The pound collapsed after the news that inflation in the UK rose to a new high recorded over the past four decades. However, then the pair compensated for all positions. In May of this year, after a significant increase in the cost of everything – from fuel to electricity and food – the Bank of England will now be much more difficult to deal with rampant price increases.

The report of the Office of National Statistics says: the consumer price index accelerated to 9.1% from 9% in April this year. Retail prices rose more than expected – up to 11.7%. There are also quite a few signs of an increase in inflationary pressure at the wholesale level. The key reason for the growth of the overall indicator was the cost of raw materials, which increased the most in the entire history of observations.

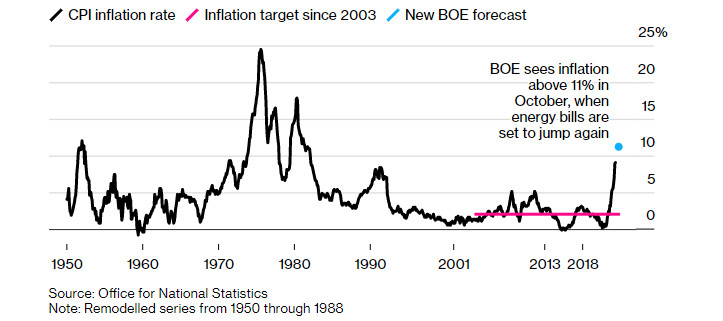

The observed figures once again underline the scale of the inflationary crisis in the UK, which has turned into a crisis in living standards. This year the situation will continue to deteriorate, as in the autumn households are waiting for another increase in utility tariffs. The Bank of England predicts that price growth will exceed 11% in October this year, which will be the peak value after which the recession should begin.

The data obtained opens up the possibility for the BOE of a larger increase in interest rates at the next meetings than 25 basis points, which is good for the pound. Sustained inflationary pressure needs more decisive action. Many economists expect inflation to accelerate in the coming months due to higher food and fuel prices.

As noted above, the main increase in the index was due to an increase in prices for food and soft drinks. Rising prices for electricity, gas, and other fuels, as well as used cars, have again made a rather significant contribution to the overall picture. Commodity prices jumped by 22.1%, which is much more than expected – the highest level since statistics were compiled in 1985. The cost of selling goods increased by 15.7% compared to last year, which is a full percentage point higher than expected – the highest since 1977.

Most recently, US Treasury Secretary Rishi Sunak said: "I know that people are concerned about the rising cost of living, so we have taken targeted actions to help families and normalize the situation. We use all the tools available in our arsenal to reduce inflation and combat price increases." Sunak also said that fiscal policy will be part of the solution to the problem, signaling that the government will keep wage settlements with public sector employees under strict control.

Let me remind you that one of the reasons for such a rapid rise in prices in the UK is the delayed demand after the coronavirus pandemic, as well as a sharp jump in household incomes due to a strong labor market. In normal times, this would be an undoubted plus for the economy, but now employers are fighting for qualified personnel and are forced to raise wages, which leads to an even greater inflationary jump and price increases.

The economy has already started to shrink, for the first time since the pandemic. Consumers, despite rising wages, are also seeing their incomes fall at the sharpest pace in two decades.

British Prime Minister Boris Johnson has already unveiled a package of measures to help offset the jump in electricity bills. On Tuesday, he also told his cabinet that the government supports the introduction of restrictions on the remuneration of public sector workers.

The British pound played back today's fall in the first half of the day and has already updated the local highs of the day in anticipation of a larger recovery after the speech of Federal Reserve Chairman Jerome Powell. However, it will be possible to talk about the resumption of the upward trend from June 14 only after the bulls gain a foothold above 1.2320, which will lead to an instant breakthrough at 1.2365 and 1.2400, where buyers will face much greater difficulties. In the case of a larger upward jerk of the pound, we can talk about the 1.2460 update. If the bears break below 1.2230 again, then the pound will go straight to 1.2165. Going beyond this range will lead to another downward movement already to the minimum of 1.2100, opening the way to 1.2030.

As for the prospects of the euro, the upward rebound that is observed after the update of the lows and the protection of the 1.0500 level inspires confidence. However, much will depend on Powell. It is possible to talk about serious purchases and attempts by bulls to correct the situation, but only after an obvious return and consolidation above 1.0540. Only after that, prospects for recovery in the 1.0600 and 1.0640 areas will open. In case of a decline in the euro, bulls need to show something around 1.0470, otherwise, the pressure on the trading instrument will only increase. Having missed 1.0470, you can say goodbye to hopes for the recovery of the pair, which will open a direct road to 1.0430. A breakthrough in this support level will certainly increase the pressure on the trading instrument, opening an opportunity for the test of 1.0380 and 1.0310.