Tuesday's trading of the EUR/USD currency pair was quiet for most of the day. However, everything was altered when the US inflation report for November was released. In general, we cautioned that the significance of this report now is comparable to that of the Fed meeting. A stronger movement was sparked by the most recent inflation report than by the Fed meeting. Therefore, we were not surprised by the movement of 110 points in a half-hour. Although we have been anticipating a significant downward correction for several weeks, the fact that the European currency increased once again was not even surprising. We have discussed moving north repeatedly over the past few months, but yesterday everything made perfect sense. More than expected, US inflation has slowed down significantly. The US dollar naturally declined due to the situation because the likelihood of the Fed tightening its monetary policy decreased as inflation rose. Additionally, the domestic currency benefits whenever the Central Bank's monetary policy is tightened.

So, based on Tuesday's results, we can only reiterate that the upward trend is still in place. There is still no reason to open short positions since the pair has been unable to move past the moving average line. Of course, this week could see several upside-down turns. Even the ECB and Fed meetings will suffice in this case. However, the reality is that the Fed's "hard" and "hawkish" stance cannot be maintained in light of the inflation report. No one has any doubts about the rate increasing by 0.5% tonight. The question was, "What level will it eventually reach?" Additionally, the Fed has no justification for raising the rate beyond 5.5–5.25%, given that inflation is showing signs of steadily declining. And the market may have long since recovered this level of the wager.

The Fed's attitude could change.

As we have previously stated, inflation now significantly influences the future of the dollar. On the one hand, the fact that inflation is declining is good for the economy. As a result, the Fed will raise the rate less frequently, hold it there longer, and do less to "cool" the economy as a whole. On the other hand, the dollar benefits from tight monetary policy, and it can be said that it lost one of its trump cards yesterday. The US dollar's potential to strengthen in the near future is most intriguing. It has already fallen far enough to justify this. Still required is a correction to the downside. The European currency has already accounted for every growth factor, so growth cannot last forever, even without declines.

The annual rate of US inflation dropped to 7.1%, which is 0.2% lower than the most optimistic forecast. The decline in the dollar value might not have occurred if it had reached 7.3%. But we work with what we've got. Now that statements about the need to keep calming the monetary mood have been made, it is reasonable to expect a 0.5% rate hike tonight. At the upcoming meeting, the Federal Reserve may only increase the rate by 0.25%, which for the market could be another cue to sell US currency. The ECB can save the dollar. The ECB may start to slow down the pace of tightening even before it waits for its inflation to slow down, as we have already stated that the pair must adjust occasionally. This element can support the dollar. Thus, a paradoxical situation arises. On the one hand, a new growth factor has been added to the euro. On the other hand, there is still a high likelihood that it will fall in the near future. Third, selling is not advised because there is only one technical signal. Before considering selling, we must still wait for the pair to consolidate below the moving average line.

