To open long positions on GBP/USD, you need:

There were no signals to enter the market last Friday. Let's take a look at the 5 minute chart and see what happened. The low trading volume amid the Christmas holidays had affected the volatility of the British pound, and for this reason we did not reach the levels I indicated. Accordingly, we did not see any signals for opening deals either. From a technical point of view, only the nearest support and resistance levels have changed today - the strategy remains the same.

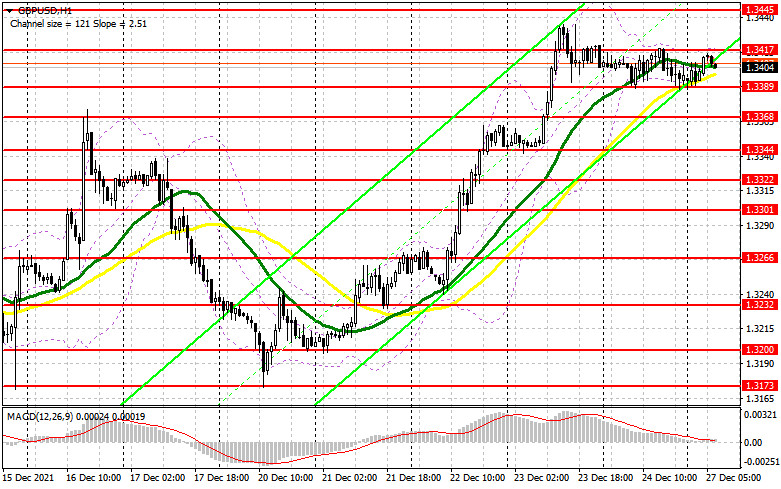

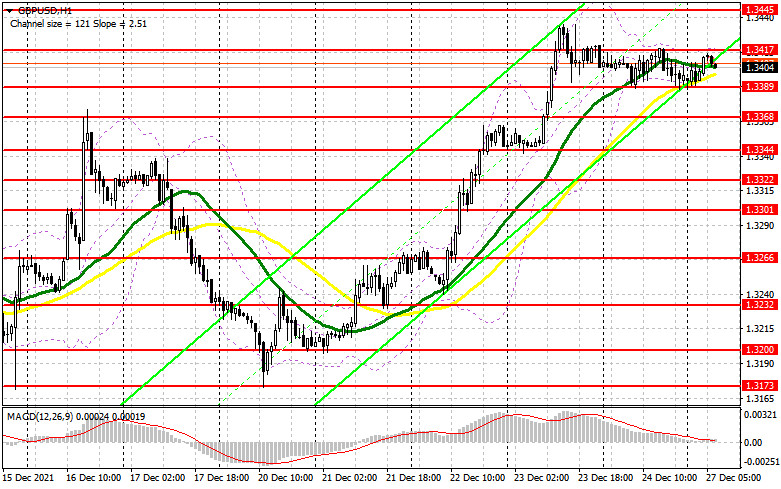

Today we do not have any fundamental statistics for the UK and many markets will continue to be closed after Christmas, or will work in a shortened session. The bulls' primary task for today is to protect the support at 1.3389. This level is very important, as its breakdown could force traders to take profits at the end of the year, which will form a more powerful fall in the pound. Only the formation of a false breakout at 1.3389 will lead to the formation of a signal to buy GBP/USD with the prospect of a continuation of the bull market aimed at breaking through the resistance of 1.3417, formed at the end of last Friday. A breakdown and test of this level from top to bottom will provide an additional entry point and strengthen the bulls' positions in order to build a new bullish trend and renew the highs: 1.3445 and 1.3472. In case the pound falls during the European session and traders are not active at 1.3389, and growth after a false breakout should be quite rapid, it is best to postpone long positions to the level of 1.3368. Only the formation of a false breakout there will give an entry point to buy the pound, counting on the preservation of the bullish momentum. It is possible to buy GBP/USD immediately on a rebound in the area of 1.3344, or even lower - from a low like 1.3322, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The bears are still looking closely at the market and are not particularly active on it, even despite the low trading volume. However, we should expect more aggressive actions in the absence of bulls at 1.3389. But the first priority is to protect the resistance at 1.3417. The formation of a false breakout at this level creates the first entry point into short positions with a subsequent decline in the pair to the 1.3389 area, which will have to be fought for. A breakdown of 1.3389 and a reverse test from the bottom up will increase the pressure by the pound and bring it down to the next support at 1.3368. Moving below this level will also be difficult given the low trading volume and low volatility expected throughout the day. A consolidation and the reverse test of 1.3368 from the bottom up will provide a new entry point into short positions with the prospect of a decline to 1.3344, where I recommend taking profits. In case the pair grows during the European session and the bears are not active at 1.3417, it is best to postpone selling until the larger resistance at 1.3445. I also recommend opening short positions there only in case of a false breakout. Selling GBP/USD immediately on a rebound is possible from a large resistance at 1.3472, or even higher - from a new high in the 1.3506 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) report for December 14 revealed that both short and long positions decreased. Considering that long positions nearly halved, this led to major changes in the negative delta. At the same time, it should be noted that this data does not include the outcome of the meetings of the US Federal Reserve and the Bank of England. As a whole, the outlook for the British pound is rather gloomy. Following the Bank of England's decision to raise interest rates, the pair rallied. However, the very next day, it faced a sell-off. As a result, many market participants hoping for the end of the bearish trend were out of the market. The US dollar will most likely enjoy high demand amid uncertainty over the new Omicron coronavirus strain, which is spreading at a fairly rapid pace, scaring off market participants from active actions. No one wants to buy an overbought dollar. At the same time, a weak pound is not attractive to investors. Until the situation with the new coronavirus wave returns to normal, the British pound will hardly gain strong upside momentum. However, high inflation remains the main reason why the Bank of England will continue to raise interest rates next year. This fact is likely to support the pound sterling. The COT report released on December 14 indicated that long non-commercial positions declined to 29,497 from 48,950, while short non-commercial positions dropped to 80,245 from 87,227. This resulted in an increase in the negative non-commercial net position from 38,277 to -50 748. The weekly closing price dipped to 1.3213 from 1.3262.

