Euro fell earlier this week, continuing the bearish trend that was observed since the beginning of September. But now the pressure has eased, so the price rose slightly.

One of the reasons is the Federal Reserve, which repeatedly expressed concern on what is happening, but none talked about any real action. Fortunately, its decision to taper bond purchases did not affect the markets much and so far had no impact on price pressures.

But doubts are emerging because the sharp rise in prices and wages signal more caution about inflation. Consumer prices have reportedly soared 6.2% y/y, with the highest gains seen in cars, food and gasoline. The personal consumer spending price index also rose 4.4% y/y, the highest since 1991 and well above the central bank's 2% target.

On the bright side, data on retail sales point to strong economic growth, which will continue at the end of this year. Sadly, this is also a signal for a further increase in the consumer price index since a number of supply chain problems have not been resolved by the government.

Many experts said the observed inflationary pressure has already gone beyond the time limit, which in the future will create problems. Powell said the surge was largely the result of rising prices for a narrow group of goods and services directly affected by the pandemic and supply problems, but this is no longer the case now.

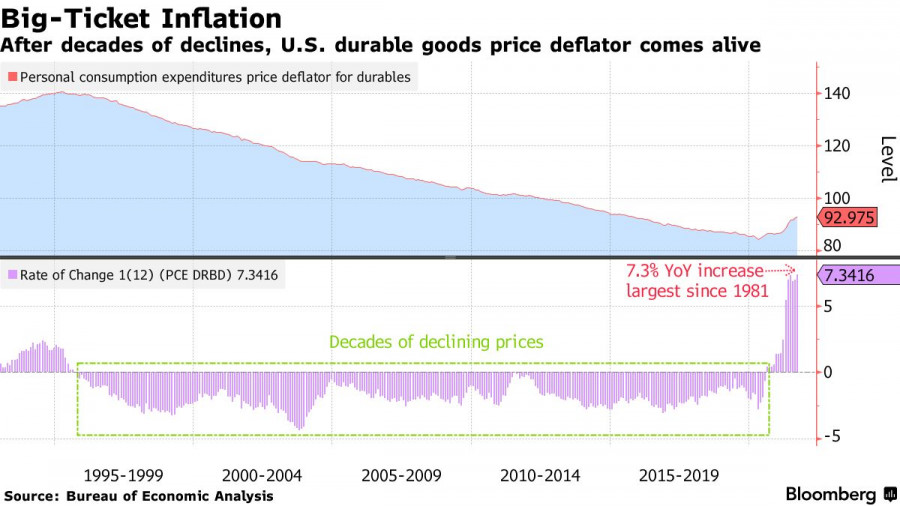

If before many Americans became frightened by another outbreak of the coronavirus, there are no signs of it now. As such, prices for used cars have dropped significantly from the June high of 45.2%, but still exceeds 25%. Meanwhile, prices of durable goods rose 7.3% y/y, the largest increase since 1981.

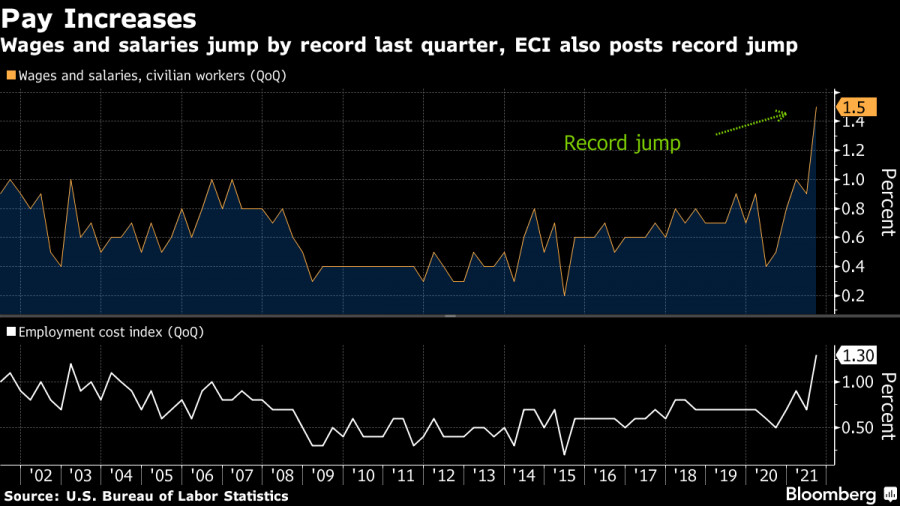

In terms of wages, Powell said back in August that there is no evidence that an increase could threaten excessive inflation. Since then, workers' wages have risen along with the labor market. This shows that people have taken advantage of the numerous job openings to find higher-paying jobs, which should spur future spending.

