To open long positions on GBP/USD you need:

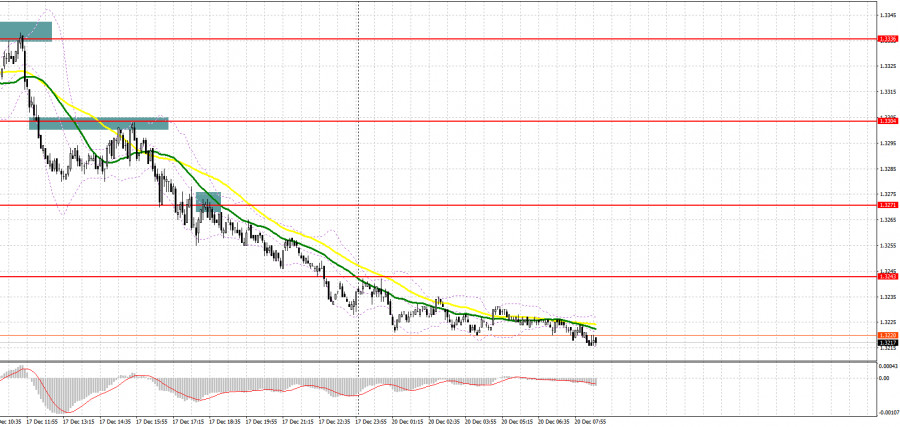

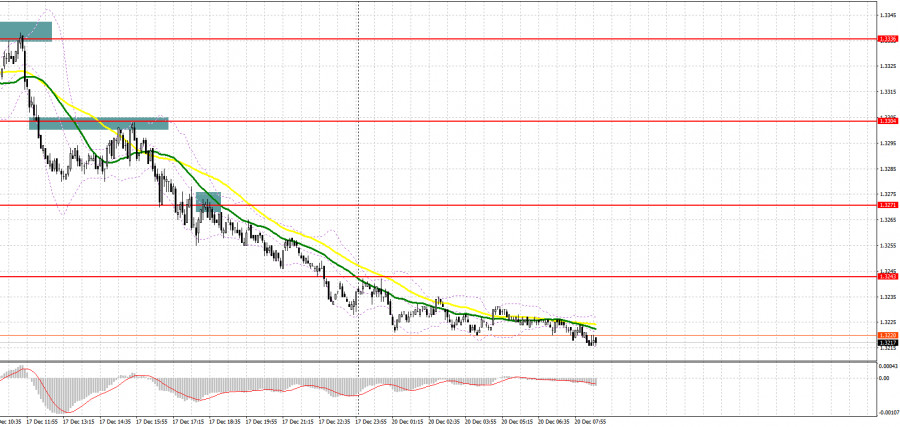

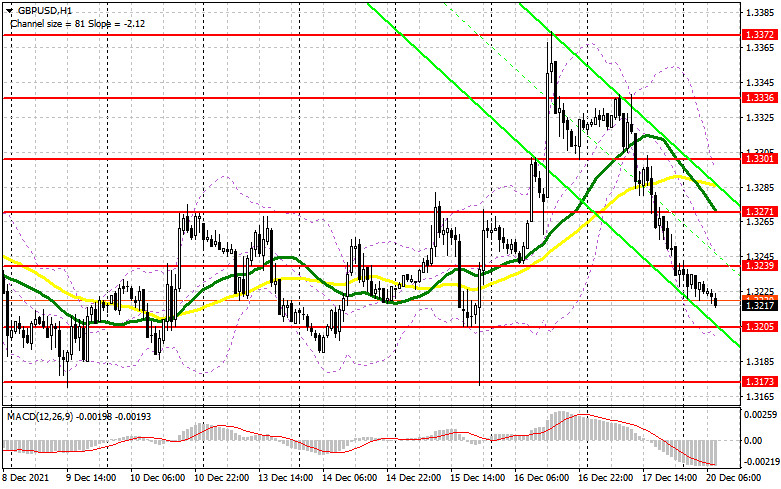

Last Friday, several strong signals to sell the pound were formed. I recommend observing the 5-minute chart and figure out the entry points. In my morning forecast, I focused on 1.3304 and 1.3336, and recommended taking them into account while making decisions to enter the market. The pound's decline in the morning and formation of a false break around 1.3304 was the reason to open long positions, following yesterday's bull trend. Notably, the point test at 1.3304 was not concerned. However, taking into account yesterday's momentum, it was safe to enter the market. Then the pound rose by 30 points, bulls hit 1.3336 and they failed to overcome it. Formation of a false break at 1.3336 forced traders to close long positions and reverse as a sell signal for the pound was formed. In the second half of the day the reverse test from the bottom to the top of 1.3304 occurred, forming another signal to sell the pound. Downward movement totaled about 60 points. Besides, what were the euro entry points this morning?

