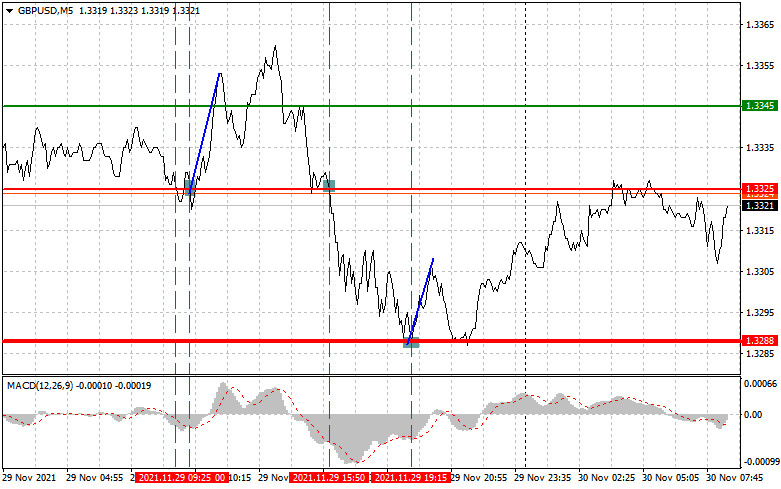

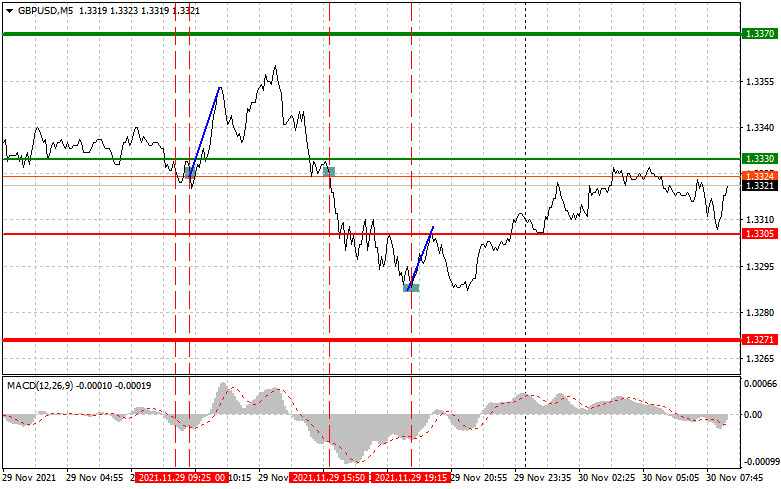

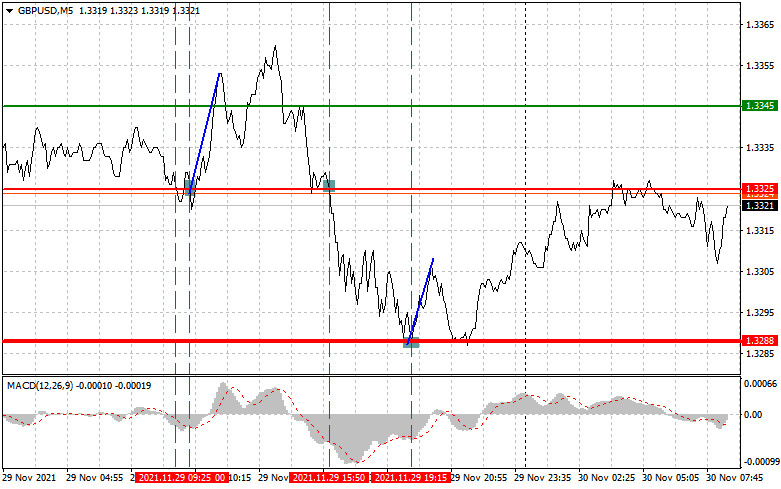

Analysis of transactions in the GBP/USD pair

There was a fairly large number of signals to enter the market yesterday. The first entry points were formed at the very beginning of the day. The first test of the 1.3325 level occurred when the MACD indicator had already fallen a lot from the zero mark, which limited the pair's downward potential. Therefore, it remained only to wait for the implementation of the second scenario, which happened. A repeat test of 1.3325 after a short period of time occurred at a time when the MACD indicator is in the oversold area, which led to the formation of a buy signal. The growth was about 30 points.

A similar situation occurred in the afternoon with the price test of 1.3325, but then the growth of the pound did not take place, which led to the fixation of losses. At the end of the day, an excellent point was formed to buy the pound at the level of 1.3288, which we paid attention to in the forecast yesterday. The growth was about 20 points.

Today, there are also no important statistics, so buyers will most likely try to rectify the situation after yesterday's decline in the pound in the afternoon. If they fail to break above the level of 1.3330 quickly, the pressure on the trading instrument will return and the entire calculation will already be in the afternoon when a number of US economic statistics are released. It is necessary to familiarize yourself with the US consumer confidence indicator, according to which a decrease in the indicator is expected. If the data disappoint traders, the pressure on the US dollar will increase. It will also be interesting to hear what Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen will tell us. It is expected that the Federal Reserve System will resort to tightening policy and begin to more aggressively curtail the bond purchase program – a bullish signal for the US dollar.

For long positions:

Buying the pound can be considered today when it reaches the entry point around the level of 1.3330 (green line on the chart) with the aim of rising to the level of 1.3386 (thicker green line on the chart). In the area of 1.3370, it is recommended to exit purchases and open sales in the opposite direction (counting on a movement of 15-20 points in the opposite direction from the level). It is possible to expect growth only in the first half of the day and then, with the aim of a small upward correction for the pair. It is important to note that before buying, make sure that the MACD indicator is above the zero mark and is just beginning its growth.

It is also possible to buy the pound today if the price reaches the level of 1.3305, but at this moment the MACD indicator should be in the oversold area, which will limit the pair's downward potential and lead to an upward reversal of the market. We can expect growth to the opposite levels of 1.3330 and 1.3370.

For short positions:

Selling the pound can be considered today only after updating the level of 1.3305 (the red line on the chart), which will lead to a rapid decline of the pair. The key target of sellers will be the 1.3271 level, where it is recommended to exit sales and immediately open purchases in the opposite direction (counting on a movement of 15-20 points in the opposite direction from the level). It is best to sell the pair on growth since the trend is still downward. It is important to note that before selling, make sure that the MACD indicator is below the zero mark and is just beginning its decline.

It is also possible to sell the pound today if the price reaches the level of 1.3330, but at this moment the MACD indicator should be in the overbought area, which will limit the upward potential of the pair and lead to a downward reversal of the market. We can expect a decline to the opposite levels of 1.3305 and 1.3271.

What's on the chart:

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price since the quote is unlikely to move below this level.

MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember, a clear trading plan is needed for successful trading. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.