Long positions on GBP/USD:

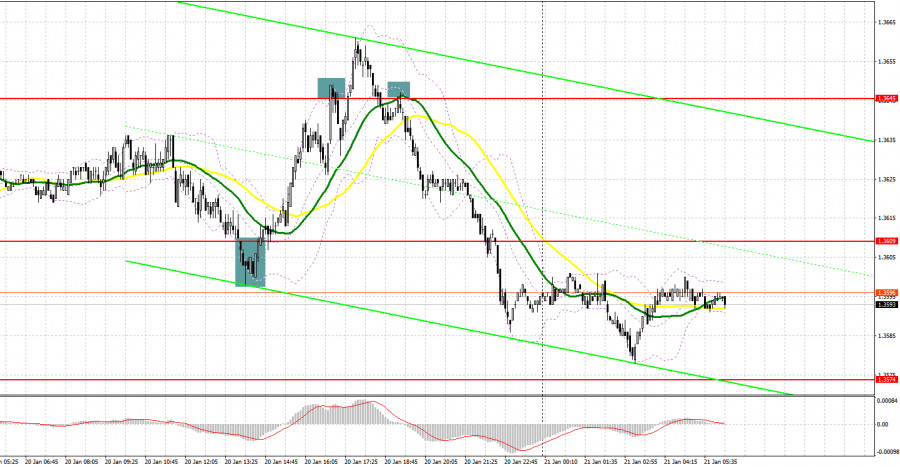

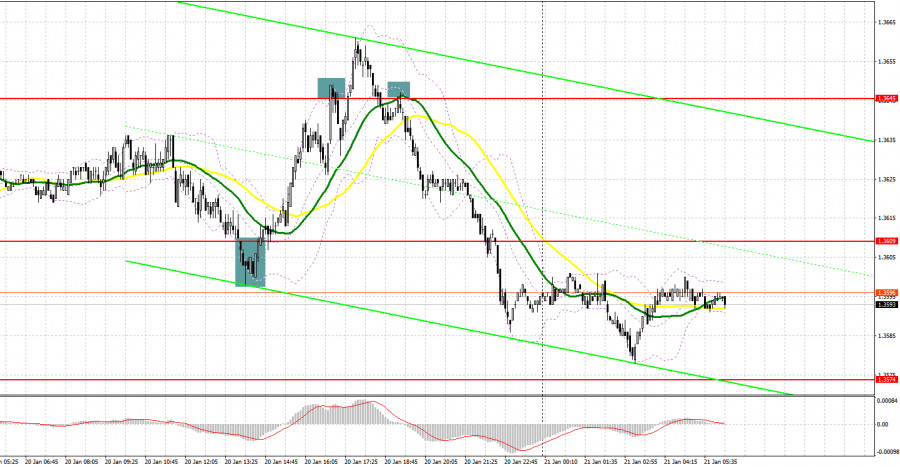

Several strong entry signals were generated yesterday. Let's switch to the M5 chart and analyze the entry points. The first half of the day was marked by low volatility, about 15 pips, as well as a small trading volume. As a result, the price failed to reach designated levels and form an entry signal. In the North American session, bulls protected support (1.3609), and an entry signal was produced. The price increased by 45 pips. Speaking of bears, a false breakout occurred at 1.3645, and the quote returned below this level and tested it from bottom to top. A sell signal was generated as a result. Consequently, the pound/dollar pair fell by 60 pips. So, what were the entry points on Friday morning?

