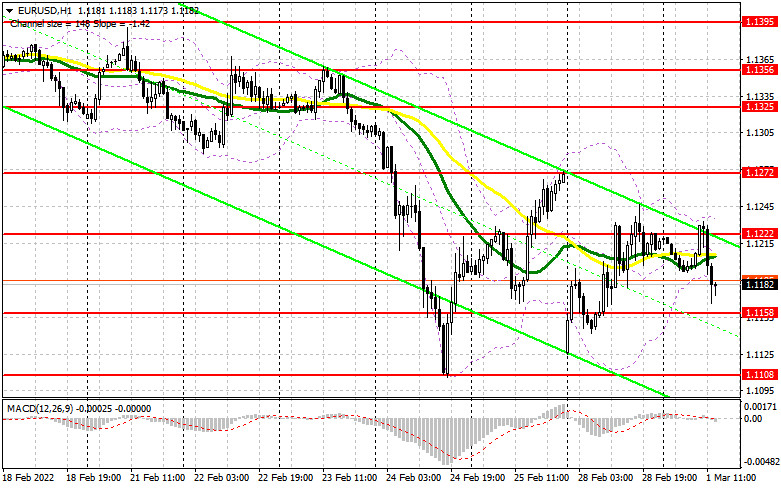

In my forecast this morning I drew your attention to the level of 1.1222 and considered this level as an entry point in the market. Let's have a look at the 5-minute chart and analyze what happened. The weak Eurozone manufacturing activity indicator did not let the buyers climb above 1.1222, and the pair has no drivers for growth because the situation in Ukraine is still getting worse. A few false breakouts, which I also noticed this morning, formed a good sell signal for the euro. As a result, the pair fell by 60 pips and got close to the morning support at 1.1164. From the technical point of view, in the second half of the day, nothing has changed.

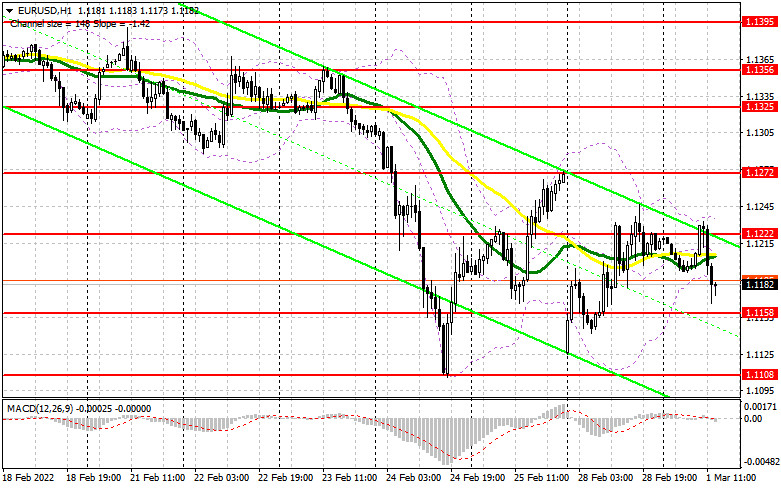

The actions of Russian troops in Ukraine continue to put serious pressure on the euro, and after yesterday's interim talks between representatives of the two countries, nothing more has happened. The Russian military continues the operation on the territory of Ukraine and there is no talk of a cease-fire yet. The foreign exchange market also reacted moderately to all events, but demand for the US dollar is gradually recovering. In the second half of the day, some fundamental statistics of the US economy, including reports on the ISM manufacturing index and change in the volume of expenditures in the construction sector, will be released, but they will be treated rather indifferently. The sharp growth of indicators may lead to further strengthening of the US dollar, so it is better to postpone purchases of risky assets. In the second half of the day, bulls need to hold the price above support at 1.1158, which was a crucial level during the European session. Only the formation of a false breakout will give the first entry point to long positions, relying on the pair's next correction. It is possible to count on a larger recovery of EUR/USD only after the smoothing of the military tension and increased bulls' activity near 1.1222. A breakthrough and a test of this level, if the weak US data is released, may trigger a buy signal and open the way to 1.1272, where traders can lock in profits. However, as I mentioned above, geopolitical tensions are likely to affect the euro. With the further aggravation of the military conflict, demand for the US dollar will only increase. In case there is no activity at 1.1158, traders are likely to start closing long positions, which will only increase the pressure on the pair. Therefore, it is better to postpone buying the pair until the pair performs a false breakout near the low at 1.1108, and it is possible to take long positions in the euro on the rebound from 1.1070 or even lower near 1.1034, allowing an upward intraday correction of 20-25 pips.

Short positions on EUR/USD:

Bears are fully controlling the market, which was proved this morning after holding the price below resistance at 1.1222. High volatility allows traders to benefit from current market conditions, as market movements are quite wide. Aside from the US data, nothing else is expected today in the afternoon, so we should keep a close eye on the US manufacturing activity data. As long as the trading is carried out below 1.1222, we may expect the pressure on the pair to persist. In the second half of the day, bears need to hold the price below this resistance. The formation of a false breakout at 1.1222, as well as negative news related to Russia and Ukraine, may form a signal to open short positions with the target of lowering the EUR/USD pair to the area of 1.1158. A breakthrough of this level and a reverse test bottom/top are likely to create an additional signal to open short positions, with the prospect of falling to the low of 1.1108, and 1.1070, where traders can generate profit. In case of strong fundamental data from the US, the pair may test 1.1034, and retest 1.0994. If the euro grows during the US session and bears show a lack of activity at 1.1222, it is better not to rush selling the pair. The optimal scenario would be short positions if a false breakdown is formed around 1.1272. Selling the pair immediately on a rebound is possible from 1.1325 or higher near 1.1356, allowing a downward correction of 15-20 pips.

