The GBP/USD currency pair continued to decline on Thursday. In the analysis of the EUR/USD pair, we already suggested that the current movement has nothing to do with logic, macroeconomics, or fundamentals. This week, the most significant reports were published in the UK, so analyzing the GBP/USD pair will allow us to draw a definitive conclusion. Many traders may not like this conclusion.

On Wednesday, U.S. reports on construction and durable goods orders supported the dollar. It didn't matter that durable goods orders declined by 1.4%. Additionally, the UK inflation report, released on Wednesday, suggested a potential decline in the British pound, as it indicated a path for the Bank of England to further ease monetary policy. The day before, the unemployment report also favored the bears over the bulls. Thus, based on the data from Tuesday and Wednesday, it is reasonable to conclude that the British pound is falling justifiably. But why did it continue to decline on Thursday when no significant events occurred in either the US or the UK? Moreover, it became known that China is preparing for a new wave of sell-offs of American Treasuries...

Yet the dollar continues to rise almost every day, regardless of whether there are important events or reports. Based on this, we conclude that much of the current strengthening of the dollar is not related to the macroeconomic background. So what is happening and how should traders act?

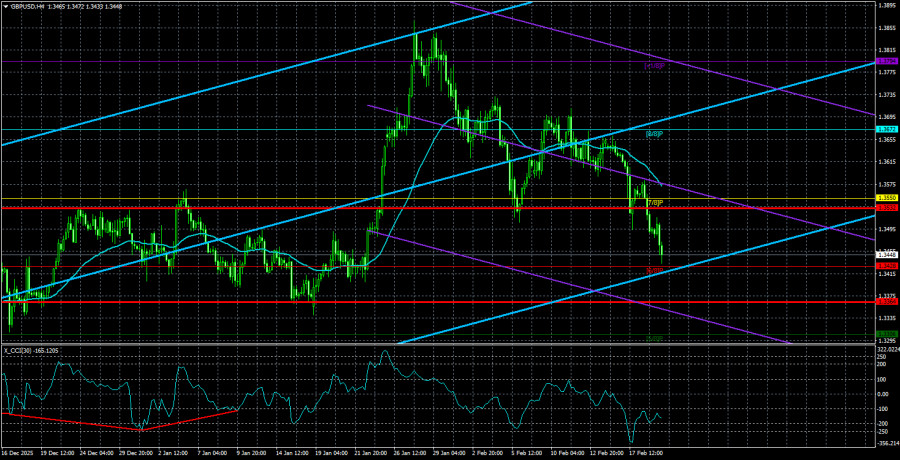

In our view, when the market demonstrates completely illogical movements, it is advisable to rely on technical factors. However, they mostly point upwards rather than downwards. On the daily timeframe, a global upward trend persists, and on the 4-hour timeframe, the CCI indicator has entered the oversold area. But all this currently does not matter because the dollar is rising for both reasonable and unreasonable reasons. How long the decline will continue is now very difficult to say, as again, there is no correlation between the fundamentals/macroeconomics and actual movements.

Therefore, the best strategy would be to trade intraday on the hourly and lower timeframes based on nearby levels, areas, and Ichimoku indicator lines. The illogical movement is observable in the short term and should be executed on lower charts.

By the way, today the US Supreme Court may announce a decision regarding Trump's tariffs. We say "may" because it was supposed to issue its verdict last November, but it keeps postponing its decision. Perhaps the current strengthening of the dollar is due to market anticipation of the cancellation of Trump's tariffs. Or to the Republican Party's defeat in the November elections. Or the possibility of Trump's impeachment following the election loss in November.

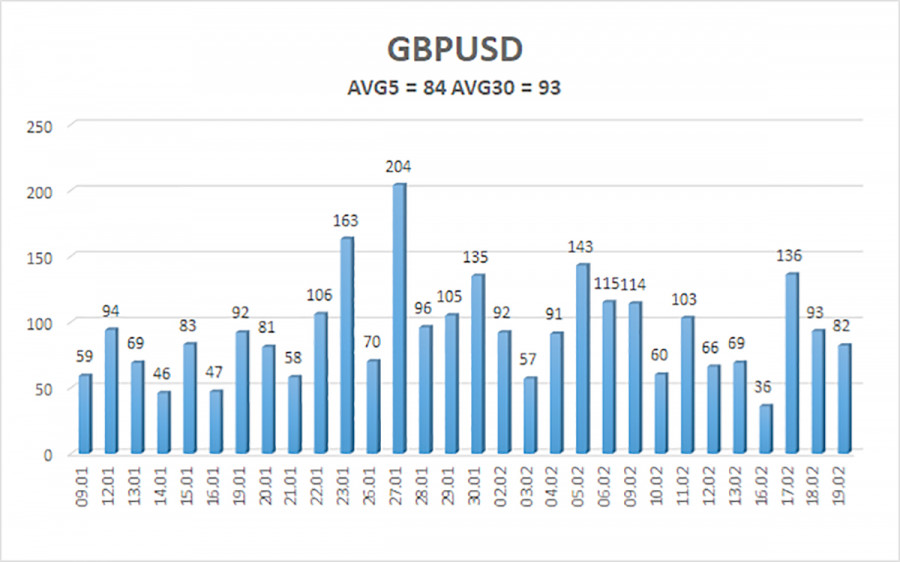

The average volatility of the GBP/USD pair over the last 5 trading days as of February 20 is 84 pips. For the pound/dollar pair, this value is considered "average." On Friday, February 20, we expect movements within the range between 1.3364 and 1.3532. The upper channel of the linear regression points upwards, indicating the restoration of the trend. The CCI indicator has entered oversold territory, signaling a possible end to the correction.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair is on track to continue its 2025 upward trend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the US economy, so we do not expect the US currency to grow in 2026. Even its status as a "reserve currency" no longer has much significance for traders. Thus, long positions with a target of 1.3916 and above remain relevant for the near term when the price is above the moving average. When the price is below the moving average line, small short positions can be considered with targets of 1.3428 and 1.3364 on a technical (corrective) basis. From time to time, the American currency shows corrections (in a global sense), but for trend growth, it requires global positive factors.

Explanations for Illustrations:

Regression channels help determine the current trend. If both are oriented in the same direction, it indicates a strong trend;

The moving average line (settings 20,0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted;

Murray levels are target levels for movements and corrections;

Volatility levels (red lines) indicate the probable price channel in which the pair will operate in the next 24 hours, based on current volatility indicators;

The CCI indicator—its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.