To open long positions on GBP/USD, it is required:

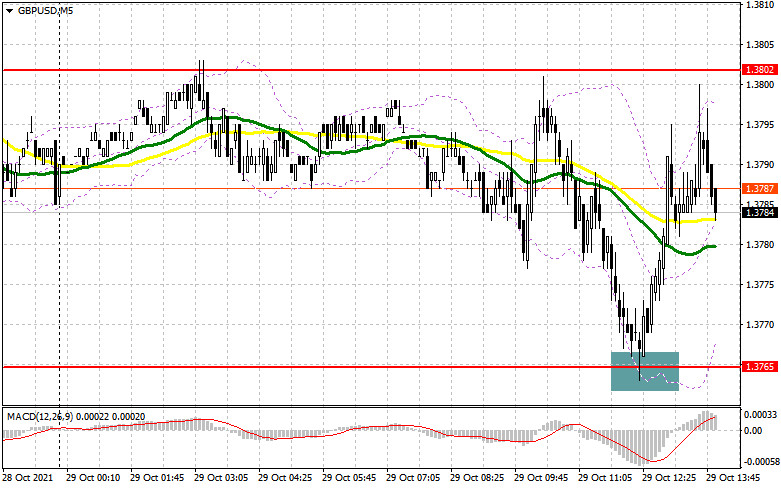

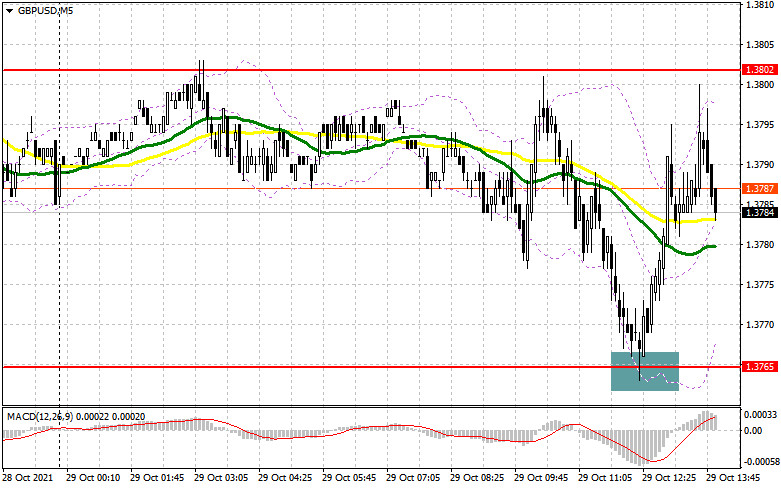

In the first half of the day, an excellent signal was formed to buy the pound. Let's look at the 5-minute chart and analyze the entry point. As a result of the decline to the support of 1.3765, which I emphasized in my morning forecast, an unsuccessful attempt by bears to push through this area led to the formation of a false breakdown and a signal to buy GBP/USD. By the middle of the day, the bulls returned to the resistance area of 1.3800, which allowed them to take about 35 points of profit from the market. For the second half of the day, the technical picture has not changed much.

The main focus of traders will be placed on changes in the level of spending and income of the US population, as well as on the consumer sentiment index from the University of Michigan. The Chicago PMI index is unlikely to lead to serious changes in the market, but it is also worth paying attention to. The bulls' task is still to return the pair to monthly highs, and it is necessary to break above 1.3799, which could not be done in the first half of the day. Only a reverse test of this level from top to bottom will give an entry point into long positions, which will allow updating the level of 1.3826. A breakdown of this range will lead to the demolition of several bears' stop orders and a larger growth of the pair in the area of the highs: 1.3864 and 1.3910, where I recommend fixing the profits. In the scenario of a decline in the pair in the afternoon against the background of strong indicators for the American economy, an equally important task for buyers will be to protect the support of 1.3765, which they successfully coped with during the European session. There are also moving averages playing on their side. Only the formation of a false breakdown by analogy with what I have analyzed above will increase the chance of a further upward correction of the pair within the day. In the scenario of the absence of active actions on the part of the bulls in the area of 1.3765, the best option for buying the pound will be a test of the next support of 1.3731. However, I advise you to open long positions there only after a false breakdown. You can watch GBP/USD purchases immediately for a rebound from the new low of 1.3697, or even lower - from the support of 1.3668, counting on a correction of 25-30 points within the day.

