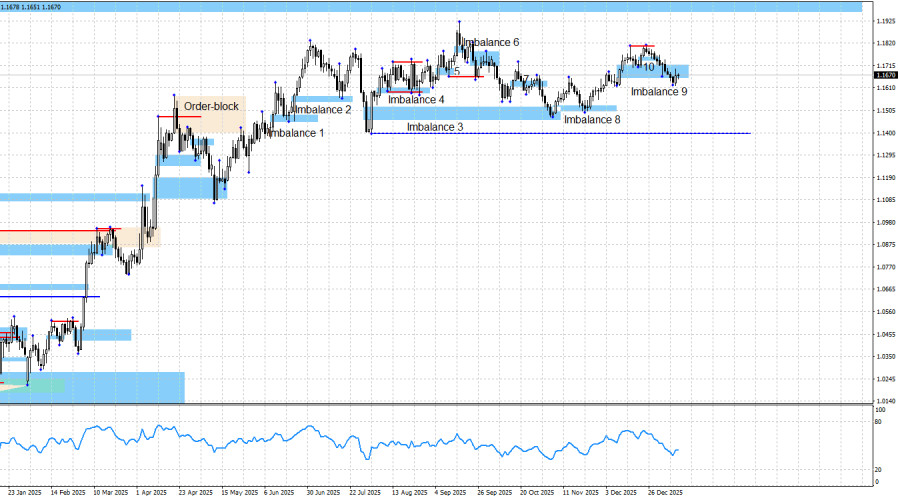

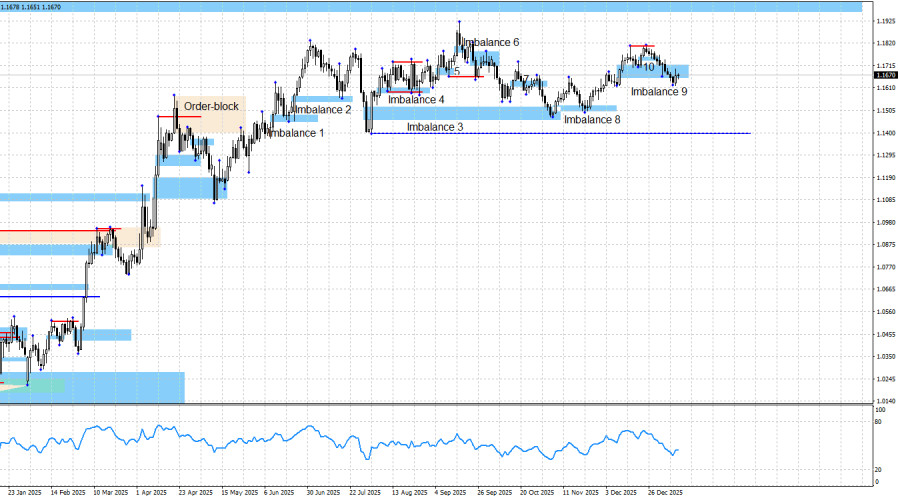

The EUR/USD pair declined for eleven consecutive days and has now spent the last two sessions undecided about its next direction. During this decline, the bullish

Imbalance 9 was fully worked through with a margin. Since this pattern has not yet been invalidated, I continue to believe that the bullish trend remains intact.In my view, bulls could have launched a new advance as early as last week, when most US economic data came in disappointing. However, bears stubbornly continued to press lower. An attempt to resolve the situation came late Monday night, when a criminal investigation was opened against Jerome Powell. Traders clearly understand who should be credited for this and what it implies. Powell himself stated that holding an independent opinion in the United States is becoming dangerous, and that the sole reason for his prosecution is his refusal to cut interest rates to the levels demanded by the US president. Neither this event nor today's inflation report managed to wake up market participants.

The US dollar began to decline on Monday's news but almost immediately ended the move. I continue to expect a bullish reaction from Imbalance 9 unless this pattern is invalidated, which would force a reassessment of the bullish impulse. At present, however, market activity is extremely weak. The news flow is present, but price movement is not. Invalidation would occur below 1.1616. This would not automatically turn the trend bearish, but it could allow bears to seize the initiative for a period of time.

The chart picture continues to signal bullish dominance. The bullish trend remains in place, but traders currently need fresh signals. Such a signal can only be formed within Imbalance 9, yet none has emerged so far. Should bearish patterns appear or bullish ones be invalidated, the trading strategy would need to be adjusted. At the moment, however, none of this is happening. There are no new patterns at all, as market movements remain extremely weak.

Tuesday's information backdrop was dominated by the US inflation report. The Consumer Price Index rose to 2.7% in December, matching both trader expectations and the previous month's reading. Core CPI came in at 2.6%, also in line with expectations and unchanged from the prior month. One of those cases where higher inflation might actually have been preferable. As a result, the Federal Reserve is now expected, with a 99% probability, to keep its monetary policy parameters unchanged at the end of the month.

Bullish traders have had sufficient reasons for a renewed advance for the past four to five months, and all of them remain valid. These include the (at least) dovish outlook for FOMC monetary policy, Donald Trump's overall policy stance (which has not changed recently), the ongoing US–China confrontation (where only a temporary truce has been reached), public protests in the US against Trump under the "No Kings" banner, weakness in the labor market, the unpromising outlook for the US economy (recession risks), and the government shutdown, which lasted a month and a half but was largely ignored by traders. Added to this are US military actions against certain countries and the criminal prosecution of Powell. Consequently, further growth in the pair appears fully justified in my view.

I still do not believe in a bearish trend. The news backdrop remains extremely difficult to interpret in favor of the US dollar, which is why I do not attempt to do so. The blue line marks the price level below which the bullish trend could be considered complete. Bears would need to push the price down by roughly 300 points to reach it, a task I consider unachievable under the current news environment and circumstances. The nearest upward target for the euro remains the bearish imbalance at 1.1976–1.2092 on the weekly chart, which was formed back in June 2021.

US and Eurozone Economic Calendar:

- US – Producer Price Index (13:30 UTC)

- US – Retail Sales Change (13:30 UTC)

- US – Existing Home Sales (13:30 UTC)

January 13 features three economic releases, none of which can be considered significant. The impact of the news backdrop on market sentiment on Wednesday, particularly in the second half of the day, is expected to be limited.

EUR/USD Outlook and Trading Guidance:

In my opinion, the pair may be approaching the final stage of the bullish trend. Although the news backdrop continues to favor bulls, bears have been more active in recent months. Nevertheless, I see no realistic reasons for the start of a bearish trend.

From Imbalances 1, 2, 4, and 5, traders had opportunities to buy the euro, and each time the market showed a degree of growth. Opportunities to open new trend-following long positions also emerged after reactions to Bullish Imbalance 3, then after Imbalance 8, and later after the rebound from Imbalance 9. This week, a second reaction to Bullish Imbalance 9 may still occur. The upward target for the euro remains 1.1976.

New long positions remain acceptable if a fresh bullish signal is formed. If not, the buying strategy will need to be reconsidered.