To open long positions on GBP/USD, you need:

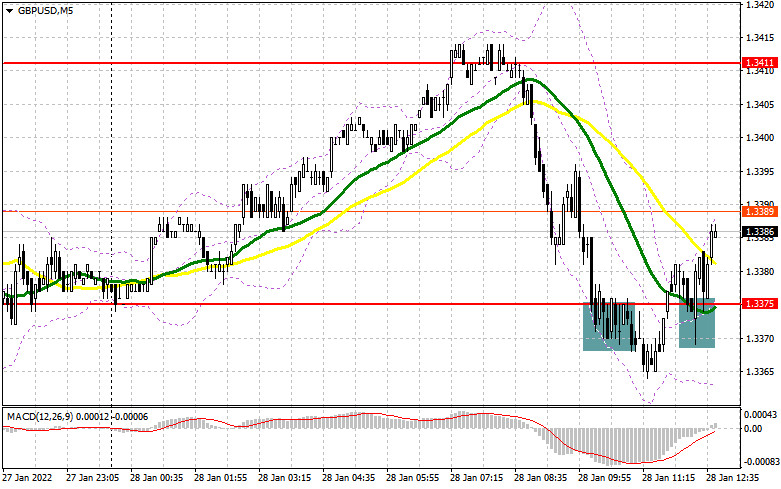

In my morning forecast, I paid attention to the level of 1.3375 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. Given that the bears were no longer in full control of the situation after yesterday's attempt to sell the pound, the correction at the end of the day spoiled their plans, the bulls managed to gather in the first half of the day and defended the level of 1.3375. Several false breakouts in this range gave excellent signals to buy the pound, but it has not yet reached a major upward correction. And what were the entry points for the euro this morning?

The whole focus will now shift to data on the American economy. If they coincide with economists' forecasts, we can expect an upward correction of the pound and growth in the resistance area of 1.3411. From a technical point of view, nothing has changed for the second half of the day, so I recommend acting according to the morning scenario.

