The EUR/USD currency pair again traded higher on Wednesday, but this time, it didn't add just the usual 30–40 points, but more than 100. Some may say that yesterday can't be considered logical, nor can the pair's movement. After all, US inflation didn't just decrease by 1% in June, and it is already within arm's reach of the target level. Thus, the Federal Reserve may refuse one or even two rate hikes in 2023, previously discussed by almost half of the monetary committee. However, things are not quite like this.

The first question that everyone interested in the currency market should ask themselves is, "When has a deviation from the forecast by 0.1% triggered a 100-point reaction?" The market actively sold the dollar from the beginning of the week. Neither on Monday nor on Tuesday were there enough reasons for its fall. Nevertheless, the US currency was depreciating in anticipation of the inflation report. The forecast was fulfilled yesterday, but the dollar lost another 100 points.

Thus, we are again facing a situation where the market uses any excuse for new pair purchases. Weak statistics from the European Union? The euro will drop by 40 points. No macroeconomic background? The dollar will drop by 30-40 points. Does macroeconomics support the euro? The dollar will lose 100. Naturally, with such a one-sided interpretation of any publications and events, the US currency can fall forever, and experts will always find a reason why the dollar fell again today or yesterday. Nobody considers that the Fed also continues to raise the rate, that no one has officially refused two rate hikes yet, and that the ECB may also end the tightening cycle soon, as some representatives of the European regulator are already saying.

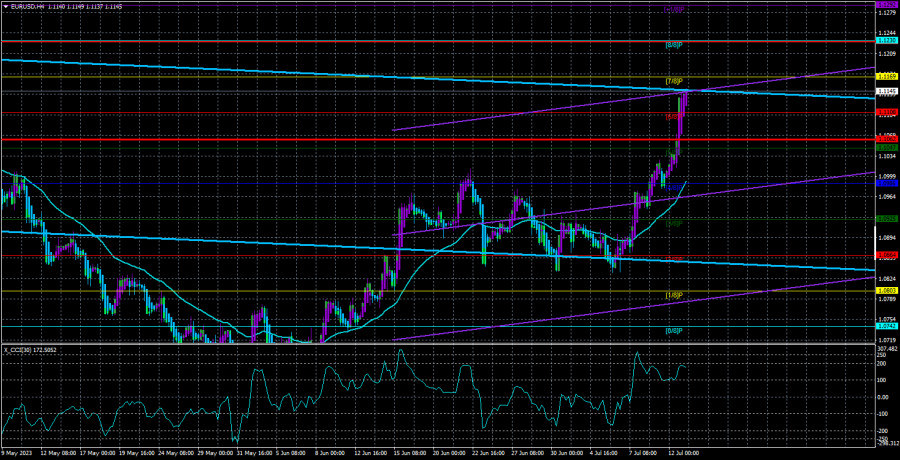

Therefore, the conclusion we can draw is the same as before. The pair has been consolidating in the 1.05-1.11 area for six months and couldn't correct downwards properly. A new phase of the upward trend has started, which may continue because traders are buying, not selling.

Core inflation remains around 5%

If you look at the report on core inflation, it becomes clear - it is also slowing down but remains at 4.8%. Thus, the main inflation can drop to 2%, but if the core remains high, the Fed needs to continue taking measures. Yesterday's slowdown in the Consumer Price Index does not affect the likelihood of a rate hike two times in 2023. The Fed has been openly suggesting that the end of the tightening cycle is near for the past few months. It can be assumed that the news about an additional two hikes was "unplanned-hawkish." However, the dollar derived no benefit from this information. Therefore, it doesn't matter how many times the Fed will raise the rate. What's the difference if the dollar has already fallen for ten months? And if it doesn't fall, it stays flat or within a limited price range.

Thus, the inflation report cannot be described as resonant or shocking. The deviation from the forecasts was minimal. The market is currently only set to buy, interpreting any news against the dollar. One must remember the weak statistics from the United Kingdom on Tuesday, which the British pound also managed to appreciate. A few days ago, the CCI indicator entered the overbought area, and nothing happened. Now a divergence is being formed with this indicator, and again, nothing is happening. Therefore, traders must understand the baselessness of the current movement, but no one forbids them to trade according to the trend. Just remember that this trend has almost no foundations.

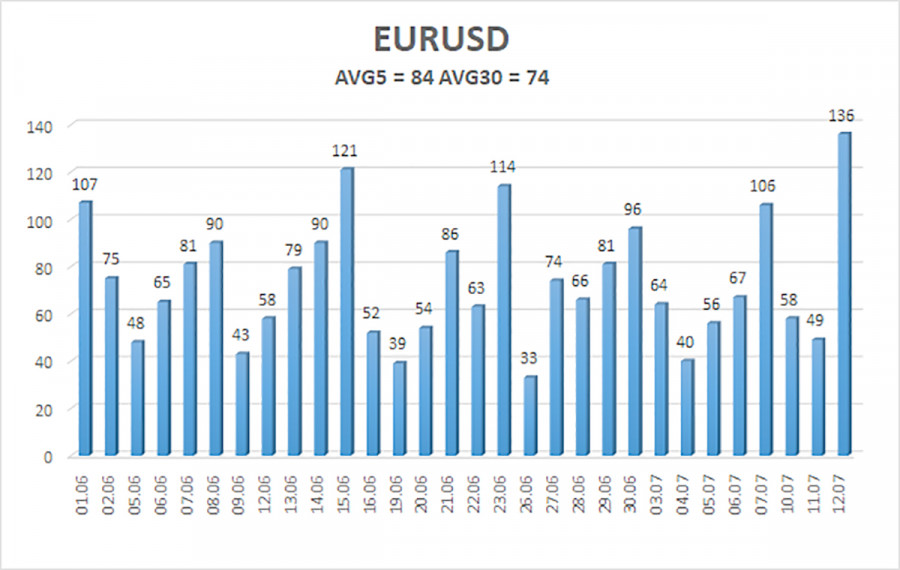

The average volatility of the EUR/USD currency pair for the last five trading days as of July 13 is 84 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.1062 and 1.1230 on Thursday. A downturn of the Heiken Ashi indicator will indicate a downward correction.

The nearest support levels:

S1 – 1.1108

S2 – 1.1047

S3 – 1.0986

The nearest resistance levels:

R1 – 1.1169

R2 – 1.1230

R3 – 1.1292

Trading recommendations:

The EUR/USD pair continues its practically vertical upward movement. It is possible to stay in long positions with targets of 1.1169 and 1.1230 until the Heiken Ashi indicator turns down. Short positions will become relevant by the price settles below the moving average line with targets of 1.0925 and 1.0864.

Explanations of illustrations:

Linear regression channels - help determine the current trend. If both are pointing in one direction, it means the trend is now strong.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI Indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.