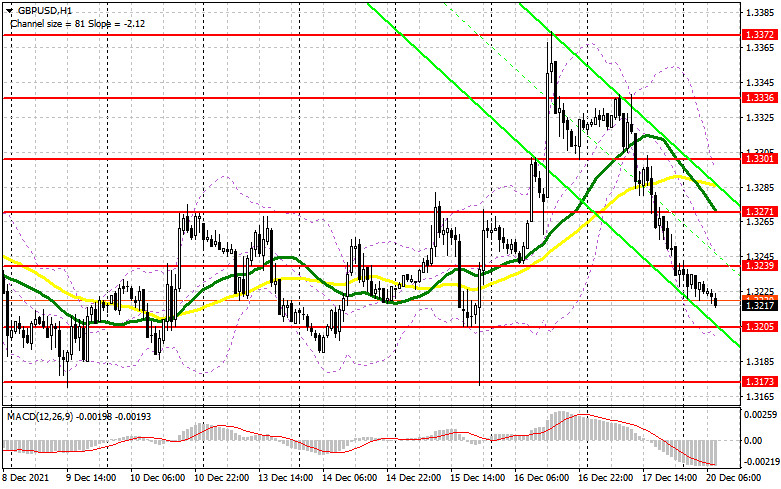

No significant fundamental statistics are released today and only the Confederation of British Industry's report on industrial orders balance is expected. Apparently, bears decided to regain control of the market by the end of the year, considering an expected interest rate hike in the US next spring. The bulls' key task for today is the defense and formation of a false break around 1.3205, similar to the one I analyzed above. Only in this case it is possible to open long positions, counting on the bear market to stop and the pound to rise to the area of 1.3239, which was formed on Friday. A breakout and a test of 1.3239 will be also of key significance as a break of this range will allow bulls to strengthen their positions targeting to update the highs of 1.3271 with the moving averages favourable to sellers and 1.3301. A top down test of 1.3271 will give an additional entry point for buying GBP/USD with the prospect of strengthening to 1.3301 and 1.3336, where I recommend taking profit. In case the pound declines during the European session and lacks activity at 1.3205, buyers will have difficulties. Therefore only the formation of a false break near the next low at 1.3173 will give an entry point to buy the pound. Besides, buyers will get their last chance to keep the trade in the sideways channel. It is possible to buy GBP/USD on the rebound around 1.3111, counting on intraday correction of 20-25 pips.

To open short positions on GBP/USD you need:

At the moment, bears are gaining control of the market. This fact is very striking after the Bank of England raised the interest rates. It is hard to predict the direction of further market movement as the fundamental factors are almost irrelevant. Bears have to hold the pound near 1.3239. Otherwise, it may result in breaking some stop-orders and a more active pair's recovery. Only a false break at 1.3239 will give a clear signal to enter short positions with the pair's further decline to the area of 1.3205, making it a valiant fight. A breakout of 1.3205 will exert more pressure on the pound and push it to the last major support at 1.3173, indicating a renewal of the bearish market. A reversal test of 1.3173 from the bottom up will provide an excellent entry point with the prospect of the pound's decline to 1.3111. Lows of 1.3070 and 1.3034 will be the further target. Besides, their renewal will end the bull market. In case the pair rises during the European session and sellers show weak activity at 1.3239, it is better to postpone sales to larger resistance at 1.3271 with the moving averages favourable for sellers. I also recommend opening short positions there only in case of a false break. It is possible to sell the GBP/USD pair immediately on a rebound from the major resistance at 1.3301, or even higher, from the new high at 1.3336, counting on an intraday rebound of 20-25 pips.

