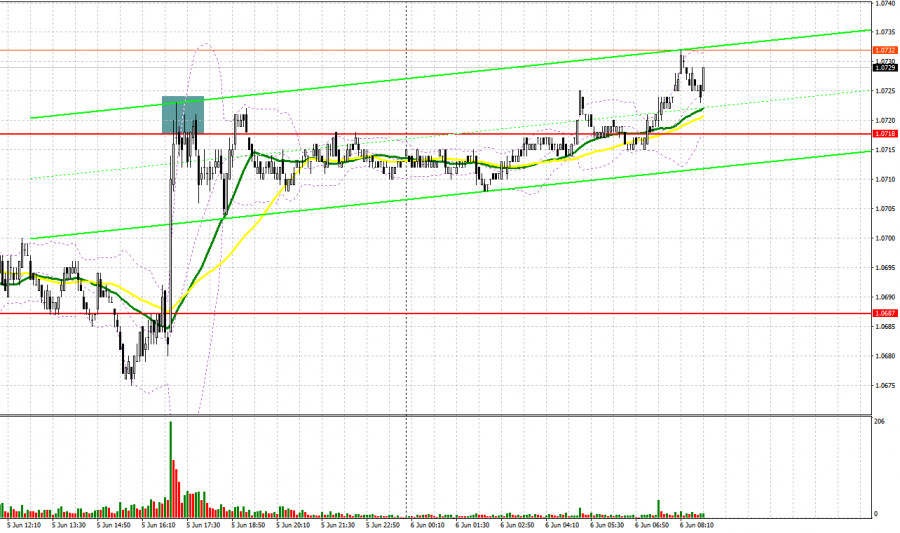

Yesterday, there was only one entry point. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.0718 and recommended making decisions with this level in focus. A rise and a false breakout of this level gave an excellent entry point into short positions. However, there was no sharp downward movement. After a 15-pip decline, demand for the euro returned.

When to open long positions on EUR/USD:

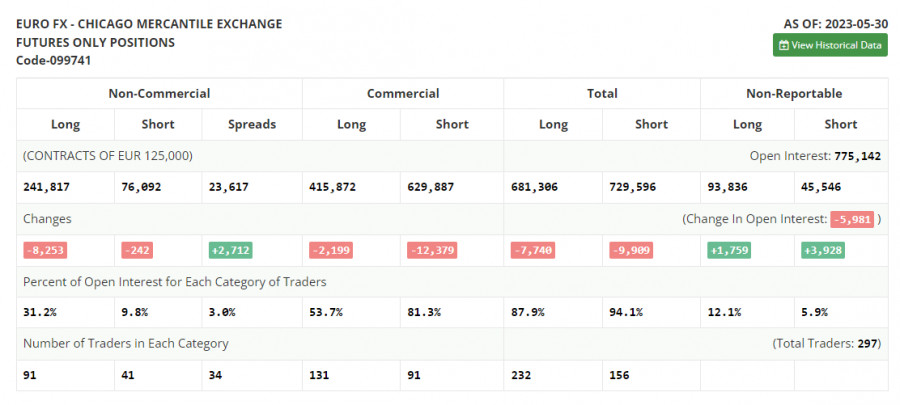

Before moving to the analysis of the EUR/USD pair, let's look at what happened in the futures market and how the positions of traders have changed. According to the COT report (Commitment of Traders) for May 30, there was a decline in long and short positions. However, a drop in long positions was bigger. It indicates falling demand for risk assets. Traders are unwilling to buy the euro due to fears of a slowdown in the European economy and a recession. What is more, the ECB sticks to aggressive monetary tightening even despite the first signs of a steady decline in inflation. Therefore, they prefer a wait-and-see approach. Meanwhile, the US labor remains resilient. Even if the Fed takes a pause in June, it is likely to keep raising rates, boosting demand for the US dollar. The COT report showed that long non-commercial positions decreased by 8,253 to 241,817, while short non-commercial positions fell by 242 to 76,092. At the end of the week, the total non-commercial net position amounted to 163,054 against 185,045. The weekly closing price slipped to 1.0732 against 1.0793.

Today, bulls will have a good chance to carry on with an upward movement. However, they need new drivers such as Germany's factory orders and the Construction PMI Index. Retail sales data for the eurozone will have little effect on the market sentiment because this report is released with a two-month delay. However, if the figure is not in line with forecasts or it climbs significantly, it may also support the euro. Yet, I prefer opening long positions today on the decline.