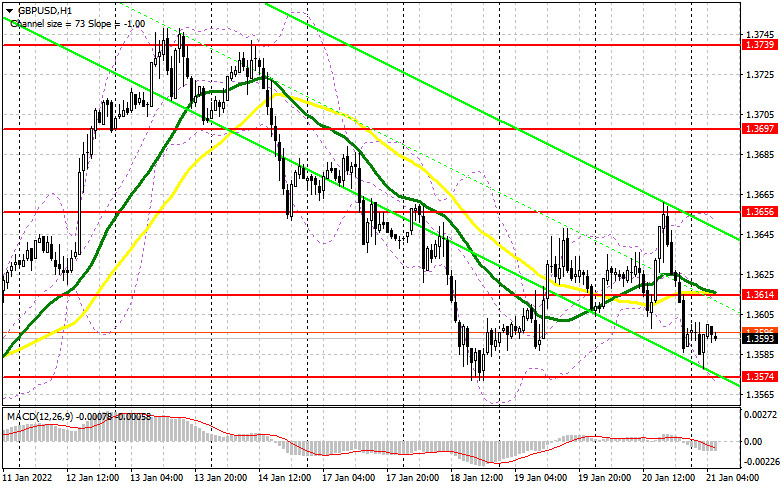

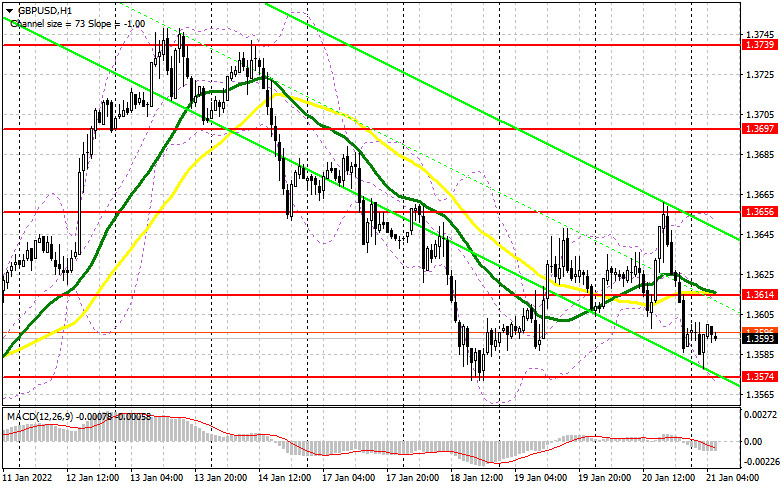

The pound sterling may feel support from today's fundamentals in the first half of the day. The British currency is expected to ascend. Apart from that, data published today in the United Kingdom may exceed market expectations. So, bulls' task for today will be to protect key support (1.3574). In case they fail, the short-term upward movement is likely to end. A false breakout at this level could produce the first buy signal with the target at 1.3614 where there are the bullish moving averages. An additional buy entry point may be produced after a breakout and test of this level from above, as well as strong retail sales results in the United Kingdom. If so, the targets are seen at yesterday's high (1.3656) and 1.3697. Traders should consider locking in profits at 1.3697. If the pound/dollar pair goes down in the European session due to disappointing data and the lack of bullish activity at 1.3574, long positions could be opened when the quote touches 1.3532 where bullish sentiment may increase. However, the bearish correction that emerged last Friday is likely to extend in case of a breakout at 1.3574. Therefore, the pound is unlikely to go up intraday. A false breakout at 1.3532 could produce an entry point to enter long positions. Traders could go long after a pullback to 1.3496 or from the low of 1.3461, allowing a 20-25 pips intraday correction.

Short positions on GBP/USD:

Bears keep trading in the sideways channel, aiming at extending the bearish correction that emerged on the last day of the previous week. So, bears' task for today will be to protect key resistance (1.3614). This level is in the middle of the sideways channel where the bullish moving averages are. A false breakout there is likely to make the first entry point to enter short positions with the target at the lower limit of the sideways channel (1.3574). Disappointing data on retail sales in the United Kingdom and Gfk consumer confidence, as well as taking control over the target, could produce an entry point to open short positions. If so, the targets are seen at 1.3532 and 1.3496 where traders should lock in profits. If the pound/dollar pair goes up in the European session and there is a lack of bearish activity at 1.3614, short positions could be opened after the quote reaches the upper limit of the channel (1.3656). Traders could go short there only in case of a false breakout. Short positions on GBP/USD could also be opened on a rebound from 1.3697 or the monthly high of 1.3739, allowing a 20-25 pips intraday correction.