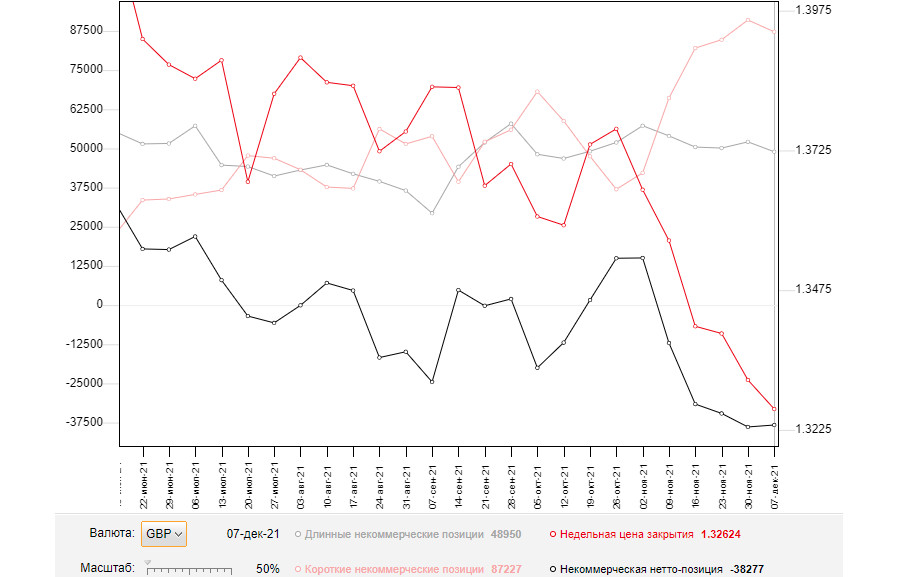

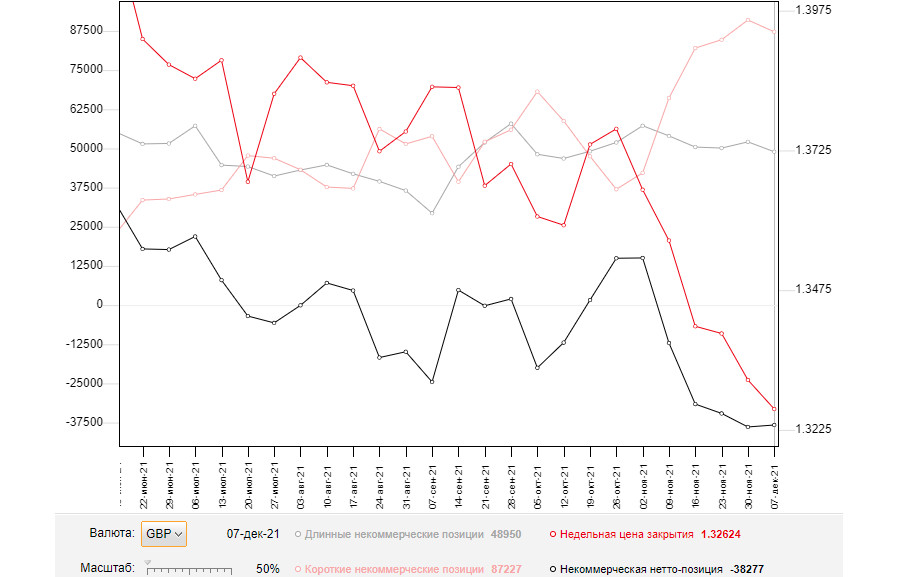

COT reports (Commitment of Traders) for December 7 recorded a reduction of both short and long positions. Taking into account almost equal decline in positions, it did not lead to serious changes of negative delta. Weak data on the UK economy released late last week obviously undermined the sentiment of the buyers of risky assets, who were counting on the upward correction of the pair before the Bank of England meeting. This week, central bank governor Andrew Bailey will give his stance on further monetary policy. If it is to be further dovish, the pressure on the pound will likely increase as the Federal Reserve representatives are planning to curtail their stimulus measures, which will be favourable for the US dollar. High inflation remains the main reason for the Bank of England to reconsider keeping the stimulus measures, however the uncertainty will remain till the outcome of the meeting on December 16. An equally serious problem for the UK is the new coronavirus variant Omicron, which could lead to another lockdown. So far, the authorities have to monitor the situation with the new variant quite closely, which is negatively affecting the economy at the end of this year. The COT report for December 7 indicated that long non-commercial positions fell from 52,099 to 48,950, while short non-commercial positions declined from 90,998 to 87,227. This resulted in the negative non-commercial net position remaining almost unchanged: -38,277 versus -38,899 a week earlier. The weekly closing price reduced slightly from 1.3314 to 1.3262.

Indicator Signals:

Moving averages.

Trading is conducted below the 30 and 50 moving averages, indicating formation of a possible bear market.

Note. The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands.

A breakout of the lower boundary of the indicator at 1.3205 will increase the pressure on the pair. In the case of growth, the resistance will be the upper boundary of the indicator at 1.3301.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. On the chart, it is marked in yellow;

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. On the chart, it is marked in green;

- MACD (Moving Average Convergence/Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20;

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements;

- Long non-commercial positions represent the total long open position of non-commercial traders;

- Short non-commercial positions represent the total short open position of non-commercial traders;

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.