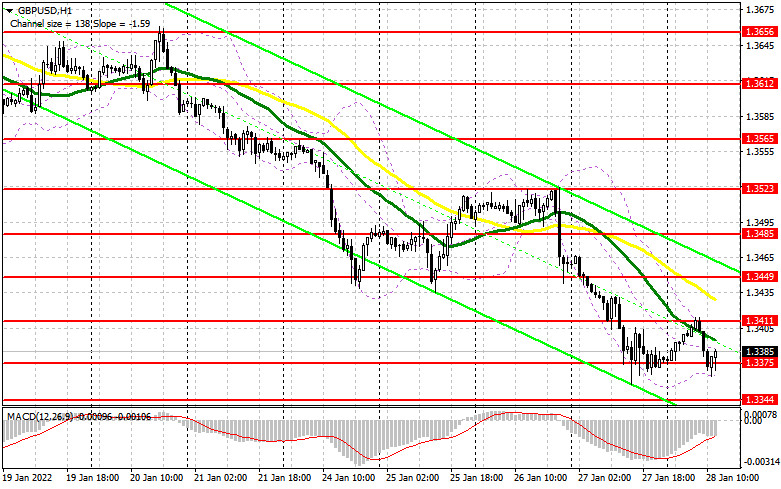

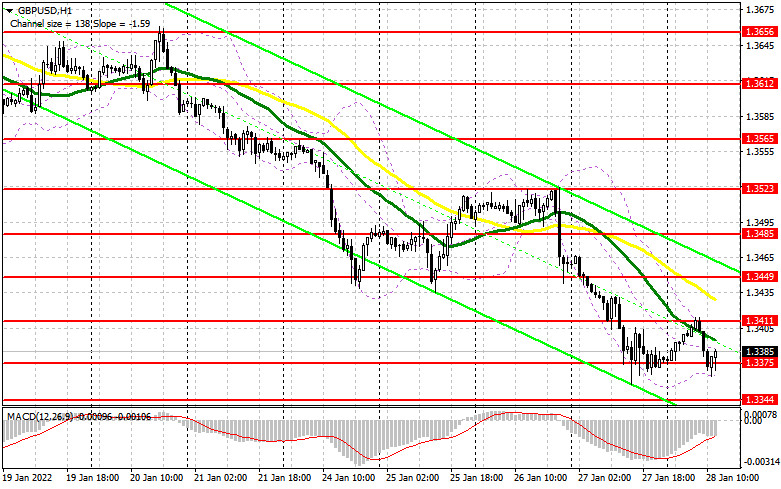

An important task of the bulls remains to protect the support of 1.3375, to which the pair can certainly return after the release of data on the income and expenses of Americans. Therefore, it is so important to form another false breakout at 1.3375, which will confirm the presence of large players in the market, counting on a correction for the pound at the end of the week. Only this forms another entry point into long trend positions. An equally important task will be a breakdown and a test of 1.3411 from top to bottom, which will give an additional entry point to return to 1.3449, where the moving averages are playing on the sellers' side. A more difficult task will be to update the 1.3485 area, which will be possible only in the case of very weak statistics for the US in the afternoon. I recommend fixing profits there.

Under the scenario of a decline in GBP/USD during the US session and a lack of activity at 1.3375, and judging by the fact that this will be the third test of the level for the day, it is better not to rush with purchases of risky assets. I advise you to wait for the update of the next major level 1.3344 and only the formation of a false breakdown there will give an entry point to long positions. You can buy the pound immediately on a rebound from 1.3322, or even lower - from a minimum of 1.3301, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

Sellers tried to prove their presence in the market, but they failed to gain a foothold below 1.3375 – a bad signal for those who are counting on the next local lows at the end of the week. Now the primary task for today remains the protection of the 1.3411 level, just above which the moving averages playing on the side of the bears pass. Only the formation of a false breakdown at 1.3411 and strong statistics on the index of personal consumption expenditures, the consumer sentiment index, and the index of inflation expectations from the University of Michigan form an entry point into short positions, followed by a decline in the pair to the area of 1.3375. A breakdown and a test of this area from the bottom up will give an additional entry point into short positions based on the decline of GBP/USD by 1.3344 and 1.3322, where I recommend fixing the profits.

If the pair grows during the American session and sellers are weak at 1.3411, it is best to postpone sales until the next major resistance at 1.3449. I also advise you to open short positions there only in case of a false breakdown. You can sell GBP/USD immediately for a rebound from 1.3485, or even higher - from this month's maximum in the area of 1.3523, counting on the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for January 18 recorded an increase in long positions and a reduction in short positions - which indicates the continued preservation of the attractiveness of the pound after the Bank of England raised interest rates at the end of last year. Expectations have increased quite seriously that at its next meeting, the regulator may again resort to another increase in interest rates by 0.25 points, which will only strengthen the pound's position. However, the observed fundamental picture creates several more serious moments that limit the upward potential. First of all, we are talking about inflation, which is "eating up" everything that the UK labor market can offer at the moment with cosmic speed. Despite high wages and falling unemployment, high inflation leaves nothing from household incomes, and high prices for energy and other services make their well-being even lower than the level that was observed during the coronavirus pandemic. If you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it more attractive. In any case, the Bank of England's decision to raise interest rates further this year will push the pound to new highs. It is worth recalling that this week everyone is waiting for the results of the meeting of the open market committee, at which a decision on monetary policy will be made. Some traders expect that the US central bank may decide to raise interest rates already during the January meeting, without postponing this issue until March. A reduction in the Fed's balance sheet will also be announced. The COT report for January 18 indicated that long non-commercial positions increased from the level of 30,506 to the level of 39,760, while short non-commercial positions decreased from the level of 59,672 to the level of 40,007. This led to a change in the negative non-commercial net position from -29,166 to -247. The weekly closing price rose from 1.3579 to 1.3647.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates a further decline in the pound trend.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the average border of the indicator in the area of 1.3411 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.