Indicator signals:

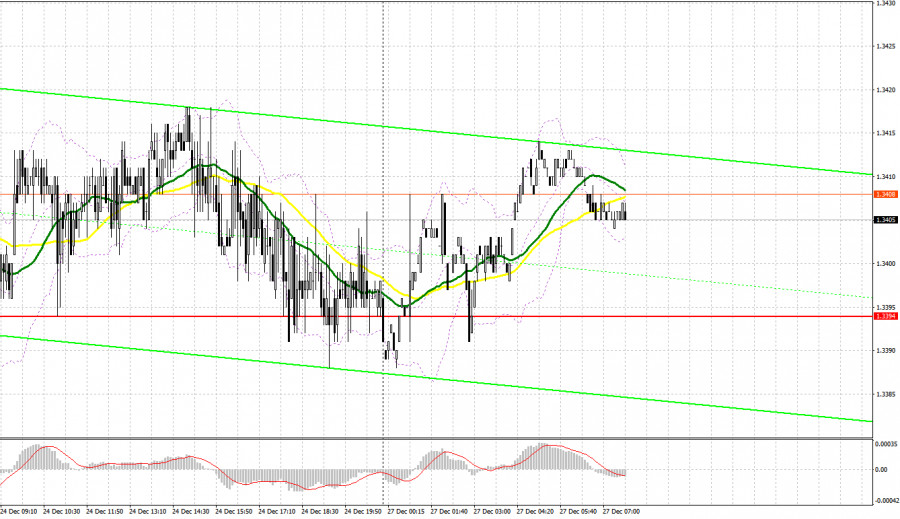

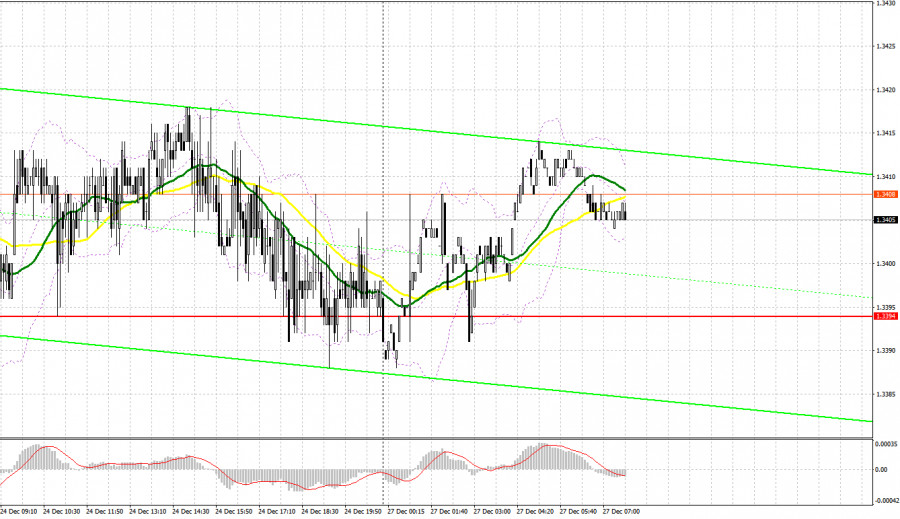

Trading is carried out in the area of 30 and 50 moving averages, which indicates the sideways nature of the market during the Christmas holidays.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.3417 will lead to a new wave of growth in the pair. A breakout of the lower border of the indicator in the area of 1.3389 will lead to a larger sell-off of the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.