When to open long positions on GBP/USD:

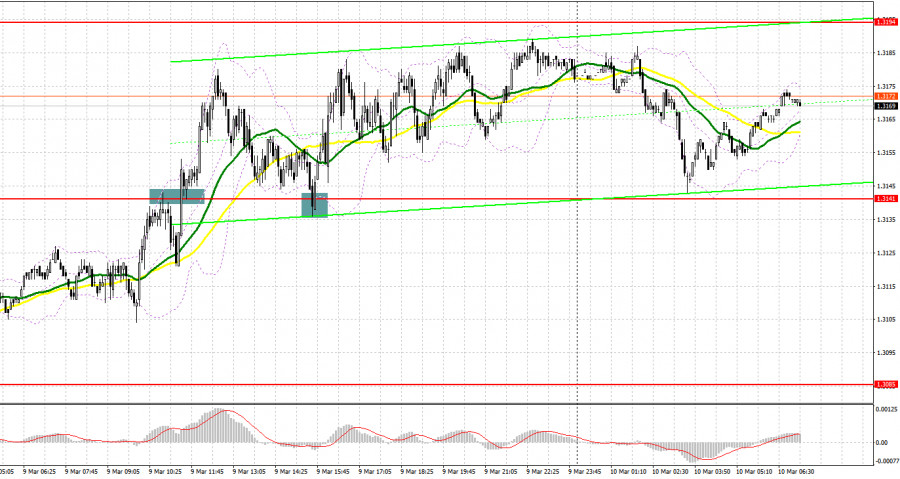

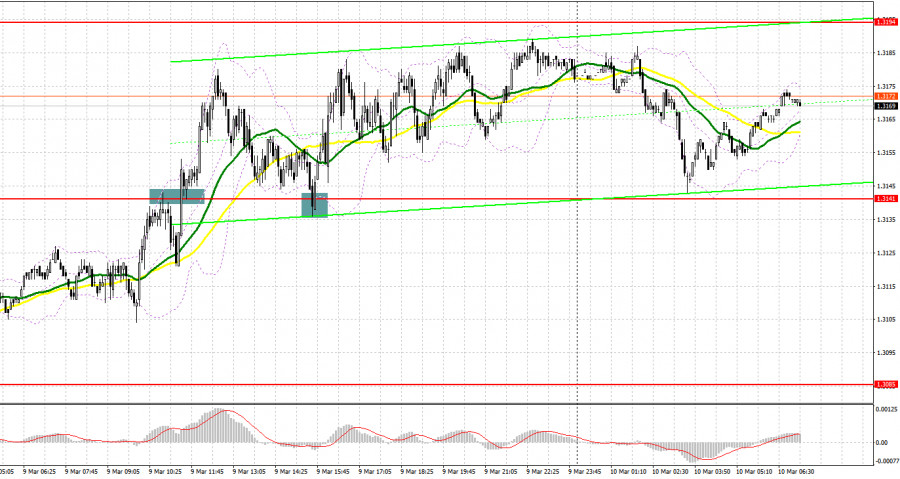

There were a few relatively profitable signals yesterday. Let's turn to the M5 chart and analyze them. In my previous analysis, I paid attention to the 1.3141 level and said you could consider entering the market from it. Bulls failed to consolidate above resistance at 1.3141, and a sell signal was produced. However, the pair did not show a strong downward move. After a 15 pips decrease, bullish activity increased, which led to a breakout and consolidation above 1.3141. Consequently, short positions had to be closed with minor losses. Traders were buying the pound due to the upward correction. The pair had risen 35 pips before pressure on the pound returned. In the second half of the day, bears tried to break below 1.3141, which resulted in another false breakout and a strong buy signal. Eventually, the pair advanced more than 40 pips.