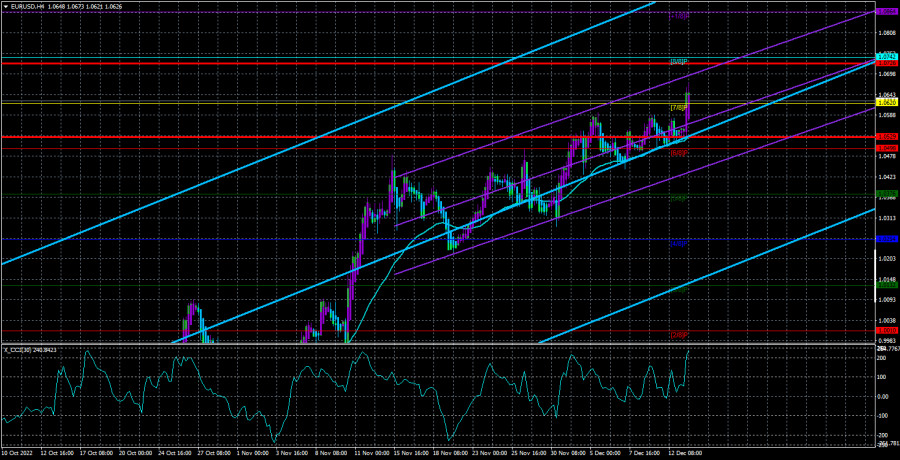

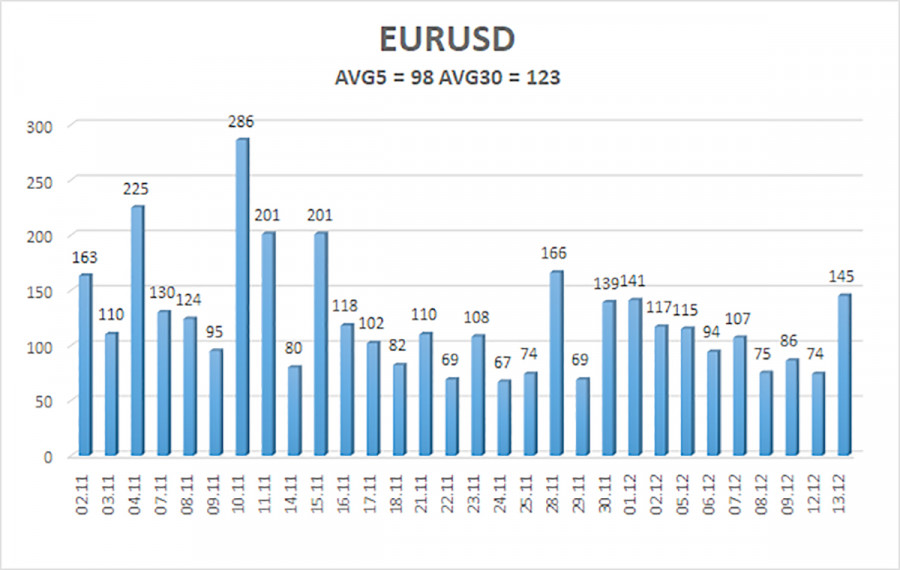

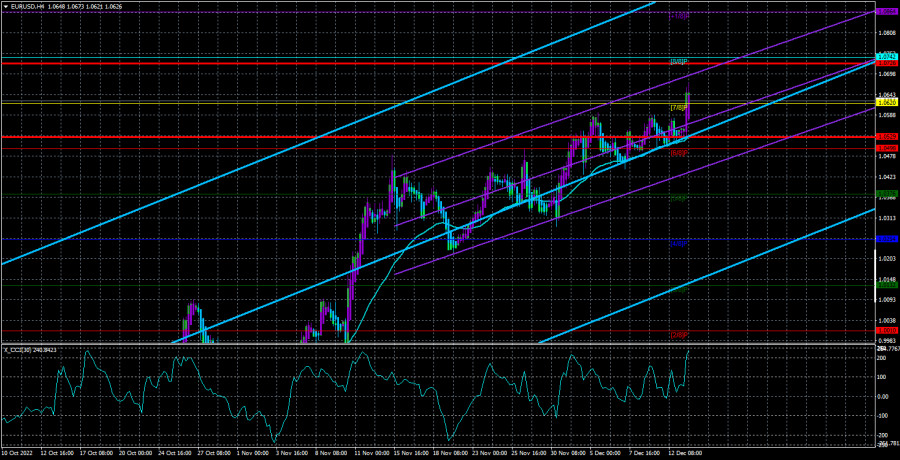

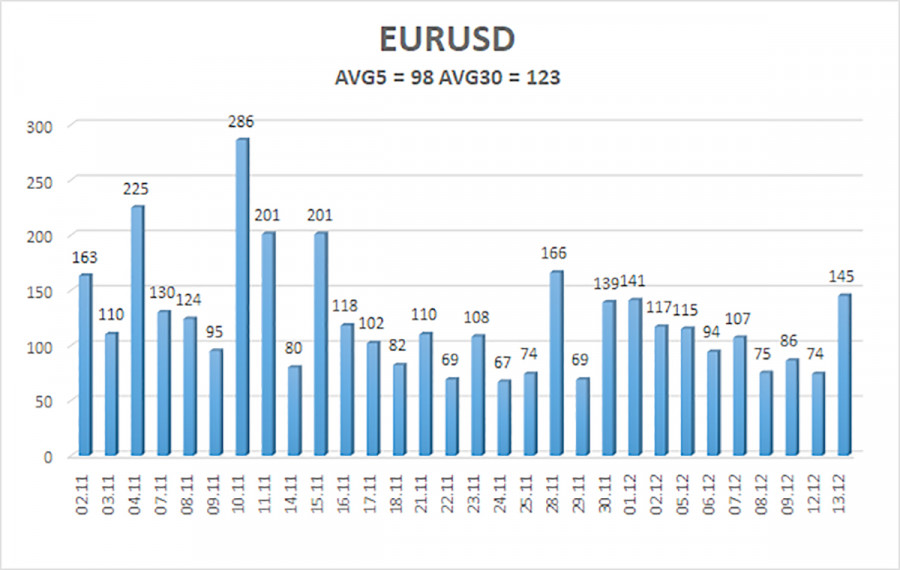

As of December 14, the euro/dollar currency pair's average volatility over the previous five trading days was 98 points, which is considered "high." So, on Wednesday, we anticipate the pair to fluctuate between 1.0529 and 1.0726 levels. The Heiken Ashi indicator's turning downward indicates a new phase of the corrective movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trading Advice:

The EUR/USD pair is still moving upward. As a result, until the Heiken Ashi indicator turns down, it is necessary to maintain long positions with targets of 1.0726 and 1.0742. No earlier than the price fixing below the moving average line with a target of 1.0376 will sales become significant.

Explanations for the illustrations:

Channels for linear regression help identify the current trend. The trend is currently strong if they both move in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.