To open long positions on GBP/USD, you need:

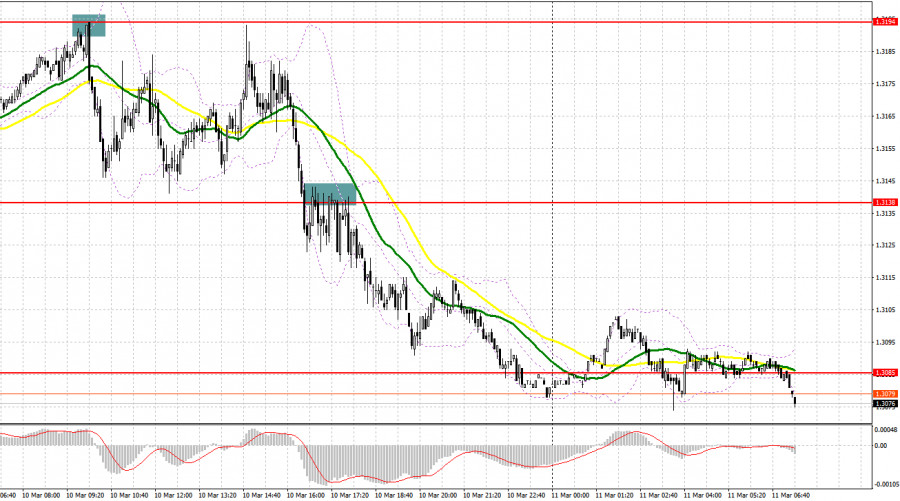

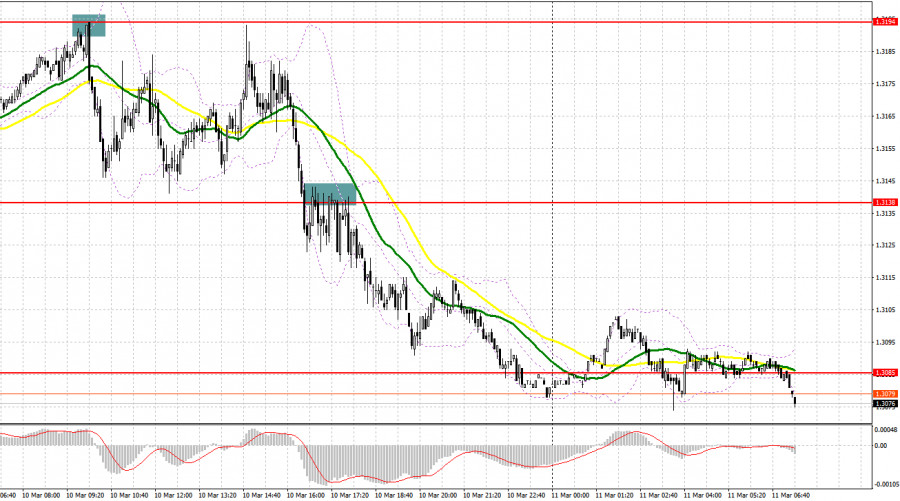

Yesterday, enough profitable signals were formed to enter the market. I suggest we take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the levels of 1.3194 and recommended making decisions on entering the market. An unsuccessful attempt by the bulls to gain a foothold above the resistance of 1.3194 led to the formation of a sell signal for the pound, after which the pair went down more than 50 points. We reached the nearest support of 1.3138 only in the afternoon after strong data on US inflation, which led to a breakdown and a reverse test of this range. As a result, another sell signal and a 50-point drop in the pound to the next support of 1.3085. And what were the entry points for the euro?

