Bitcoin and Ether are gradually returning to February highs as interest in risky assets grows and geopolitical tensions decrease. The upward correction of the US stock market also has a positive effect on investor sentiment.

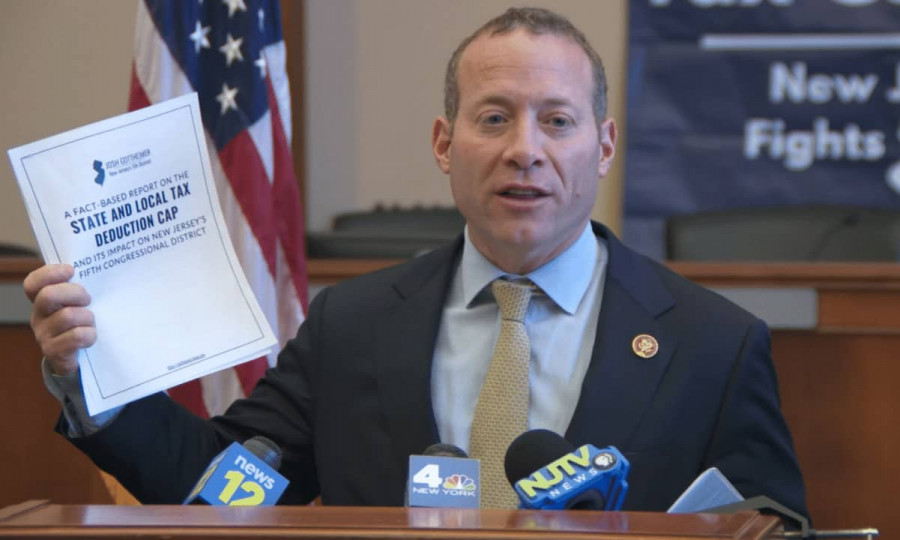

But an interesting news emerged yesterday, partly related to the development and regulation of digital assets in the US. Member of the US House of Representatives Josh Gotteimer introduced a stablecoin insurance bill, which will allow it to be exchanged for US dollars in a ratio of one to one.

Interestingly, the bill will allow banks and non-banking financial institutions to issue stablecoins in the US, but this will have certain requirements. One of them is the need for cash-backed reserves to be held in a designated segregated account insured by the Federal Deposit Insurance Corporation (FDIC). The Fed will also oversee stablecoin issuers and issue regulations related to leverage ratio, audit requirements, anti-money laundering compliance, and so on.

Such measures will help protect investors from various kinds of scammers who can take advantage of crude legislation in the field of digital assets. Insurance will also create a series of obstacles for companies that do not have enough free funds, thereby weeding out small players trying to catch on to the rapidly developing digital asset market.

On a different note, BlockFi is reportedly willing to pay $100 million to settle allegations by the US Securities and Exchange Commission (SEC) that it illegally offered a product in which customers received fairly high interest rates for transferring their digital tokens. According to experts, the fine will be one of the most severe imposed on a crypto company. The SEC also wants to find out if the services offered by BlockFi fall under the definition of securities that must be registered with the relevant regulatory authorities.

BlockFi operates under the sector's standard DeFi scheme, where crypto lenders who have deposited tens of billions of dollars are promised returns far in excess of those available through traditional savings accounts as a thank you for providing liquidity. But as part of the agreement with regulators, BlockFi will no longer be able to open new accounts for most Americans.

"We have been in productive ongoing dialogue with regulators at the federal and state level. We do not comment on market rumors," said BlockFi spokeswoman Madeleine McHugh. "We can confirm that clients' assets are safeguarded on the BlockFi platform and BlockFi Interest Account clients will continue to earn crypto interest as they always have."

Recently, SEC Chairman Gary Gensler criticized the DeFi sector, arguing that some companies offer financial services without adhering to the benchmark investor protection rules that banks, brokers and other financial institutions in the industry have long followed.

BlockFi will pay a $50 million fine to the SEC and another $50 million to various states.

Technical analysis for Bitcoin

A lot depends on $45,350 because a breakout will lead to a further rise to $48,554 and $51,810. Meanwhile, a dip below the level will result in a fall to $41,750, $39,120 and $36,090.

Some experts believe that $33,000 was the bottom of Bitcoin, and now there is much more asymmetry in favor of growth than a decline. In the medium term, there are other encouraging signs that the downtrend observed since the fall of last year has ended. A pullback above the 50-day moving average is a bullish signal, but in order to finally put all the dots, Bitcoin needs to go beyond the 200-day average, which is still very far away.

Technical analysis for Ethereum

A lot depends on $3,100 because a breakout will lead to a further increase to $3,362, $3,562 and $3,887. Meanwhile, a fall below this level will result in a dip to $2,620.