To open short positions on GBP/USD, you need:

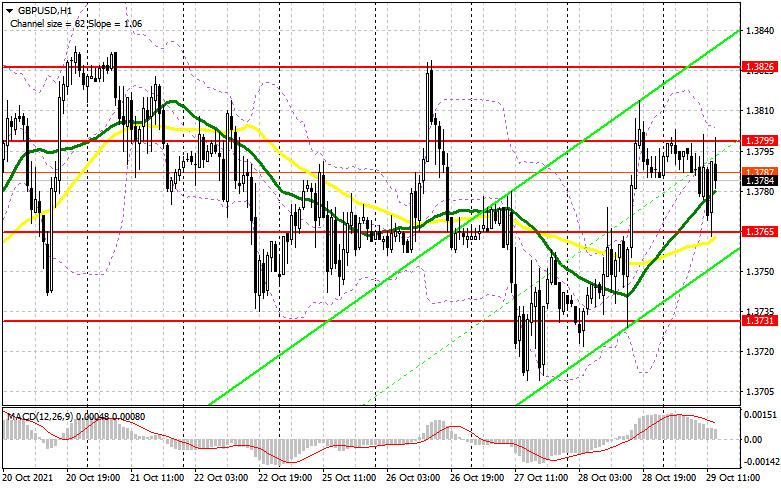

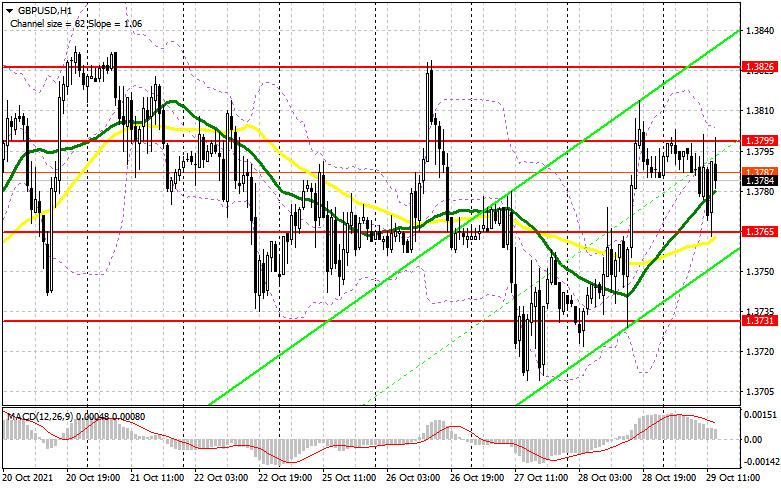

The sellers of the pound are also aimed at bringing the market back under their control, but it seems that now is the time to think about how to defend the resistance of 1.3799. Only the formation of a false breakdown there will lead to the formation of a sell signal, which will push the pair to the support of 1.3765, where the moving averages that limit the downward potential pass. A breakout of 1.3765 and a reverse test from the bottom up will form a signal to open new short positions in the expectation of a fall to the lower border of the 1.3731 side channel, the breakdown of which will provide the sellers of the pound with a direct path to the lows: 1.3697 and 3668, where I recommend fixing the profits. However, such a scenario will be possible in the case of strong fundamental statistics on the American economy. In case of further growth of GBP/USD in the afternoon and the absence of bear activity at 1.3799, I advise selling the pound only after the formation of a false breakdown at monthly highs around 1.3826. I advise you to open short positions immediately for a rebound from the level of 1.3864, or even higher - from a new maximum in the area of 1.3910, counting on the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for October 19 recorded a reduction in short and an increase in long positions, which reflects the upward trend in the pound observed in the middle of this month. It led to the return of the net position of a positive value. Speeches and statements by representatives of the Bank of England that it is necessary to take inflationary pressure more seriously also add confidence to buyers of the pound. Last week's speech by the Governor of the Bank of England, Andrew Bailey, was positively received in the market. He once again repeated his position on changing monetary policy. However, a slight slowdown in monthly and annual inflation growth in the UK limited the upward potential of the pair in the middle of the week, which led to its locking in a side channel. I advise you to count on the further strengthening of the pound and take advantage of any decline in the short term, which may form in the case of weak fundamental statistics. The COT report indicates that long non-commercial positions rose from the level of 46,794 to the level of 49,112, while short non-commercial positions fell from the level of 58,773 to the level of 47,497. It led to a change in the non-commercial net position from a negative value to a positive one. The delta was 1,615, against -11,979 a week earlier. The closing price of GBP/USD increased significantly: from 1.3591 to 1.3735.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates the continuation of the pound's growth in the short term.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

Volatility has decreased, which does not give signals to enter the market.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.