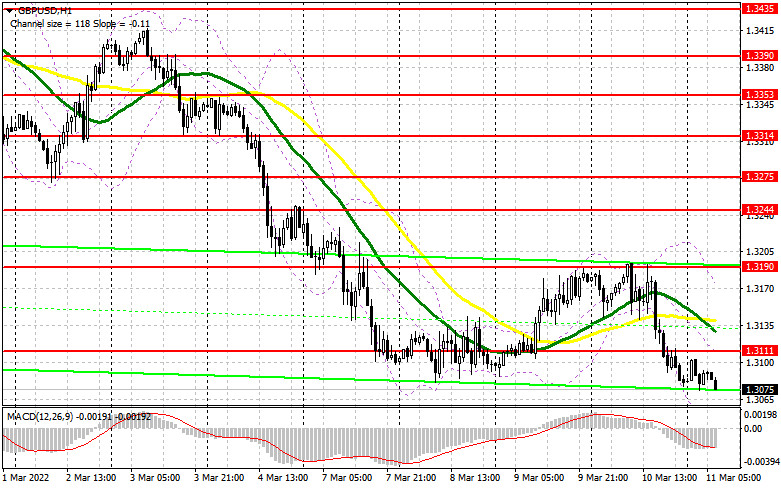

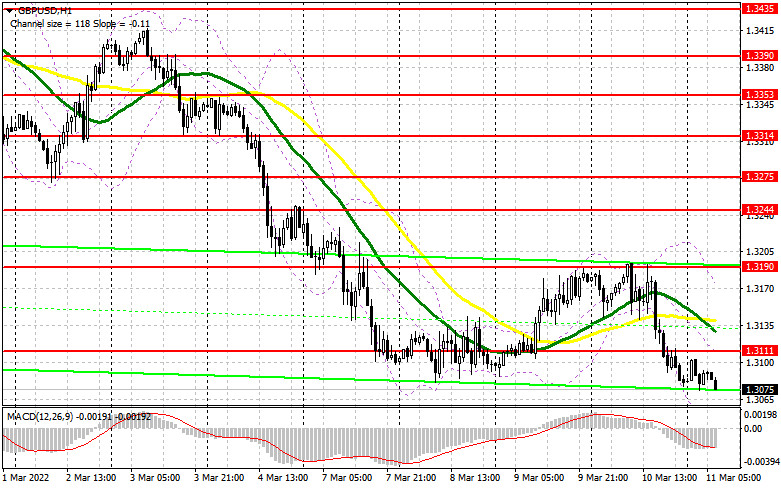

Annual lows are completely smeared, which forced us to revise the technical picture and not in favor of buyers. Yesterday's sharp increase in inflation in the United States, although it was predictable, everyone understands that there is nothing good in this, and what inflation will be in the UK now, against the background of a rapid increase in energy prices, one can only guess. All this has a very bad effect on the economy and slows down its growth - you can see the final result on the graph. But the fall of the pound is limited, as we have clear aggressive actions of the Bank of England about interest rates ahead since inflation in the UK is now almost the most important headache of citizens and politicians governing the country. An increase in rates will lead to a return of demand for the pound. A large number of economic statistics are planned today, and the report on UK GDP for January this year will attract special attention. An important task of the bulls during the European session will be to protect the support of 1.3034, to which the pound is gradually declining. Long positions from this level can be considered only after the formation of a false breakdown and a strong report on economic growth rates at the beginning of this year. Growth in this scenario will bring the pair back to the resistance of 1.3111, which will also not be so easy to get above. In the area of 1.3111, there are moving averages that play on the sellers' side. Only a breakthrough and a reverse test of this area from top to bottom, together with strong data on GDP, changes in industrial production, and the index of activity in the UK services sector, will lead to the demolition of several sellers' stop orders, allowing bulls to more actively increase long positions. The target, in this case, will be the 1.3190 area. A more difficult task will be to reach the resistance of 1.3244 - this will deal a strong blow to yesterday's bearish trend. I recommend fixing profits there. In the scenario of a decline in GBP/USD during the European session and the absence of bulls at 1.3034, it is best to postpone purchases until the next support around 1.2976 - this is a more reliable level. But I advise you to open long positions there only when a false breakdown is formed. You can buy GBP/USD immediately for a rebound from 1.2914, or even lower - from a minimum of 1.2856, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

Bears control the market again and now a lot will depend on the behavior of the pair at annual lows. The fall of the pound may continue at any moment due to the deterioration of the geopolitical situation in Ukraine, as well as after the weak fundamental statistics for the UK, which are quite a lot today. The priority target of the bears for today will be the support of 1.3034, however, the protection of the level of 1.3111 will be important. Only the formation of a false breakdown at 1.3111 will lead to the first signal to sell the pound with the prospect of falling to the 1.3034 area. A breakout and a reverse test of this range will increase pressure on the pound, which will continue the bearish trend and give another entry point to short positions with the expectation of falling to a minimum of 1.2976. The aggravation of the geopolitical situation will open the way to 1.2914 and 1.2856, where I recommend fixing the profits. In the case of GBP/USD growth during the European session and weak sellers' activity at 1.3111, it is best to postpone sales to a larger level of 1.3190, from which the pair declined yesterday after the US data. I also advise you to open short positions there in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from 1.3244 or even higher - from a maximum of 1.3275, counting on a correction of the pair down by 20-25 points within a day.

The COT reports (Commitment of Traders) for March 1 recorded a sharp increase in long positions and a reduction in short ones. This led to a reduction of the negative delta value to almost zero. However, you need to understand that now such reports are secondary, and the market is changing almost daily, flying by 100-200 points against the background of the ongoing geopolitical conflict that has affected almost the whole world. Most likely, the report next week will show a sharp demand for short positions, so it's best not to look too closely at the current figures yet. It makes no sense to talk about what the policy of the Bank of England or the Federal Reserve System will be since, in the event of an aggravation of the military conflict, it will not matter at all. Now Russia and Ukraine have sat down at the negotiating table, and much will depend on the results of these meetings - there will be a lot of them. The only thing that is clear for sure is high inflation in the UK, which will force the Bank of England to act more actively. Given the slowdown in economic growth and retaliatory sanctions from Russia, it is unlikely that the regulator will go for a sharper increase in interest rates - and this must be done, otherwise, inflation will devour not only the available incomes of the population but also sharply reduce them. The COT report for March 1 indicated that long non-commercial positions increased from the level of 42,249 to the level of 47,679, while short non-commercial positions decreased from the level of 48,058 to the level of 48,016. This led to the preservation of the negative value of the non-commercial net position at the level of -337 versus -5,809. The weekly closing price dropped to 1.3422 against 1.3592.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving averages, which indicates the return of sellers to the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline in the pair, the lower limit of the indicator in the area of 1.3034 will act as support. In the case of growth, the upper limit of the indicator around 1.3175 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.