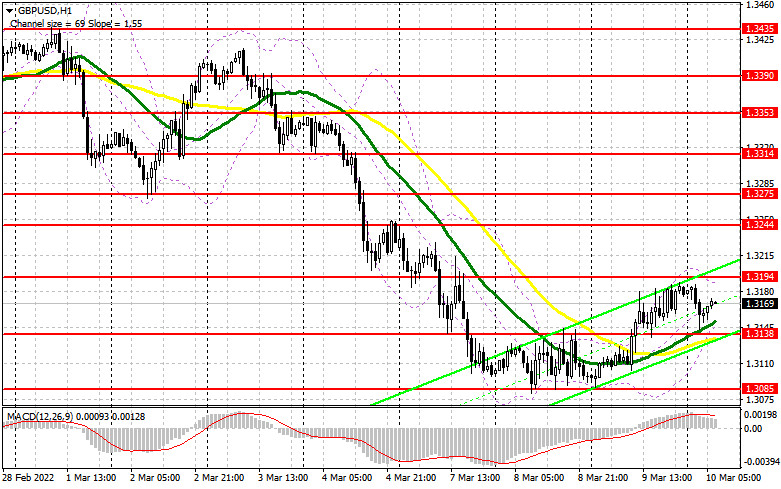

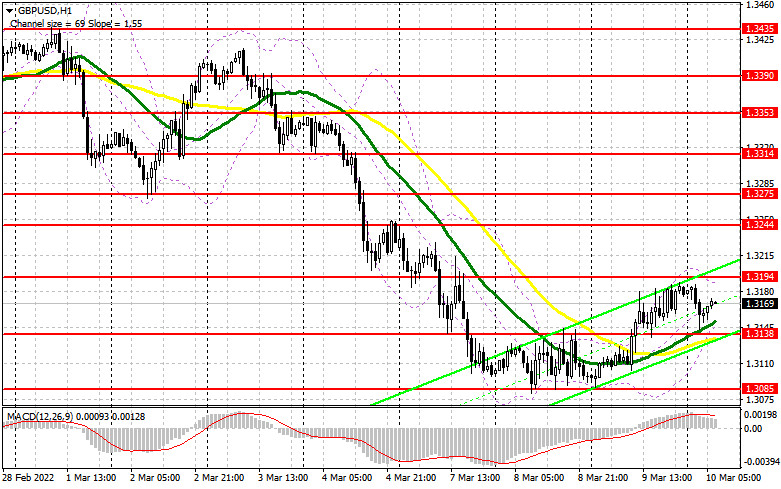

Although GBP bulls managed to leave the range of 1.3138, the pair stuck in a narrow sideways channel, which means the downtrend may soon resume. The market is focused on today's US inflation report. Meanwhile, the pound's downside potential is limited ahead of a possible rate hike by the Bank of England. Continuing inflation in the UK is a major headache for the country right now. Demand for the pound will increase if the regulator hikes rates. Since no macro events are expected, you should pay attention to technical levels today. Bulls will try to protect the 1.3138 support level during the European session. The bullish moving averages are also located there. Long positions could be considered from this level after the formation of a false breakout since they will be entered against the bear market. In such a case, the pair will return to support at 1.3194. Yesterday, the pair failed to break above it. A breakout and a retest of this mark from top to bottom will trigger the stop orders of sellers, allowing bulls to increase the volume of long positions. The 1.3244 mark will serve as a target. The bear trend that dominated the market since early February will slow down if the pair reaches resistance at 1.3275. You should consider taking a profit there. In the event of a fall during the European session and a decrease in bullish activity at 1.3138, it will become possible to go long when the price reaches support at 1.3085 and only if there is a false breakout. Long positions on GBP/USD could be entered immediately on a rebound from 1.3034 or the 1.2976 low, allowing a 20-25 pips correction intraday.

When to open short positions on GBP/USD:

Bears have loosened their grip of the market. However, the situation may reverse after the release of the inflation rate in the US. Yesterday's attempt of bears to return to the market in the second half of the day failed. Nevertheless, they managed to protect 1.3194, which only confirmed the presence of major players. A fall in the pound may resume at any time amid geopolitical developments in Ukraine. Bears will try to protect support at 1.3138 and another important level of 1.3194. A false breakout at 1.3194 will produce the first sell signal with the target at 1.3138, which plays the key role for the bear trend. Pressure on the pound will increase in case of a breakout and a retest of this range. Consequently, the bear trend will resume, and a sell entry point will form with the target at the 1.3085 low. If geopolitical tensions escalate further, the pair may head towards 1.3034 and 1.2976, where you should consider taking a profit. In the event of a rise during the European session and a decrease in bearish activity at 1.3194, it would be wise to go short as soon as the price reaches 1.3244 and only if there is a false breakout. Short positions on GBP/USD could be entered immediately on a bounce from 1.3275 or the 1.3314 high, allowing a 20-25 pips correction intraday.

