The most important week of December for EUR/USD is behind us: the Federal Reserve and the European Central Bank voiced their positions, baffling both bulls and bears of the pair. The parties failed to interpret the results of the meetings in favor of the dollar or the euro. Central banks did not "drown" or "elevate" currencies, preserving a kind of balance in their rhetoric. They made the expected decisions, so the market's attention was focused on the accompanying statements and the comments by Fed Chairman Jerome Powell and ECB President Christine Lagarde. However, even they could not help traders to determine the vector of price movement. There were too many "buts" and too many "ifs" in their stance.

From a formal point of view, last week ended with the bears' victory. The bulls couldn't bust through the area of the 7th figure and at the end of Friday, they couldn't keep the price at the 6th level either, ending the five-day trading at 1.0586.

On the one hand, the Fed did not justify the dovish hopes (expectations were too high), on the other hand, the ECB did not surprise market participants with an overly-hawkish stance (ECB members who are supporters of the 50-point rate hike won a convincing victory, thereby, eliminating the option of a 75-point hike). So after weighing the pros and cons, traders leaned toward the greenback.

In my opinion, the market has come to a reasonable conclusion that the Fed has voiced hawkish messaging, despite the actual slowdown in the rate hike, without ruling out various options. First, the median forecast for the final rate was revised upward: it rose to 5.1%. Secondly, Powell said that the pace of monetary tightening is not determinative, as decisions to raise the rate "will be made at any given meeting, depending on incoming statistical data." This phrase is ambiguous - it can be interpreted both in favor of the dollar and against it.

Powell has "tied" the pace of monetary policy tightening to the pace of acceleration/slowdown of inflation and other macroeconomic indicators. If inflation indicators show a downtrend and other economic indicators grow, the probability of a further slowdown in the rate of tightening of monetary policy (up to 25 points) will increase. In addition, the final point of the current cycle may be lower than announced. But if inflation climbs again, the Fed will go with the basic scenario: it will raise the rate in 50-point increments to at least 5.1%. Moreover, according to the New York Fed's John Williams (who has a standing vote on the Committee), the Fed could "hike more than the terminal rate projected in the dot plot." Notably, he made this high-profile statement after the results of the December meeting were summarized.

Obviously, now the market will focus on the main inflation indicators, the dynamics of which will have the strongest impact on the pair (as well as on other dollar pairs of the major group).

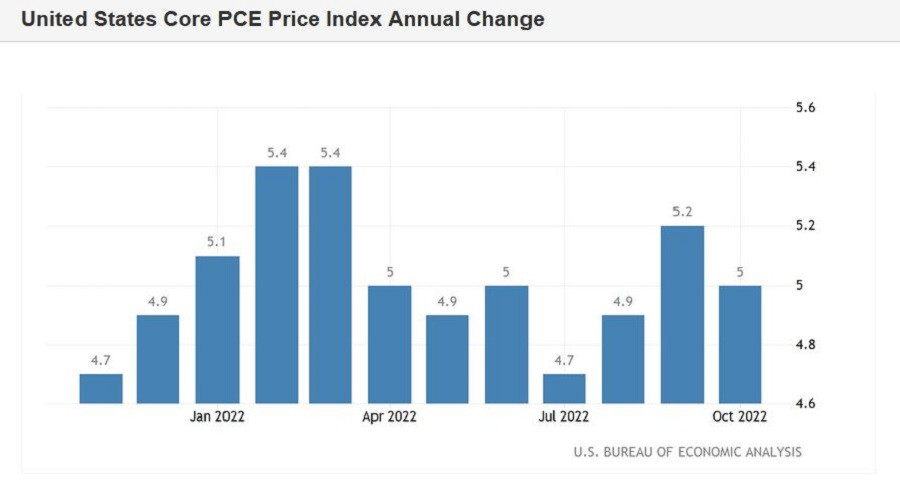

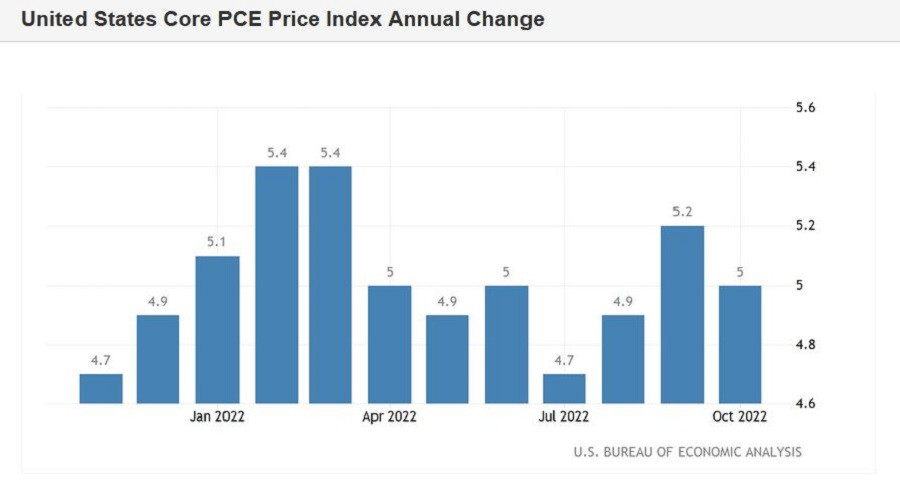

That is why the key release of the coming week is the Core PCE price index. So, on Friday, December 23, we will find out the dynamics of the Fed's most preferred inflation measure - the Personal Consumption Expenditures Index. Fed members pay special attention to this report, so it tends to provoke a lot of volatility among dollar pairs. The index had an uptrend on an annualized basis in August and September (reaching 5.2%), but growth slowed to 5.0% in October.

Most analysts expect the PCE index to fall to 4.6% in November. In such a case, the index would update a multi-month low, reflecting the weakest growth rate since October 2021. In that case, the dollar would come under pressure across the board, also against the euro. But if the report turns out to be in the green zone, there will be a backlash from the dollar bulls, given the controversial outcome of the December Fed meeting. In case the PCE index is on the greenback's side, EUR/USD may return to the range of 1.0250-1.0450 (the middle and upper lines of the Bollinger Bands indicator on the daily chart).

Of course, the forthcoming week will also be full of other fundamental events. For instance, German IFO indexes will be released on Monday, and ECB Vice-President Luis de Guindos will give a speech; on Tuesday, Germany will publish the producer price index, and the US will publish the report on construction permits; on Wednesday, Americans' consumer confidence and secondary market housing sales will be released; on Thursday, the final data on US economic growth in the third quarter will be released; on Friday (besides the PCE index) - primary market housing sales.

And yet, the key, defining release for the EUR/USD pair will be the Core PCE price index. It will determine the vector of the EUR/USD price movement at least until the end of the current year.