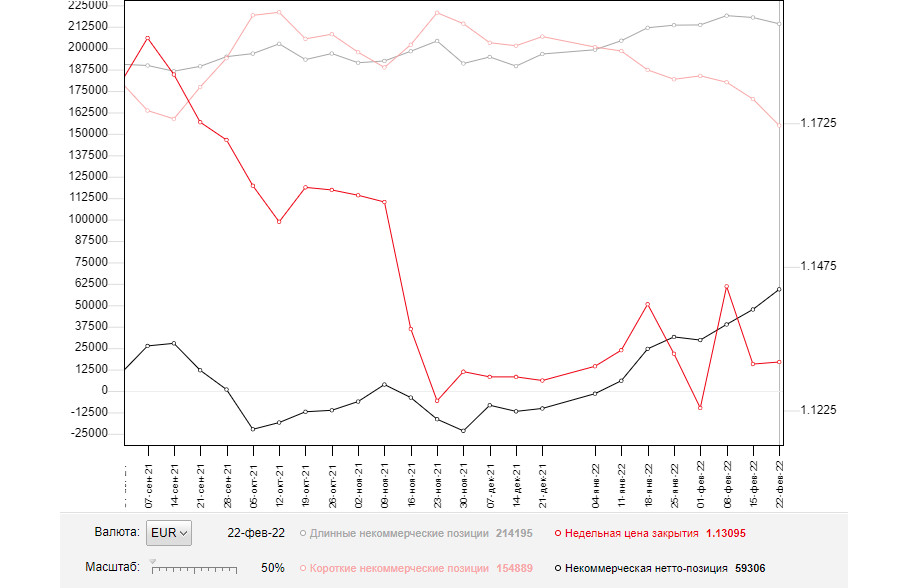

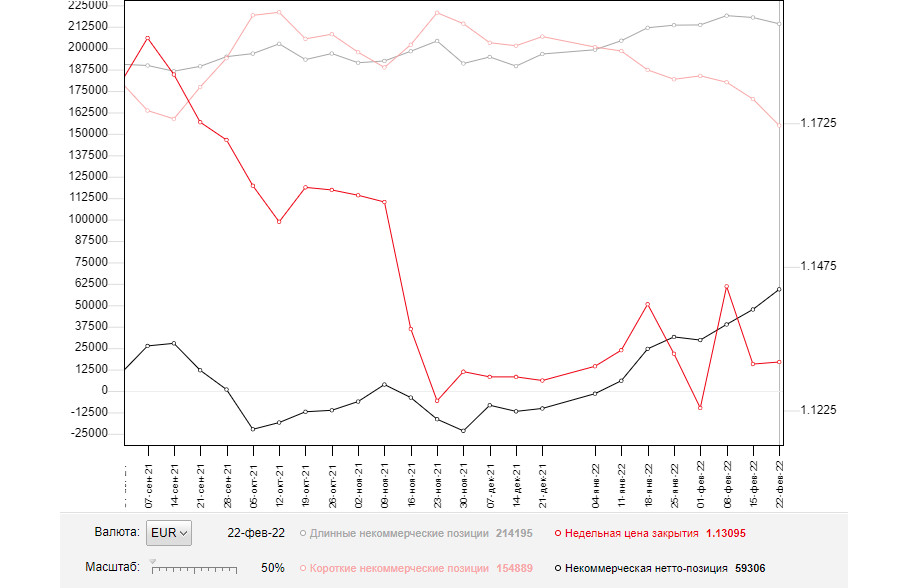

The COT (Commitment of Traders) report for February 22 once again showed a decrease in both long and short positions, which led to an increase in the positive delta, as there were far fewer short positions. Under the conditions of the tough geopolitical conflict, which has affected almost the whole world, there is no sense to talk about what the policy of the European Central Bank or the Federal Reserve System will be, because in case the military conflict aggravates, it will not make any difference. Russia and Ukraine have started negotiating, and much will depend on the results of these meetings. There will be a lot of them. In the current situation, it would not be too right to consider the COT report, especially given its secondary informative status for traders. I recommend being cautious with risky assets and buying the euro only after the tense relations between Russia, Ukraine, the EU, and the US ease. Any new sanctions against Russia will have serious economic consequences, which will affect financial markets and not only the Russian ruble but also the euro. This will happen because of Russia's response to the sanctions, which clearly will hurt the EU creating additional pressure on the euro. The COT report indicates that long non-commercial positions decreased only slightly to 214,195 from 217,899, while short non-commercial positions decreased to 155,889 from 170,318. This means that there are fewer buyers willing to sell the euro, but this does not add buyers to the market. It seems that traders prefer to sit on the fence. At the end of the week, the total net position rose to 59,306 against 47,581. The weekly closing price was unchanged at 1.1309 against 1.1305 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates some confusion of traders with the further direction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.1230 will act as resistance. A breakthrough of the lower boundary of the indicator at 1.1180 will increase pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.