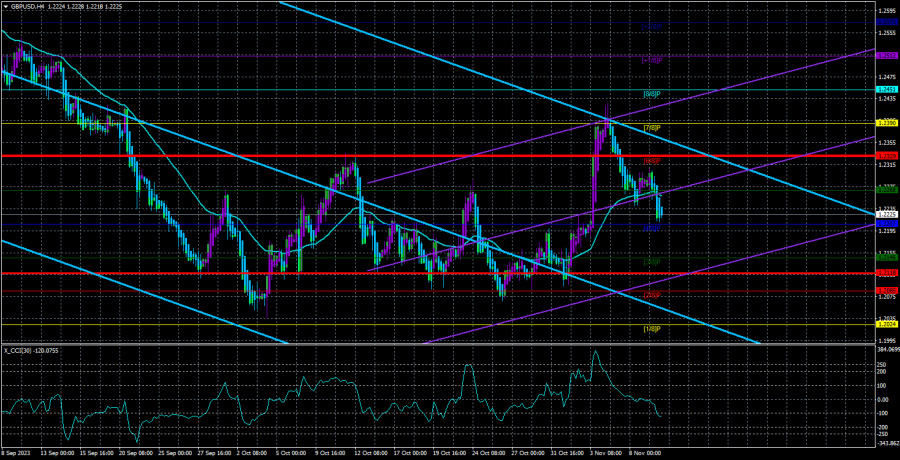

The GBP/USD currency pair on Thursday, unlike the EUR/USD pair, continued its downward movement and settled below the moving average. Thus, the chances of seeing a decline in the pound in the near future are slightly higher than for the euro. However, both European currencies move very similarly 80% of the time, so we expect a decline in both the euro and the pound. In any case, we expect a decline in both the euro and the pound. In the past month, we have repeatedly mentioned that the current rise is a correction against a two-month fall. When the correction ends, the trend is restored. Therefore, the minimums around the level of 1.2050 are the minimum target for the pound in the near future.

The fundamental background also favors the strengthening of the American currency. Huw Pill, the Bank of England's chief economist, Jerome Powell, and a few of his coworkers all gave speeches yesterday. Their statements strongly resonate with each other. We will discuss this below. Thus, the probability distribution for the rate hike of the Bank of England and the Fed is approximately the same as in the case of the ECB and the Fed: the American regulator can raise the rate with a probability of 20–30% and the Bank of England – with a probability not exceeding 10%. This factor may well exert pressure on the British pound, which has grown undeservedly strongly in the last year and now requires a "fair value restoration."

It is worth noting the 24-hour TF separately. The price barely managed to enter the Ichimoku cloud. Last Friday, US statistics failed, but we saw only one upward movement, after which the pair has been falling for 4 days and completely offset the growth of last Friday by 200 points. Thus, it can be concluded that the market is still not set for buying the pound. Yes, if statistics from across the ocean are weak, local growth of pairs is possible, but not more. Add to this the double overbought condition of the CCI indicator on the 4-hour TF, and the conclusion becomes obvious: only a southern direction.

The Bank of England is shifting from a "hawkish" to a "dovish" stance. This week, we have already mentioned that the Bank of England may start lowering the rate next year. So far, we are talking about a small decrease, by 0.3-0.5%. There is nothing surprising in this. If the rate starts to fall next November (and inflation by that time will be at 3%), what's strange about it? Obviously, sooner or later, inflation will approach the target level, and the regulator will begin to soften monetary policy. However, the problem is that it does not matter when and under what circumstances the easing begins. If the Bank of England signals a rate cut, the pound will fall. At the same time, the Fed shows its readiness to continue tightening if inflation shows too high values. Inflation in the United States has been rising for three consecutive months. Jerome Powell admits a new hike, and Mr. Pill from the Bank of England does not. This factor may well put pressure on the pair.

The Chief Economist of the Bank of England, Huw Pill, stated yesterday that to contain inflation, it is not necessary to further raise the key rate. At the same time, he admitted that consumer prices are still rising too quickly and wages are growing too fast. It would seem that with such data, a new tightening is needed, but the British regulator expects inflation to decrease to 5% by the end of the year and then expects to see a further slowdown without additional tightening. What this optimism is based on is unclear. But again, the naked eye sees the difference between assessing the current situation and the readiness of the central bank to intervene. The Fed is ready for new challenges; the Bank of England, it seems, is not. Thus, we believe that the decline in the British pound will continue.

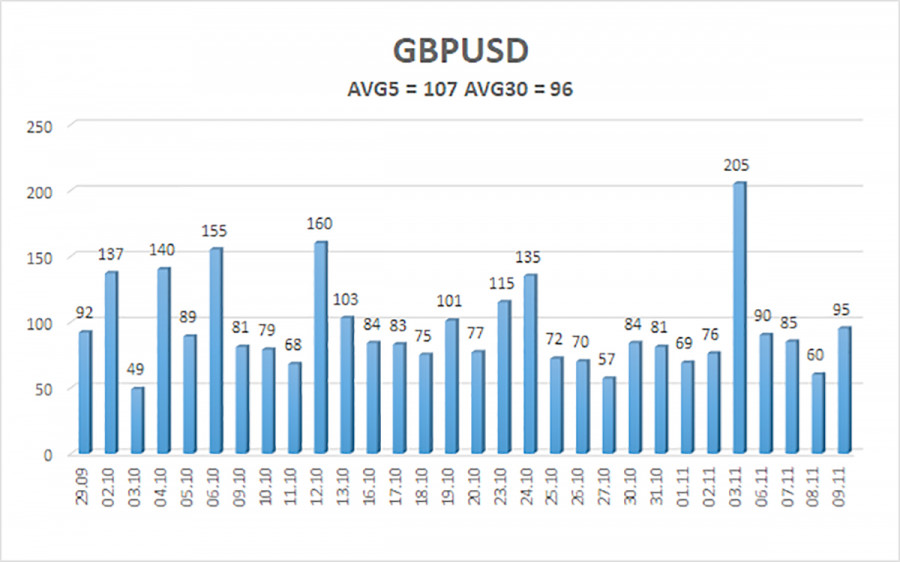

The average volatility of the GBP/USD pair over the last 5 trading days is 107 points. For the pound/dollar pair, this value is considered "average." On Friday, November 10, we expect movements within the range limited by the levels of 1.2118 and 1.2332. The reversal of the Heiken Ashi indicator upwards will indicate a small rollback before a new wave of downward movement.

Next support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

R3 – 1.2390

Trading recommendations:

The GBP/USD currency pair has initiated a new phase of downward movement, which could mark the beginning of a new downtrend. Short positions can be considered at present, with targets at 1.2146 and 1.2118 until the Heiken Ashi indicator reverses upwards. Long positions will become reasonable upon a new consolidation above the moving average line, with targets at 1.2329 and 1.2390. However, at the moment, everything points towards a resumption of the downward trend.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will move in the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold zone (below -250) or the overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.