To open long positions on GBP/USD, you need:

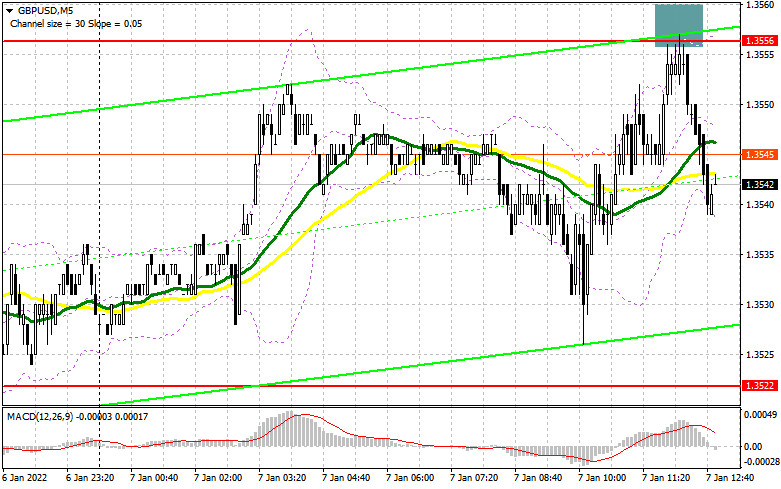

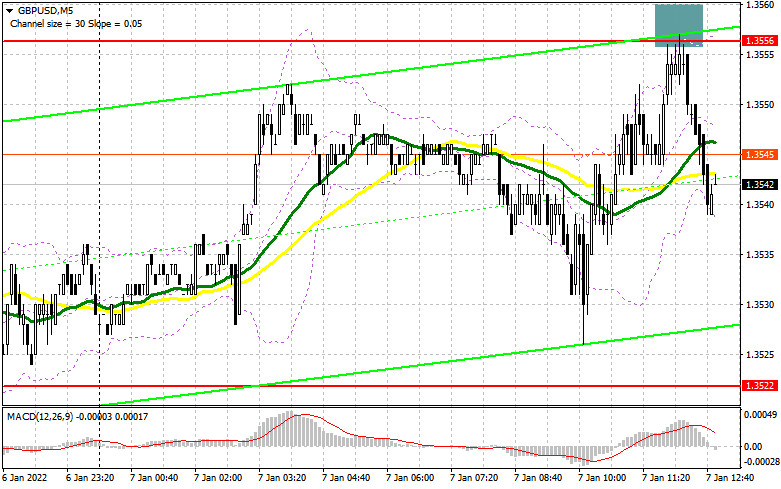

In my morning forecast, I paid attention to the level of 1.3556 and recommended making decisions on entering the market. Let's take a look at the 5-minute chart and figure out the entry points. Today's attempts by bulls to gain a foothold at new highs have not been successful. The formation of a false breakdown at the level of 1.3556 led to the formation of a sell signal for the British pound, which is still valid at the time of writing. Most likely, traders will focus on today's data on the American labor market, so much will depend on them. The technical picture has not changed in any way for the second half of the day. And what were the entry points for the euro this morning? And what were the entry points for the euro this morning?

