Events in the United States have been unfolding like in a Hollywood blockbuster where the necessary wire is cut right on time to stop the countdown for the explosion of the atomic bomb and the world is saved. The country risked a default and a shutdown. If President Joe Biden did not sign the bill to raise the debt ceiling by midnight, it would produce an effect of an exploded bomb. Anyway, the president has signed the legislation at the very last moment without even looking. At first glance, this is how it looks. However, taking a closer look at what has happened, it becomes evident that everything is even more interesting and complicated.

Firstly, Congress voted against raising the debt ceiling through the end of 2022. This decision surprised everyone, especially Senators, who agreed to pass a stopgap measure that funds the government through December 3, 2021. As soon as the bill went to the Senate, it was immediately drafted and sent to the president. Notably, the fiscal year in the US ended yesterday. From now on, the government should be funded from the new budget that has not been approved. The decision to repeal the national debt ceiling is intended to win legislators some time to adopt the budget.

Meanwhile, both Democrats and Republicans do everything to ensure that there is no budget at all. Thus, the Senate Republican Leader said that the budget could be adopted if Joe Biden's social program was cut to $1.5 trillion from $3.5 trillion. The Democratic leader in Congress, in turn, delayed a planned vote on the infrastructure bill. We will certainly see how the parties will battle over the budget allocation. Nevertheless, the very fact that the country has managed to escape a default boosted the greenback

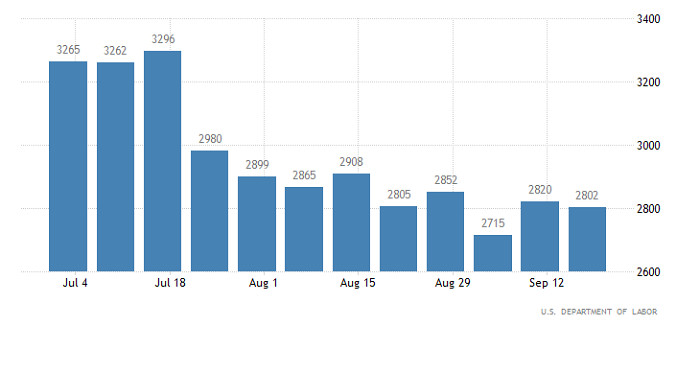

Clearly, amid all this going on, nobody has paid attention to macroeconomic data. Anyway, US Q2 GDP came in line with the preliminary estimate, rising to 12.2% from 0.5% in the previous period. Initial jobless claims grew by 11K instead of falling by 16K. Meanwhile, continuing jobless claims decreased by 18K when the reading had been forecast to increase by 2K.

United States Continuing Jobless Claims:

Although the situation with the public debt has somewhat stabilized in the United States, the energy crisis in Europe does not seem to be worsening anymore. The euro is clearly oversold. However, it does not mean that a correction may begin soon. Today, the eurozone's inflation report is scheduled for release. Its results may disappoint investors. In the best-case scenario, consumer prices may rise to 3.1% from 3.01%. In the worst case, inflation may accelerate to 3.3%. Anyway, inflation keeps growing, posing considerable risks to the economy. At the same time, the ECB does nothing to tackle the issue. That is why the euro is likely to go down today.

Eurozone Inflation:

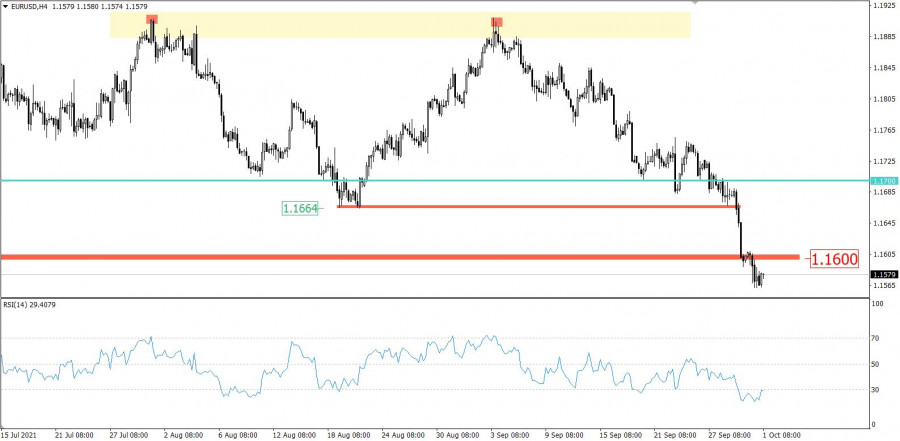

Despite the oversold status, the bearish trend in EUR/USD has extended. The quote consolidated below the support level of 1.1600.

The Relative Strength Index (RSI) has been below 30 for three days in a row, signaling the oversold market.

The daily chart shows not just a continuation of the downward cycle, but an attempt to change the medium-term trend.

Outlook:

The euro remains under bearish pressure. The quote is below 1.1600. If speculative interest stays strong in the market, a further decline towards 1.1500-1.1450 may take place despite the pair's oversold status.

The price may rebound anytime. However, it is unlikely to change the current situation in the market.

In terms of complex indicator analysis, technical indicators are signaling to sell the pair for short-term, mid-term, and intraday trading amid the extension of the downward trend.