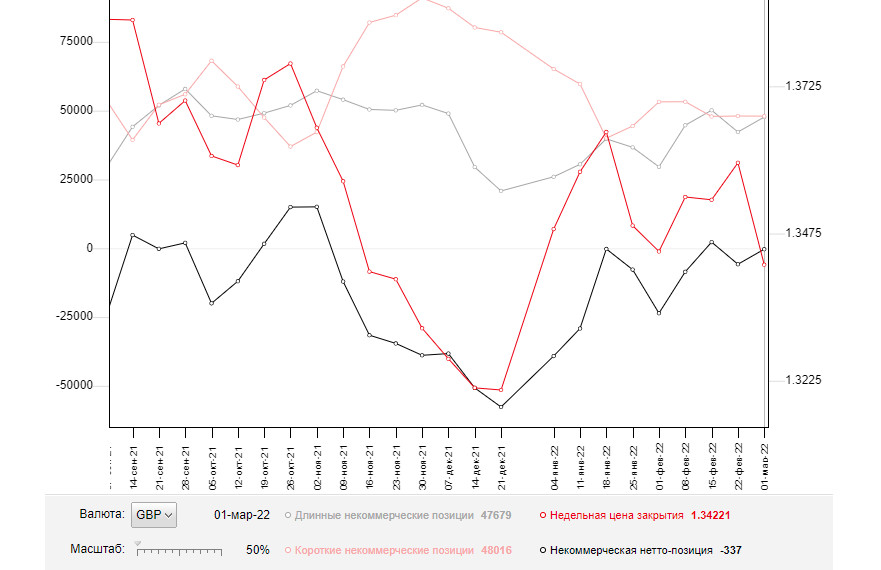

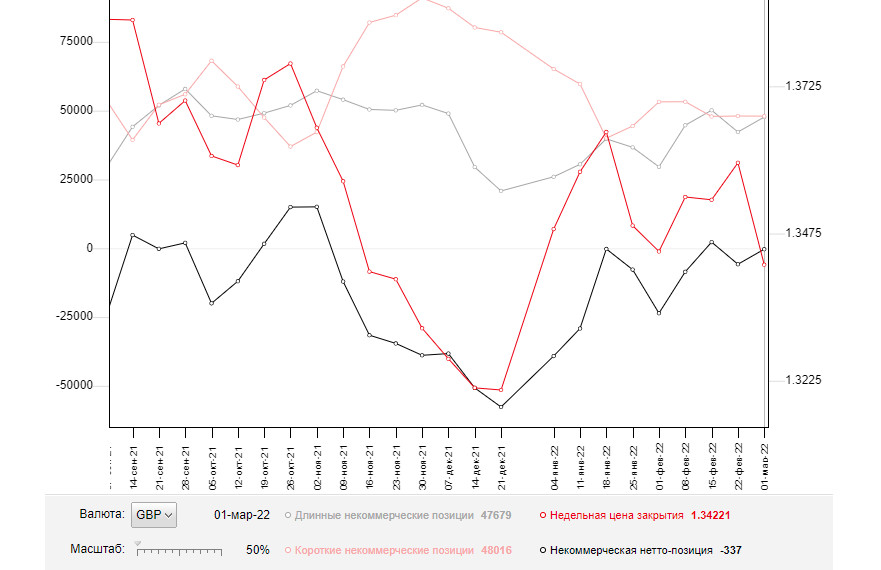

The Commitments of Traders report for March 1 logged a sharp rise in long positions and a fall in short ones. The negative delta increased almost to the zero level. However, it is important to understand that such reports are now of secondary importance. The situation in the market changes almost every day. The market experiences fluctuations of 100-200 pips due to the ongoing geopolitical conflict. The report is highly likely to reveal a significant increase in short positions next week. Therefore, you should pay less attention to the current results. Neither the Bank of England's nor the Federal Reserve's stance on monetary policy will matter if the armed conflict gets more tense. Russia and Ukraine have agreed to hold peace talks. A lot will depend on the outcome of these meetings. At the same time, it is clear that high inflation in the UK will urge the BoE to adopt a more aggressive stance on monetary policy. Due to a slowdown in economic growth and retaliatory sanctions from Russia, the regulator is unlikely to go for a sharper increase in interest rates, which should be done because consumer incomes will plummet otherwise. The COT report for March 1 revealed a rise in long non-commercial positions to 47,679 versus 42,249 and a drop in short non-commercial positions to 48,016 from 48,058. The total weekly non-commercial net position increased to -337 versus -5,809. The weekly closing price fell to 1.3422 from 1.3592.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, indicating a possible correction.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The lower band at 1.3138 stands as support. Resistance is seen at 1.3194, in line with the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.