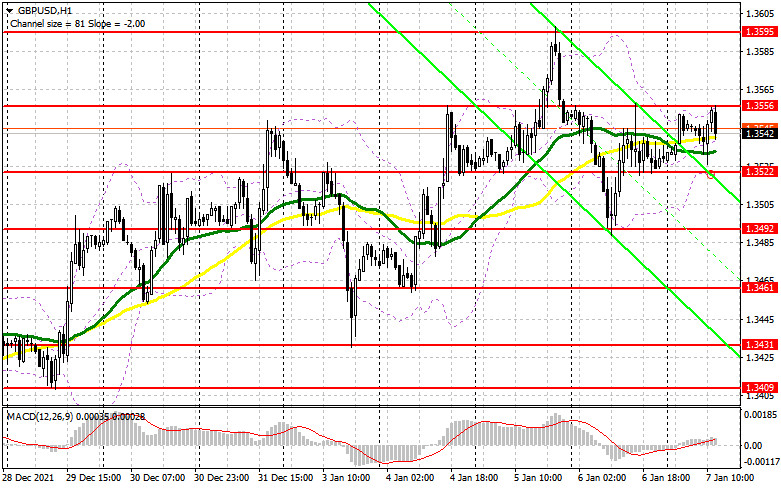

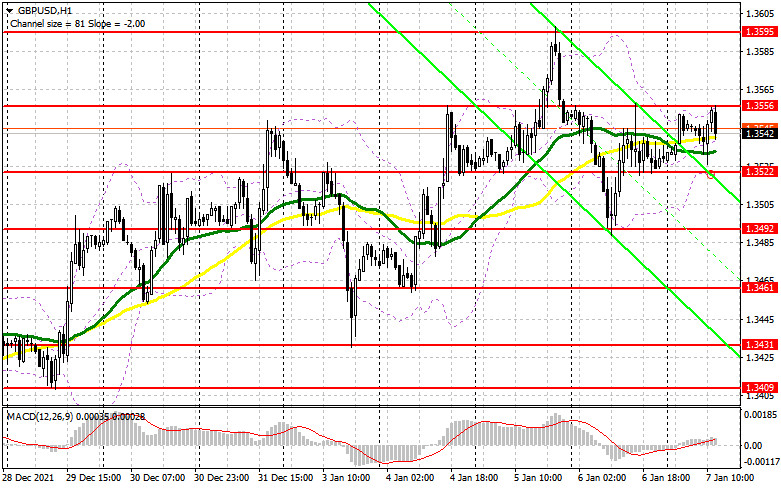

The primary task of buyers for today remains to protect the support of 1.3522, which was formed following the results of yesterday. This level is a kind of middle of the side channel in which the pound has been since the middle of this week. Weak data on changes in the number of people employed in the non-agricultural sector in the US will have a serious impact on the pair, which may return demand for the British pound. The formation of a false breakdown at 1.3522 forms a good buy signal with the prospect of the continued growth of GBP/USD, aimed at a breakthrough of 1.3556, which was not possible today. A breakdown and test of this level from top to bottom will give an additional entry point and strengthen the position of buyers to continue building a bullish trend and update the highs: 1.3595 and 1.3649. A more distant target will be the 1.3694 area, where I recommend fixing the profits. In the scenario of a decline in the pound during the US session and a lack of activity at 1.3522, it is best to postpone purchases to the level of 1.3492. Only the formation of a false breakdown there will give an entry point in the expectation of maintaining bullish momentum. You can buy GBP/USD immediately on a rebound from 1.3461 or even lower - from a minimum of 1.3431, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

The bears again defended the level of 1.3556, and while trading will be conducted below this range, we can count on a larger drop in the pair. However, as noted above, much will be the envy of the data on the American economy. Protection of 1.3556 remains the primary task today, as a repeated exit above this range will create several technical problems. The formation of a false breakdown at this level forms another entry point into short positions, followed by a decline in the pair to the area of 1.3522, for which you will have to fight hard. A breakdown of 1.3522 and a reverse test from the bottom up will increase the pressure on the pound and dump it to the next support of 1.3492, formed by the results of yesterday. Only the consolidation and the reverse test of 1.3492 from the bottom up will give a new entry point into short positions with the prospect of a decline in GBP/USD already to 1.3461 and 1.3431, where I recommend fixing the profits. However, such a scenario is possible only in the case of very good data on changes in the number of people employed in the US non-agricultural sector. If the pair grows during the American session and sellers are weak at 1.3556, it is best to postpone sales to a larger resistance of 1.3595. I also advise you to open short positions there only in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from a large resistance of 1.3649 or even higher - from a new maximum in the area of 1.3694, counting on the pair's rebound down by 20-25 points inside the day.

In the COT reports (Commitment of Traders) for December 28, a reduction in both short and long positions was recorded. Considering that long positions have shrunk much more, this has only increased the negative value of the delta. The data take into account the meeting of the Federal Reserve System and the Bank of England, however, we remember that the pound declined strongly after the rapid growth that occurred due to the increase in interest rates. If you look at the overall picture, the prospects for the British pound look pretty good. The Bank of England's decision to raise interest rates continues to fuel the markets with new buyers, and a more aggressive policy of the regulator next year will certainly strengthen the bullish trend for the GBPUSD pair. High inflation remains the main reason why the Bank of England will continue to raise interest rates. On the other hand, the US dollar also has support: The Federal Reserve system plans to raise interest rates in the spring of next year, which makes the US dollar more attractive. The COT report for December 21 indicated that long non-commercial positions fell from the level of 29,497 to the level of 20,824, while short non-commercial positions fell from the level of 80,245 to the level of 78,510. This led to an increase in the negative non-commercial net position from -50,748 to -57,686. The weekly closing price has hardly changed: 1.3209 versus 1.3213 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates the lateral nature of the market before important data.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline in the pair, the average border of the indicator around 1.3522 will act as support. A breakthrough of the upper limit of the indicator in the area of 1.3556 will lead to a new wave of growth of the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.