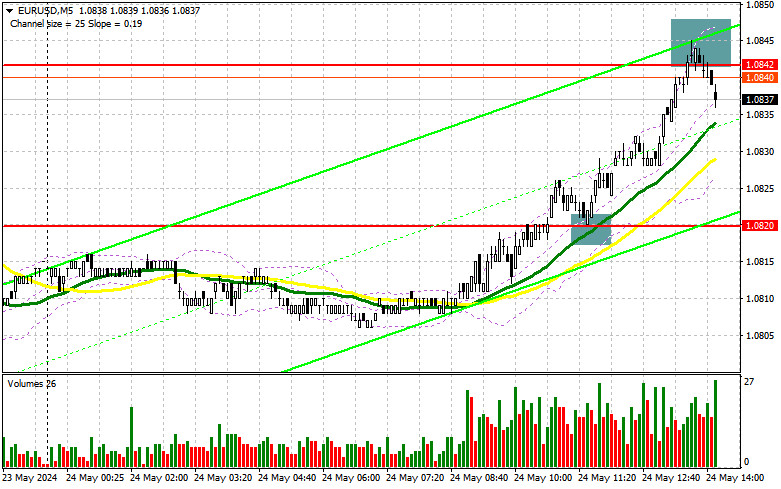

I focused on the 1.0820 level in my morning forecast and planned to make entry decisions from there. Let's look at the 5-minute chart and analyze what happened. A breakout and retest of 1.0820 signaled a buy, resulting in the pair rising by more than 30 points. The technical picture for the second half of the day remains unchanged.

To open long positions on EUR/USD:

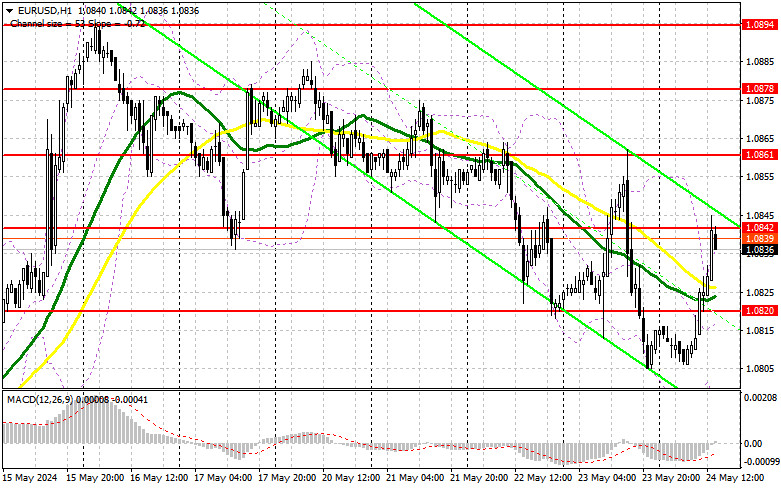

In the second half of the day, we expect several data releases on durable goods orders, consumer sentiment, and inflation expectations from the University of Michigan. These figures are quite important for determining intraday sentiment, and good statistics will help realize the sell signal formed in the first half of the day around 1.0842. Also, remember the speech by FOMC member Christopher Waller, calling to keep interest rates unchanged to combat inflation, which should also support the dollar. If the pair falls, I plan to open long positions after a decline and a false breakout formation around the support at 1.0819. This will be a suitable entry point in anticipation of another test of 1.0842 - the resistance level that has yet to be breached. A breakthrough and update of this range from top to bottom will strengthen the pair with a chance for a surge to 1.0878. The furthest target will be the 1.0895 high, where I will take profits. If EUR/USD falls and there is no activity around 1.0819 in the second half of the day, the pressure on the market will return, leading to a more significant decline towards 1.0796. Only after this can we talk about forming a new bearish trend. I plan to enter there only after a false breakout formation. I plan to open long positions immediately on a bounce from 1.0772 with a target of a 30-35 points upward correction within the day.

To open short positions on EUR/USD:

Sellers have a chance to regain market control, but excellent US statistics are needed. With it, bears will likely seize the initiative and work out the sell signal from 1.0842. Only another false breakout similar to what I discussed above around 1.0842 will provide an entry point for new short positions, with the prospect of the euro declining and updating the support at 1.0819, which bears missed during European trading. A breakout and securing below this range, followed by a retest from bottom to top, will provide another selling point, with the pair moving towards the 1.0796 low, where I expect more active buyer participation. The furthest target will be the 1.0772 low, where I will take profits. In case of upward movement of EUR/USD in the second half of the day and the absence of bears at 1.0842, buyers will regain market control. Still, a more significant trend development can be expected only after weak US statistics. In this case, I will postpone sales until testing the next resistance at 1.0861. I will also sell there, but only after a failed consolidation. I plan to open short positions immediately on a bounce from 1.0878 with a target of a 30-35 points downward correction.

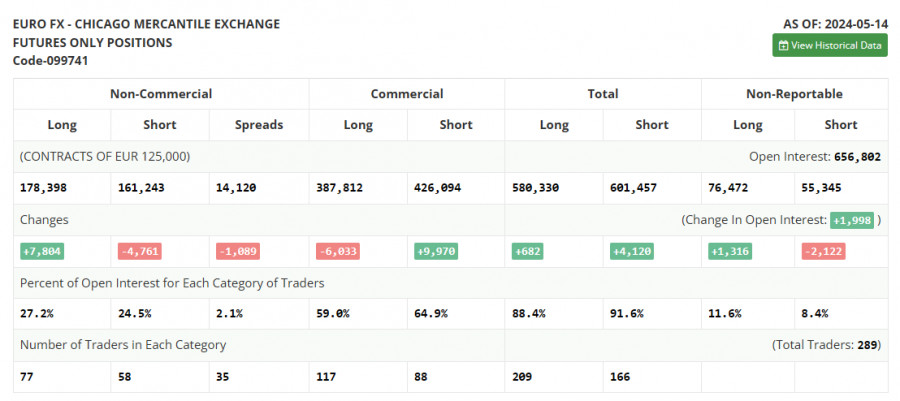

COT Report (Commitment of Traders):

The COT report for May 14 showed an increase in long positions and a decrease in short positions. Recent statements from ECB representatives about possible rate cut scenarios and good figures indicating continued slowing price pressure in the region were interpreted in favor of buying risky assets. However, in the short term, rate cuts could pressure the euro. However, now, more discussions focus on the need to stimulate the economy, ensuring euro growth in the medium term if borrowing costs are eased. The COT report indicated that long non-commercial positions increased by 7,804 to 178,398, while short non-commercial positions fell by 4,761 to 161,243. As a result, the spread between long and short positions decreased by 1,089.

Indicator Signals:

Moving Averages

Trading is around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of moving averages on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the indicator's lower boundary, around 1.0795, will act as support.

Description of Indicators:

- Moving average (MA): Defines the current trend by smoothing volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving average (MA): Defines the current trend by smoothing volatility and noise. Period – 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators like individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet specific requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.