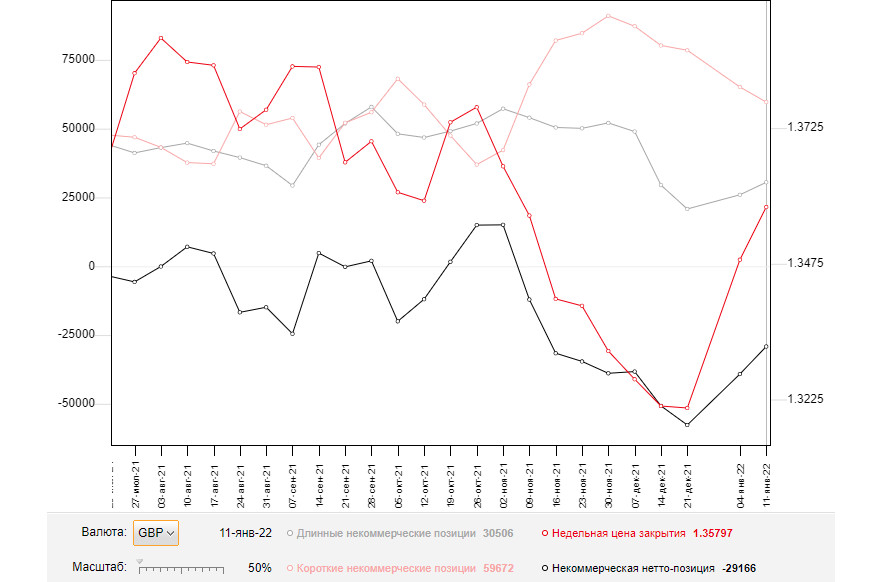

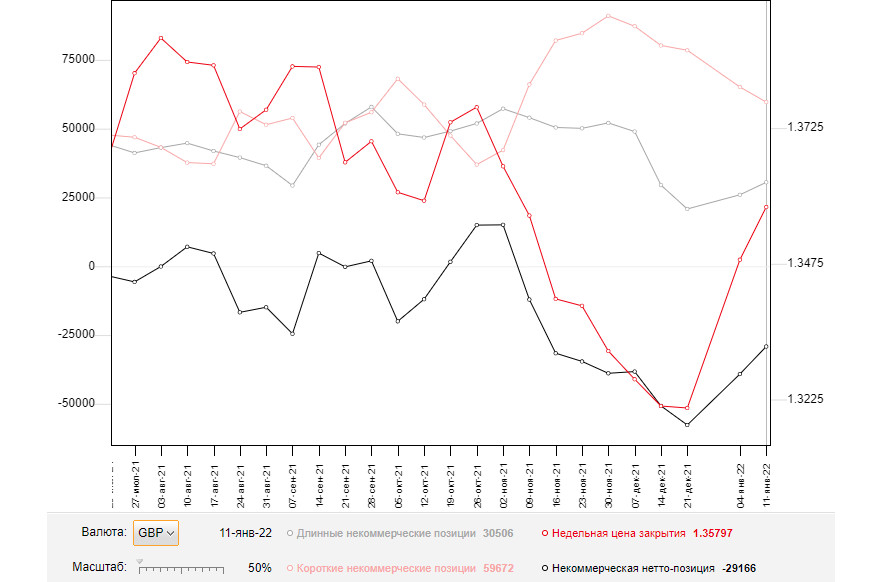

The COT report as of January 11 logged a rise in long positions and a decrease in short ones, indicating steady demand for the pound sterling after the Bank of England raised the interest rate at the end of last year. Generally speaking, the British currency has good potential, and the bearish correction is making it a more attractive instrument. The BoE's decision continues to provide support for buyers of risk assets. The regulator is expected to make a few more rate hikes this year, driving the pound sterling higher. Soaring inflation is the main reason for the hawkish Bank of England. Last week, Chairman Jerome Powell said that US Federal Reserve would not hurry to raise interest rates due to a sharp drop in retail sales in December, which should somewhat reduce inflationary pressure. As a result, demand for the US dollar decreased, allowing the pound sterling to extend gains. The COT report as of January 11 revealed an increase in long non-commercial positions to 30,506 from 25,980 and a fall in short non-commercial positions to 59,672 versus 65,151. The negative non-commercial net position rose to -29,166 from -39,171. The weekly closing price grew to 1.3579 versus 1.3482.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating the extension of the bearish trend.

Note: The period and prices of moving averages are viewed by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands

Resistance is seen at 1.3656, the upper band, if the price goes up. Otherwise, the pair could find support at 1.3574, the lower band, if the quote goes down.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.