With regards to the bond market, yields have returned to their highs again amid falling demand. This suggests that consumer and investor inflation expectations have risen to their highest levels in recent years as prices accelerate. Many investors also expect interest rates to rise in the future. This is not alarming to the Fed as they pay a lot of attention to what the people think about prices.

In any case, the bull market for the US dollar will continue until the end of the year, especially since investors are confident that the Fed will act more aggressively next year. Changes are already possible at the December meeting, and one of the former Fed officials said rates may increase even before the end of the bond purchase program.

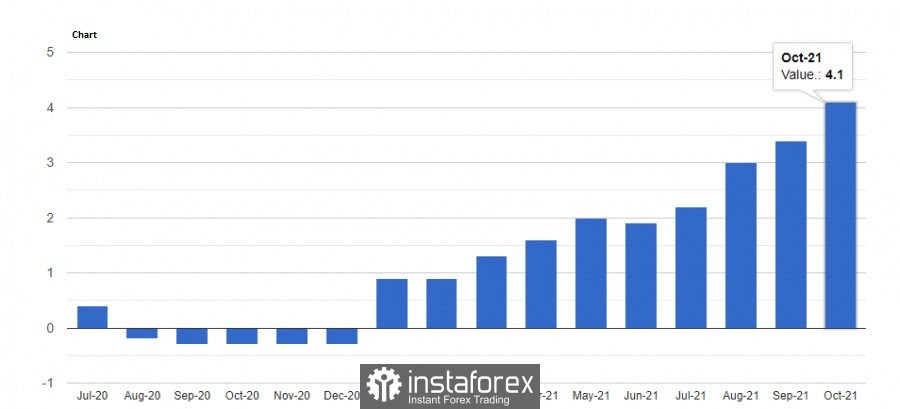

Talking about the Euro area, inflation surged in October, with CPI rising to 4.1%. Core inflation, which excludes energy, food, alcohol and tobacco, also increased to 2.0%. It was energy prices that contributed the most to the growth, followed by services and non-industrial goods. The report detailed that energy prices jumped 23.7% y/y, while prices for food, alcohol and tobacco rose 1.9%.

Meanwhile, the trade surplus fell to € 2.454 billion in September, from $ 6.039 billion last year. This is much higher than the amount last August, which was only € 1.317 billion. Apparently, exports rose 10.3% y/y, while imports rose 22.5%.

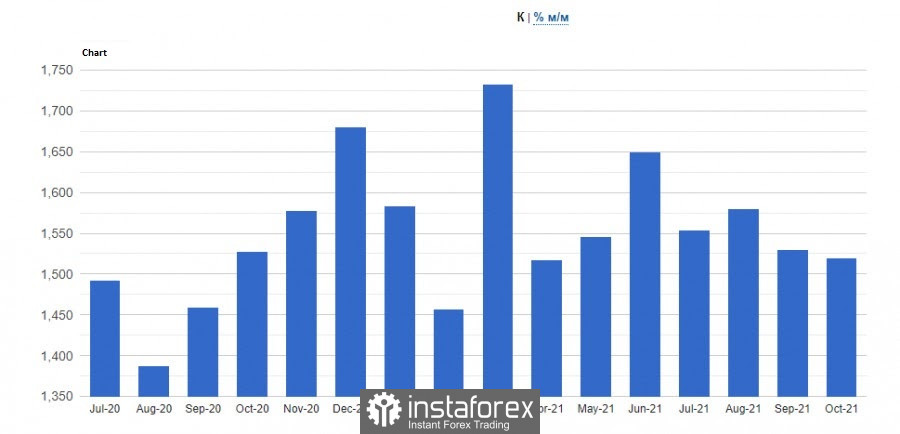

Going back to the US, the number of new homes commissioned dropped 0.7% to 1.520 million a year in October, after falling 2.7% to 1.530 million in September. The continued downturn came as a surprise to economists, who had expected housing construction to jump 1.6% to 1.580 million. Meanwhile, issued building permits rose 4.0% to 1.650 million.

In terms of EUR/USD, a lot depends on 1.1280 because a breakout will lead to a further drop to 1.1260, 1.1220 and 1.1190. But if the quote returns to 1.1330, euro could hit 1.1360 and 1.1390.

British pound (GBP)

Pound rose amid a strong report on the UK labor market. Acceleration in inflationary pressures pushed the quote up as well.

According to the Office for National Statistics, CPI rose 4.2% in October, from 3.1% a month ago. This is the highest rate since November 2011 and is more than double of the Bank of England's 2% target. The central bank predicted that inflation will peak around 5% in April 2022, but it may hit that level as early as December 2021.

And because of that, rates may hike in December, despite Bank of England governor Andrew Bailey saying the opposite thing. Recent data may influence him to think differently, especially since the UK labor market is also improving significantly.