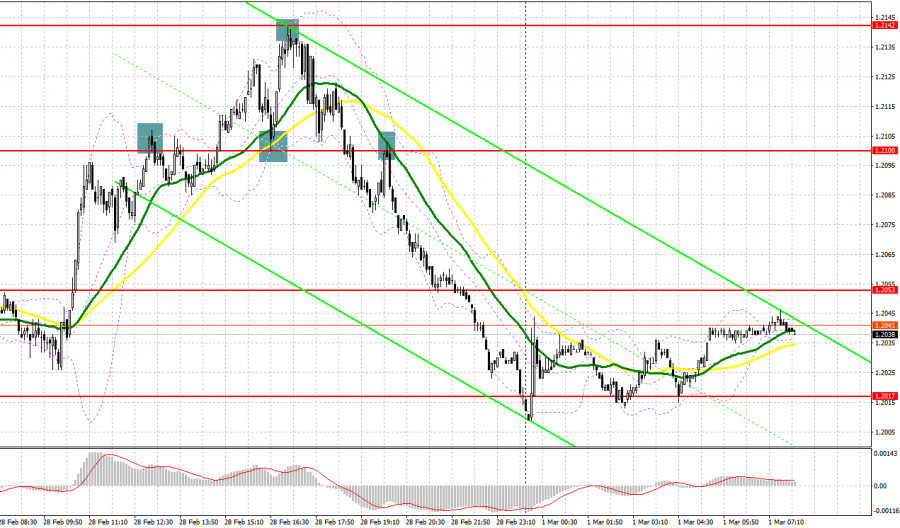

A lot of trading signals were made yesterday. Let's look at the M5 chart to get a picture of what happened. In the previous review, I focused on the 1.2066 level and considered entering the market there. A breakout and a downside retest created a buy entry point. The quote rose by 35 pips. A false breakout through 1.2100 in the North American session produced a sell entry point. The price dropped by 10 pips. Demand for GBP increased. Eventually, a breakout and a downside retest at 1.2100 along with growth by about 40 pips brought a profit of some 40 pips. Selling on a bounce off 1.2142 brought another 40 pips of profit. At the close of the trading day, a breakout and a retest at 1.2142 created a sell entry point, and the pair plunged by 85 pips.

When to open long positions on GBP/USD:

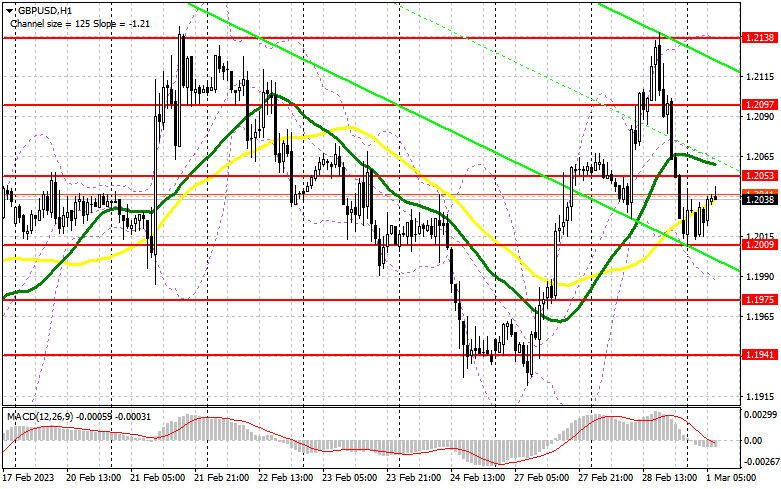

A series of important macro releases able to affect the price of GBP/USD is scheduled for today, including the UK's manufacturing PMI, mortgage approvals, and net lending to individuals. Governor Andrew Bailey's speech will perhaps be the central event of the day as he may shed some light on the future of interest rates in the UK. If the pair is under pressure in the European session, which is highly likely, the bulls should protect the 1.2009 level. A drop and a false breakout through the mark will make an additional signal to buy, allowing a bullish correction toward the 1.2053 intermediate resistance, which is near the moving averages. In case of consolidation and a downside retest, GBP/USD will head toward the 1.2097 high. Above it, there stands another target at 1.2138 where I am going to lock in profits. If the bulls lose their grip on 1.2009 in the European session, yesterday's downward move will continue, the bears will get more aggressive, and GBP/USD will face intense pressure. Eventually, the bear trend will resume. The trading plan will be to buy after a false breakout through support at 1.1975 or after a rebound from the 1.1941 low, allowing a correction of 30 to 35 pips intraday.

When to open short positions on GBP/USD:

To extend the downtrend, the bears should protect the nearest resistance at 1.2053 and regain control over support at 1.2009. Growth and a false breakout through 1.2053 in the European session after the release of macro statistics will make a sell signal, pushing GBP/USD toward support at 1.2008. A breakout and a retest of the mark after Governor Bailey's speech will discontinue a correction, and bearish sentiment will increase. A sell signal will be generated, targeting 1.1975. The most distant target is seen at 1.1941 where I am going to lock in profits. If GBP/USD goes up and there are no bears at 1.2053, the bullish activity will increase. The bears will lose their grip on the market. A false breakout through the 1.2097 resistance level will create a sell entry point. If there is no trading activity there as well, I am going to sell GBP/USD on a bounce off the 1.2138 high, allowing a bearish correction of 30 to 35 pips intraday.

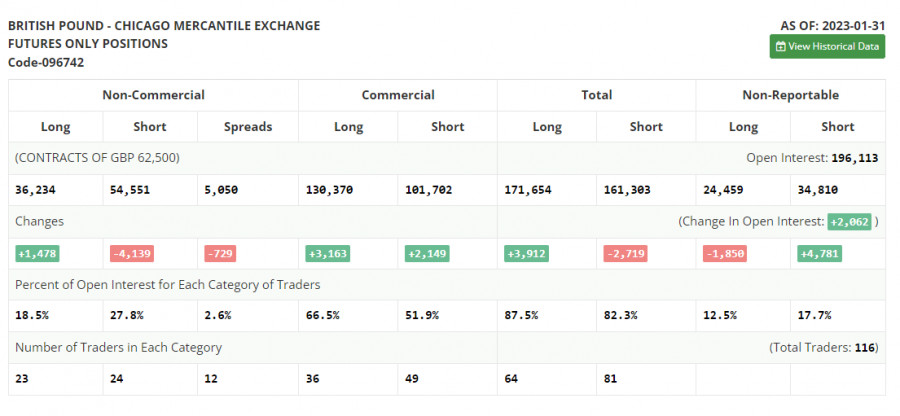

Commitments of Traders:

The COT report for January 31 logged a rise in long positions and a drop in short ones. Clearly, traders bet on the hawkish Bank of England when deciding to leave the market ahead of the meeting. In fact, COT data from a month ago is of little interest at this point as it is irrelevant due to the technical glitch the CFTC recently suffered. Therefore, we will have to wait for fresh COT data. This week, there will be no interesting macro events in the United States. Therefore, the pressure on risk assets may ease somewhat. In theory, this could trigger a bullish correction in GBP/USD. According to the COT report, long non-commercial positions increased by 1,478 to 36,234. Short non-commercial positions dropped by 4,139 to 54,551. Consequently, the non-commercial net position came in at -18,317 versus -23,934. The weekly closing price fell to 1.2333 from 1.2350.

Indicator signals:

Moving averages

Trading is carried out near the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.2138, in line with the upper band. Support stands at 1.1990, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.