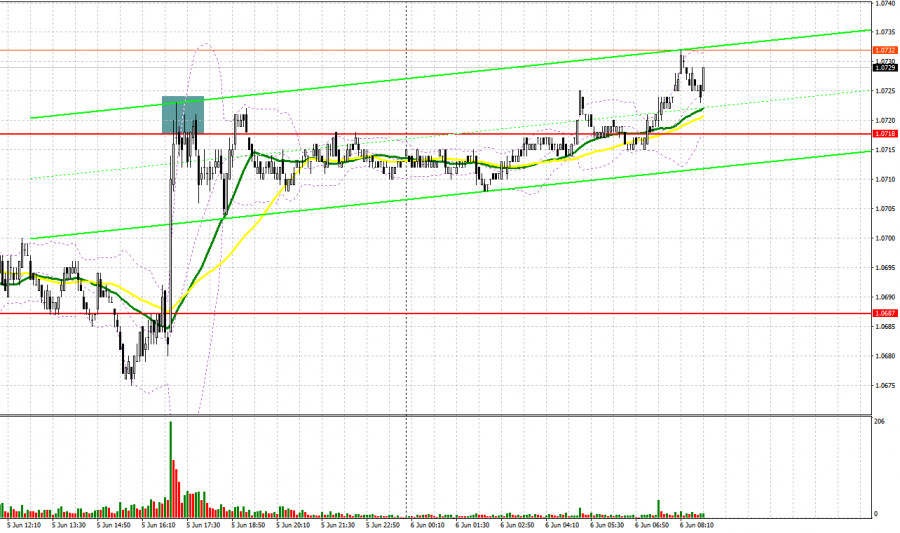

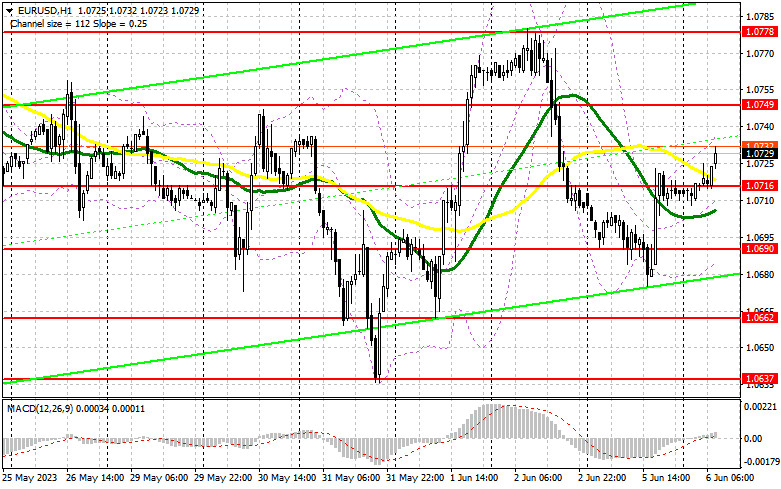

It would be better to open long positions only after a false breakout of the support level of 1.0716 where the moving averages are passing in positive territory. The pair could jump to the resistance level of 1.0749. A breakout and a downward retest of this level will facilitate demand for the euro, giving an additional entry point into long positions. The pair may reach last week's high of 1.0778. A more distant target will be the 1.0805 level where I recommend locking in profits. If bulls fail to defend 1.0716, the pressure on the pair may return. Therefore, only a false breakout of the support level of 1.0690 will give new entry points into long positions. You could buy EUR/USD at a bounce from the low of 1.0662, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers almost lost the upper hand yesterday. However, it did not significantly change the overall trend after Friday's fall. If the upward correction continues after the release of economic reports for Germany, bears need to protect the resistance level of 1.0749. A false breakout of this level may provide a sell signal that could push the pair to the support level of 1.0716. Consolidation below this level as well as an upward level will trigger a decline to 1.0690. A more distant target will be the 1.0662 level where I recommend locking in profits. If EUR/USD rises during the European session and bears fail to protect 1.0749, which is also likely as upbeat Germany's economic reports may improve market sentiment, bulls will try to regain control. In this case, I would advise you to postpone short positions until a false breakout of 1.0778. You could sell EUR/USD at a bounce from 1.0805, keeping in mind a downward intraday correction of 30-35 pips.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages, which indicates that traders are hesitant to pick up a trajectory.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0690 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.