The EUR/USD currency pair was adjusted on Wednesday. Recall that at the end of last week and the beginning of the current one, the European currency staged another collapse, which even somehow passed without due attention, because cryptocurrencies, US stock indices, and stocks were falling in parallel. Thus, the collapse was massive. Moreover, it is even difficult to say what exactly provoked this collapse. Results of the ECB meeting? They were not openly "dovish" and at first, the euro even showed growth. The report on American inflation? Who can be surprised by rising inflation now? An increase in the likelihood of a more aggressive tightening of the Fed's monetary policy? It is already aggressive. We are not saying that all these factors are far-fetched and had no right to provoke another fall in the euro and a rise in the dollar. We are only saying that none of these factors should have surprised the market so much that the euro currency fell by 400 points in three days.

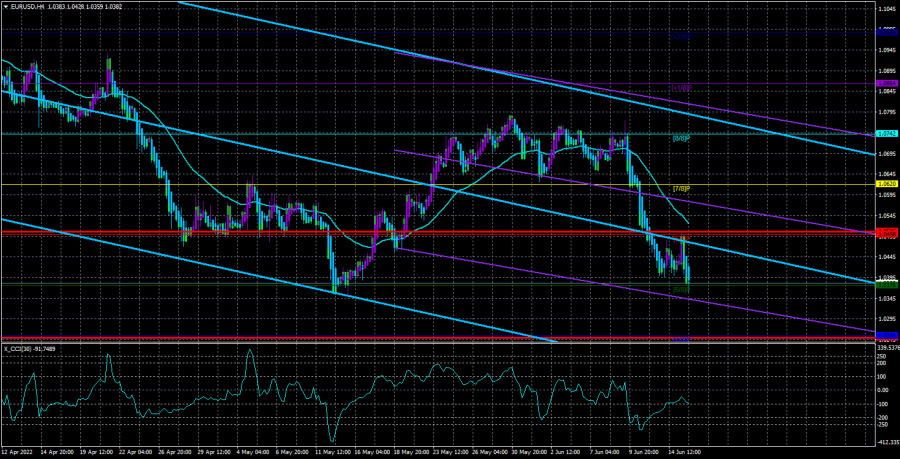

Traditionally, in our review, we do not consider the results of the Fed meeting, as well as the movements that happened last night and tonight. The reason is simple - only American traders have the opportunity to work out the results of the meeting, but European traders will start working on them only today in the morning. Another reason is that traders often trade impulsively during the publication of results or Jerome Powell's speech, without thinking too much, and then we get illogical movements. Therefore, we believe that it is better to wait for the time when emotions will calm down, and it will be possible to analyze the results and movements of the pair with a fresh head, without the influence of emotions. In the meantime, it should be said that formally, a downward short-term trend is now maintained and not formally, a long-term downward trend. Moreover, any results of the meeting are unlikely to affect so much that the long-term trend will be broken. And any movements immediately after the announcement of the results can be easily leveled the next day.

What are the prospects for the European currency?

It should be noted that the prospects of the euro should be divided into long-term and short-term. In the long term, everything is clear. No matter how hard the ECB tries, its rate will remain below the Fed rate for a long time. This means that the American economy will be trite more profitable for investment than the European one. Thus, this factor can maintain high demand for the dollar as long as the Fed raises the rate. Although all traders already clearly understand that the rate increase will last up to the levels of 3-3.5%, we still cannot say when exactly this level will be reached. Moreover, the representatives of the monetary committee themselves do not take risks in their statements and say that they will constantly analyze the state of the economy and the inflation rate to adjust the monetary approach in time.

But the short-term prospects of the euro, oddly enough, can be quite good. This is supported, for example, by the fact that the euro currency has fallen again, not quite deservedly. Or the fact that the euro has already fallen in price over the past two years very much, but it cannot be adjusted normally in any way. Or the fact that traders are already ready to raise the Fed rate by at least 1% at the June and July meetings, which means this decision can already be put into the course of the pair. Thus, we will not be surprised if the European currency is trading with an increase in the next week or two. There are no other support factors for the euro yet. It is still close to 20-year lows and can update them at any time. The geopolitical situation in Eastern Europe is unchanged, and sanctions against the Russian Federation are already beginning to take effect on the European economy. Oil and gas prices continue to rise, provoking an increase in prices for almost all goods and services. The fight against inflation at these stages does not give any positive results. Altogether, this suggests that the euro can still only hope for a technical correction.

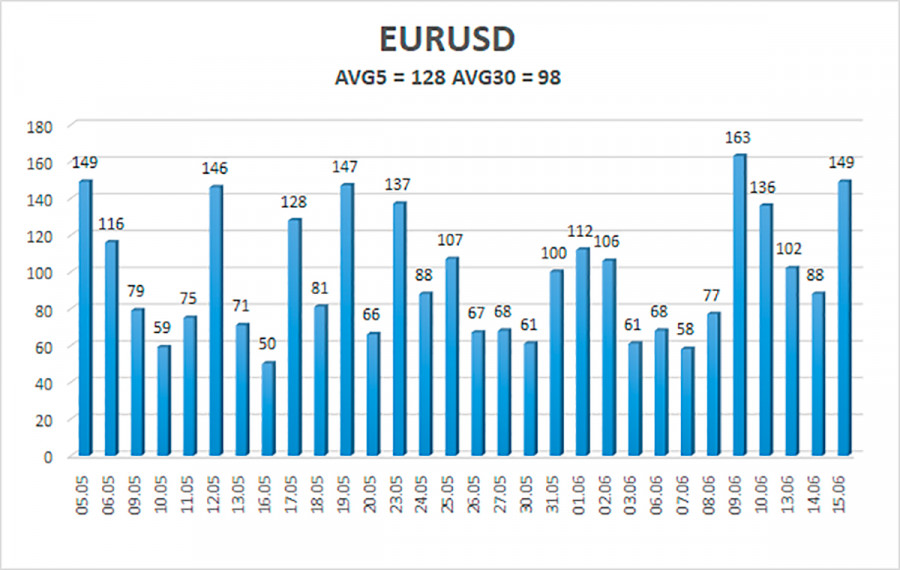

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 16 is 128 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0250 and 1.0506. The reversal of the Heiken Ashi indicator back up will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.0376

S2 – 1.0254

S3 – 1.0132

Nearest resistance levels:

R1 – 1.0498

R2 – 1.0620

R3 – 1.0742

Trading recommendations:

The EUR/USD pair continues to fall strongly and maintains a downward trend. Thus, it is now possible to stay in short positions with a target of 1.0254 until the Heiken Ashi indicator turns upwards. Long positions should be opened with a target of 1.0620 if the price is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.